3 Altcoins To Watch This Weekend | September 20 – 21

This weekend, NEAR, OP, and PUMP could see sharp moves as technical signals and token unlocks shape their paths. Traders should watch key support and resistance levels closely.

The past week proved to be rather bullish for the crypto market, with many altcoins noting sharp gains. However, the coming weekend will be crucial as well, considering it will be a test of the rallies’ sustainability.

BeInCrypto has analyzed three altcoins that could either make gains or face reversals this weekend.

Near Protocol (NEAR)

NEAR emerged as one of the best-performing altcoins in the last 24 hours, rising 13% to $3.20. Despite the bullish momentum, the rapid surge raises concerns about potential short-term exhaustion in price action.

The RSI is entering the overbought zone above 70.0, a level that has historically triggered reversals for NEAR. If investors move to sell, the token could drop to the $3.06 support or even slip lower to $2.70.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

NEAR Price Analysis. Source:

Price Analysis. Source:

NEAR Price Analysis. Source:

Price Analysis. Source:

However, if NEAR manages to resist bearish market pressure, the price could push past $3.34. Securing this level as support would invalidate the bearish outlook and potentially drive the altcoin higher toward $3.60.

Optimism (OP)

OP is set to undergo a 116 million token unlock this weekend, worth nearly $95.95 million. The supply increase could pressure the price negatively as the influx may exceed existing demand. This could create short-term volatility for the altcoin.

Currently, OP trades at $0.838, holding above the $0.812 support and marking a monthly high. If the token unlock triggers selling, the price could break below $0.812. OP will thus potentially fall to $0.760, undermining its recent recovery momentum.

OP Price Analysis. Source:

Price Analysis. Source:

OP Price Analysis. Source:

Price Analysis. Source:

If bullish momentum prevails, OP could defy selling pressure and rise beyond $0.875. Flipping this resistance into support would invalidate the bearish outlook. This could potentially push the token further toward the $0.909 price level in the coming days.

Pump.fun (PUMP)

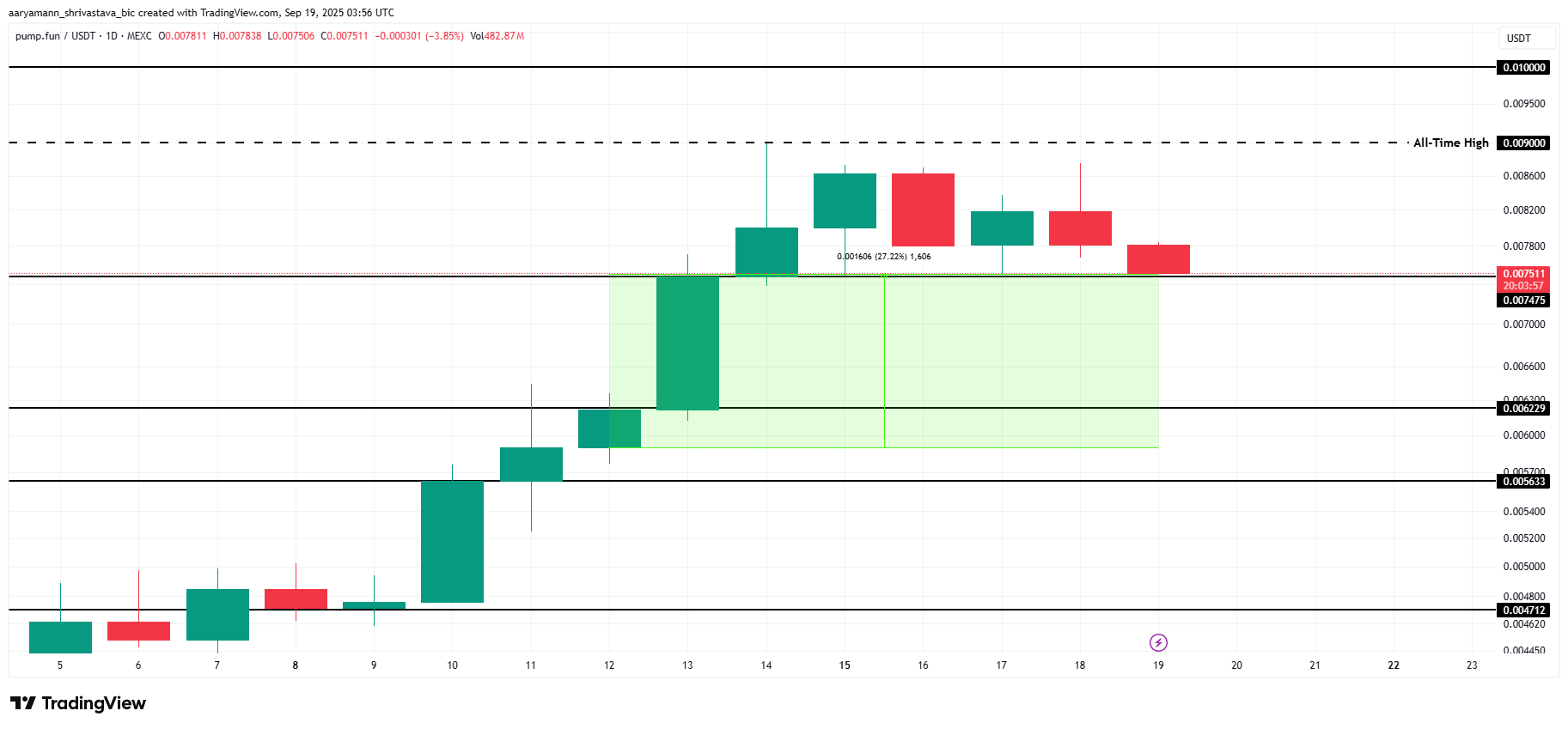

Another one of the altcoins to watch this weekend is PUMP, the price of which is at $0.0075, holding steady above the $0.0074 support. A successful bounce from this level could spark recovery. This would give the altcoin a chance to build upward momentum and push toward its all-time high in the near term.

The ATH for PUMP sits at $0.0090, requiring a 21% rise. Considering the token gained 27% over the past week, the probability of another rally appears feasible. If bullish momentum continues, PUMP could reclaim its peak price over the coming weekend.

PUMP Price Analysis. Source:

Price Analysis. Source:

PUMP Price Analysis. Source:

Price Analysis. Source:

However, if selling pressure intensifies or bearish sentiment takes control, PUMP could fail to defend the $0.0074 support. In such a scenario, the altcoin may decline further, slipping to $0.0062 and invalidating the bullish outlook while increasing downside risk for investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Behind the 15 million financing, does Surf aim to become an AI analyst in the crypto field?

Cyber co-founder starts a new venture.

Castle Island Ventures partner: I don’t regret spending eight years in the cryptocurrency industry

A cryptocurrency practitioner who once held libertarian ideals became disillusioned after reflecting on a career spent building "financial casinos," sparking a profound reflection on the divergence between the original aspirations and the current reality of the crypto space.

Powell: Employment is weakening, inflation remains high, and no one is talking about rate hikes now

Powell pointed out that the U.S. labor market is cooling, with hiring and layoffs slowing down and the unemployment rate rising to 4.4%. Core PCE inflation remains above the 2% target, but service inflation is slowing. The Federal Reserve has cut interest rates by 25 basis points and started purchasing short-term Treasury bonds, emphasizing that the policy path needs to balance risks between employment and inflation. Future policies will be adjusted based on data. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

$RAVE TGE Countdown: When Clubbing Becomes an On-Chain Economic Activity, the True Web3 Breakthrough Moment Arrives

RaveDAO is rapidly growing into an open cultural ecosystem driven by entertainment, becoming a key infrastructure for Web3 to achieve real-world adoption and mainstream breakthrough.