BTC Market Pulse: Week 39

Bitcoin rallied to $117k in anticipation of a Fed rate cut last week, before retreating to $115k under renewed selling pressure.

Overview

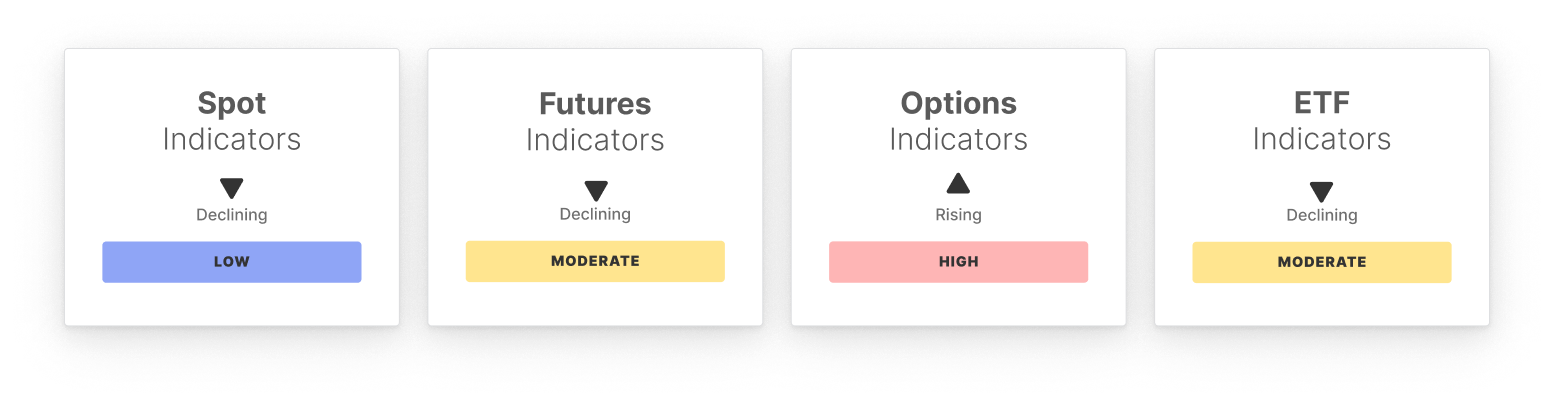

In the spot market, RSI eased from overbought levels, CVD fell sharply, and volumes slipped near the low band, signaling weakening demand and fragile participation despite recent strength.

The futures market showed mixed dynamics. Open interest held steady near highs, while funding rose modestly, pointing to cautious optimism. Yet, perpetual CVD plunged into heavy negative territory, reflecting aggressive sell-side pressure and distribution from leveraged traders.

In the options market, open interest broke above its high band, highlighting stronger participation. Volatility spreads widened sharply, showing rising uncertainty, while skew edged higher, reflecting mild downside hedging. Together, these point to heightened expectations for volatility but without strong bearish conviction.

US spot ETFs cooled after strong prior inflows. Netflows dropped sharply, trade volumes held steady, and MVRV eased slightly, signaling tempered institutional demand. Confidence remains intact, but the sharp slowdown hints at a pause in accumulation from TradFi participants.

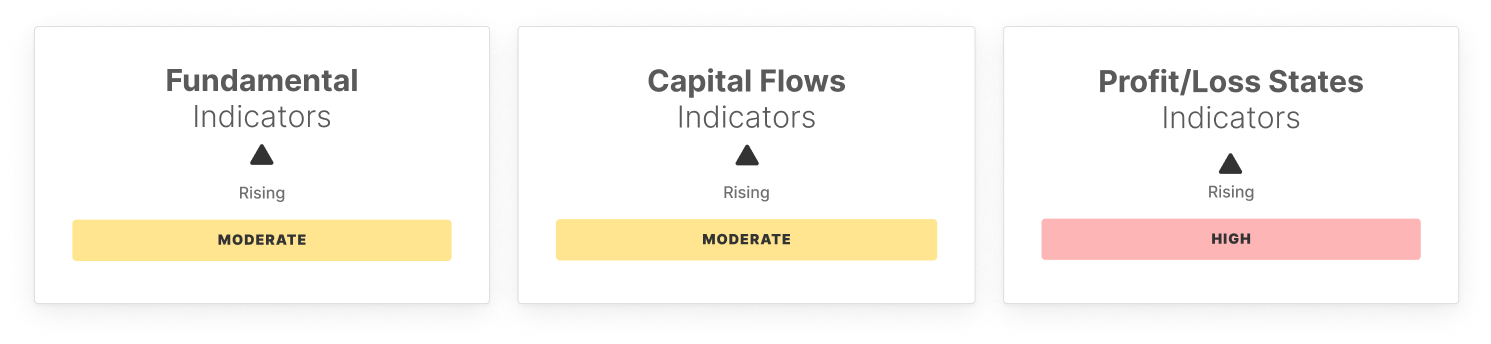

On-chain fundamentals showed mixed signals. Active addresses and transfer volume improved, signaling stronger engagement and rising capital flows. In contrast, fees declined, pointing to lower congestion and subdued speculative demand, suggesting participation is rising but with lighter transactional urgency.

Capital flows remained steady but cautious. Realized cap change eased slightly, STH/LTH ratios rose modestly, and hot capital share edged above range, signaling growing short-term activity. While the structure remains balanced, elevated short-term flows raise the risk of higher volatility.

Profit and loss states improved further. Supply in profit, NUPL, and realized P/L all climbed, reflecting broad investor profitability and active profit-taking. Sentiment appears resilient and cautiously bullish, though rising realization hints at growing risk of demand exhaustion.

In sum, the overall structure resembles a buy-the-rumor, sell-the-news pattern. Momentum carried Bitcoin higher into the Fed narrative, but weakening spot flows, heavy futures distribution, and softer ETF demand now weigh on the market. While profitability and engagement remain supportive, the risk of further cooling looms unless demand strengthens to absorb selling pressure.

Off-Chain Indicators

On-Chain Indicators

Don't miss out!

Smart market intelligence, straight to your inbox.

Subscribe nowPlease read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why the plunge was even more severe than the market expected

System uncertainty and pressure are increasing.

How does the leading player in perpetual DEX view the future trend of HYPE?

If you believe that the trading volume of perpetual DEXs will continue to grow, then HYPE is one of the purest and most leveraged ways to capture this trend.

ETH Plummets and Rebounds: A Market Baptism Amidst the Storm

Bitcoin market reshuffle: who is selling?