Falcon Finance unveils USDf expansion and RWA redemption plans

Falcon Finance is expanding its USDf stablecoin reach, launching fiat on- and off-ramps across LATAM, Turkey, MENA, Europe, and the U.S., while adding real-world asset redemption options.

- In 2025, Falcon Finance will add fiat on- and off-ramps in LATAM, Turkey, MENA, Europe, and the U.S., introduce physical gold redemption in the UAE, and support tokenized assets such as T-bills and stablecoins.

- In 2026, the protocol will launch a RWA engine for corporate bonds and private credit, expand gold redemption to MENA and Hong Kong, and roll out institutional-grade USDf products and investment funds.

Falcon Finance, the next-generation dual-token synthetic dollar protocol, has released an updated whitepaper, outlining its ongoing yield strategies and an expanded roadmap for global adoption and institutional integration.

The main update centers on expanding how USDf, Falcon Finance’s stable, overcollateralized synthetic dollar , can be used and redeemed across both digital and real-world assets. In 2025, the protocol will extend its fiat rails in LATAM, Turkey, MENA, Europe, and the U.S., enabling users to deposit and withdraw USDf in their local currencies.

This year, the protocol will also introduce physical gold redemption in the UAE, giving users the option to convert their USDf into gold. Alongside this, USDf will support tokenized assets such as T-bills, stablecoins, and select cryptocurrencies.

In 2026, Falcon Finance plans to launch a modular Real-World Asset engine, enabling the tokenization of corporate bonds, private credit, and other financial instruments into USDf-backed onchain liquidity. The protocol will also expand physical gold redemption services to additional financial hubs in the MENA region and Hong Kong, while rolling out institutional-grade USDf products and investment funds.

These updates come on the heels of several key milestones for the project. Most notably, USDf has recently surpassed 1 billion in circulation, ranking it among the top ten Ethereum-based stablecoins by market cap. The protocol also completed its first “live mint” of USDf against a tokenized U.S. Treasury fund, achieving an overcollateralization ratio of 116%, independently verified by ht.digital.

How Falcon Finance’s USDf earns yield

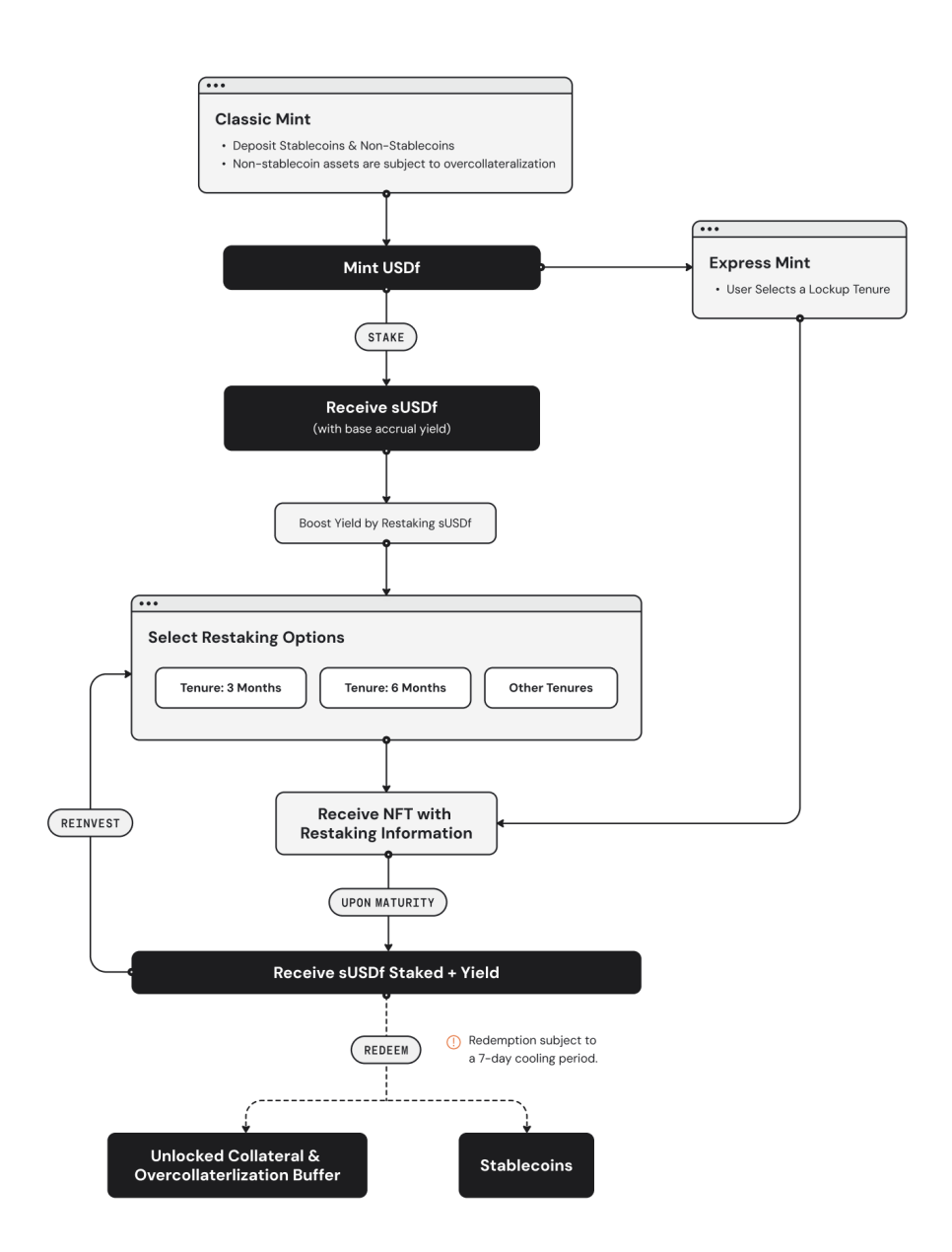

USDf is created when users deposit eligible collateral into the Falcon Finance protocol. This collateral can include stablecoins, major cryptocurrencies, or tokenized RWAs . For non-stablecoin assets like BTC or ETH, an overcollateralization ratio ensures that each USDf is fully backed, protecting both users and the protocol from market volatility.

Once minted, USDf can be staked to generate sUSDf, a yield-bearing token that accrues income through Falcon Finance’s diversified institutional-grade strategies, such as funding rate and price arbitrage. Users can redeem sUSDf for USDf, or, for non-stablecoin deposits, they can reclaim their original collateral along with any accrued overcollateralization buffer.

Source: Falcon Finance USDf Mint and Redemption Flowchart | Falcon Finance Whitepaper V2

Source: Falcon Finance USDf Mint and Redemption Flowchart | Falcon Finance Whitepaper V2

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."