Bitcoin Primed To Explode by Double Digits to New All-Time High if This Support Level Holds, Says Trader – But There’s a Catch

Cryptocurrency analyst and trader Ali Martinez says one support level is currently the “most important” for Bitcoin ( BTC ).

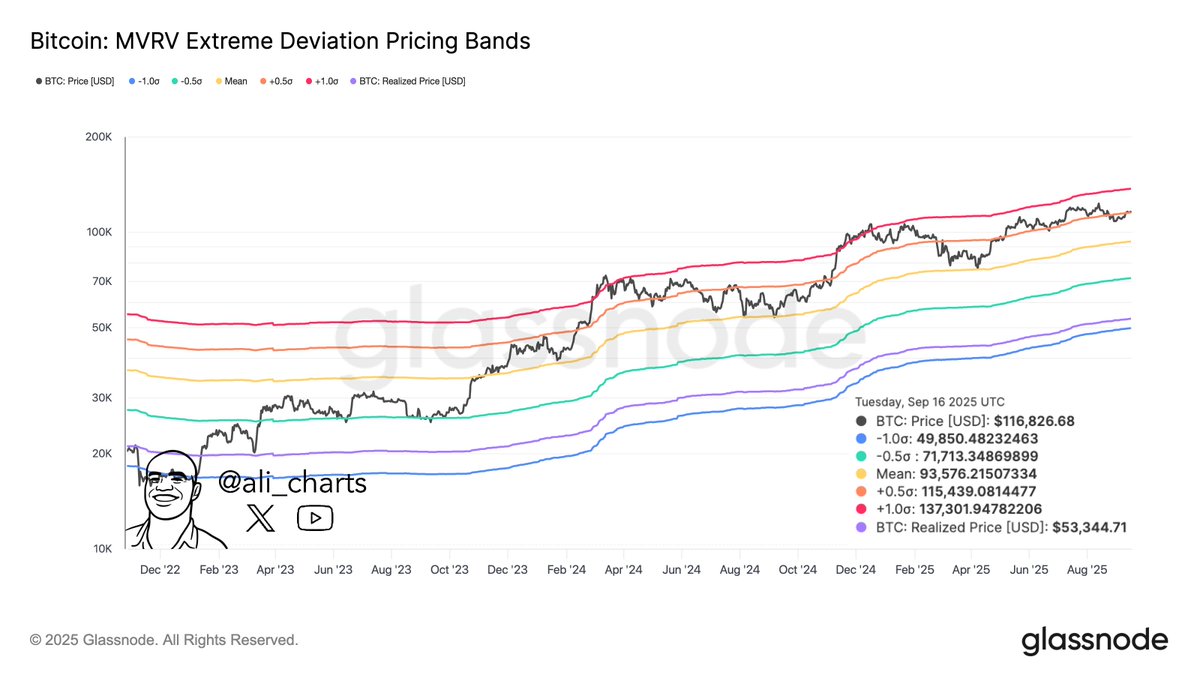

Martinez tells his 156,500 followers on X that, based on the MVRV (Market Value to Realized Value) Extreme Deviation Pricing Bands, the $115,440 support level could determine whether Bitcoin hits a new all-time high or plummets to lows last recorded in May.

MVRV (Market Value to Realized Value) Extreme Deviation Pricing Bands are a tool in on-chain analysis used to identify potential market tops and bottoms.

Martinez says that if the $115,440 support level holds, Bitcoin could go up by around 17% from the current level. Bitcoin could, however, plummet by around 20% if the support level crumbles, according to Martinez.

“Hold it, and $137,300 is next.

Lose it, and $93,600 comes into play.”

Source: ali_charts/X

Source: ali_charts/X

Bitcoin is trading at $117,150 at time of writing.

According to Martinez, Bitcoin is witnessing an increase in the number of long positions while the open interest, which is an indication of swelling market speculation, is also rising. This is happening at a time when Bitcoin is facing major resistance, Martinez says.

These conditions, per Martinez, pose the “risk of a long squeeze ahead.” A long squeeze occurs when leveraged long positions encounter a price crash, which forces them to sell and thus creates a series of cascading liquidations.

Source: ali_charts/X

Source: ali_charts/X

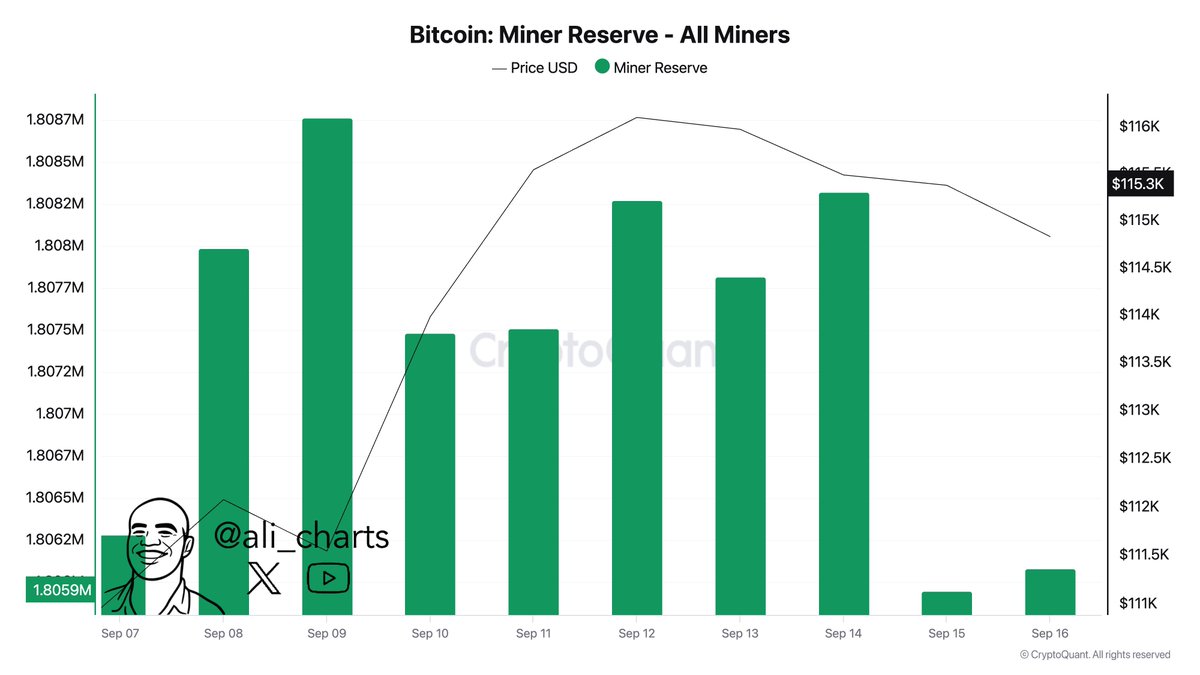

Citing analytics firm CryptoQuant’s data, Martinez further says that over the past three days, Bitcoin miners have disposed of BTC worth more than $234 million.

“Miners sold over 2,000 Bitcoin in the past 72 hours!”

Source: ali_charts/X

Source: ali_charts/X

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hotcoin Research | Fusaka Upgrade Approaching: Analysis and Outlook on Ethereum Long and Short Positions

This article will review Ethereum's recent performance, provide an in-depth analysis of the current bullish and bearish factors facing Ethereum, and look ahead to its prospects and trends for the end of this year, next year, and the medium to long term. The aim is to help ordinary investors clarify uncertainties, grasp trends, and provide some reference to support more rational decision-making during key turning points.

Crypto Market Surges as Bitcoin Rebounds and Privacy Coins Shine

In Brief Bitcoin rebounded over the weekend, testing the $86,000 mark. Privacy-focused altcoins Monero and Zcash showed notable gains. Total market value surged, crossing the $3 trillion threshold again.

Trending news

MoreBitget Daily Digest (Nov 24) | Total Crypto Market Cap Rebounds Above $3 Trillion; Michael Saylor Posts “Won’t Surrender,” Hinting at Further Bitcoin Accumulation; Bloomberg: Bitcoin’s Decline Signals Weak Year-End Performance for Risk Assets, but 2026 May Have Growth Momentum

Following the attack, Port3 Network announced it would migrate its tokens at a 1:1 ratio and burn 162.7 million PORT3 tokens.