Date: Thu, Sept 18, 2025 | 10:20 AM GMT

The cryptocurrency market is showing upside resilience today as Ethereum (ETH) jumps to near $4600 mark with a 2% intraday gain, following the latest Fed rate cut decision. Riding on this momentum, several memecoins are flashing bullish setups — including Brett (BRETT).

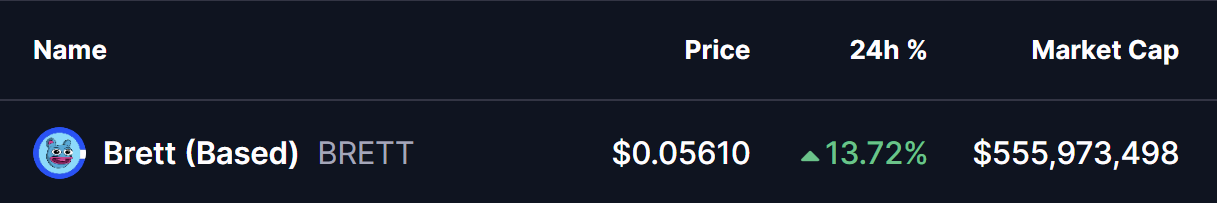

BRETT has surged by 13% today, and while its rally has been impressive, a developing harmonic pattern on the daily chart suggests there may be more upside ahead.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Hints at Upside Continuation

On the daily timeframe, BRETT is currently forming a textbook Bearish Gartley harmonic pattern, which often signals a continuation rally before eventually reaching a reversal zone.

This pattern began at point X ($0.09209), retraced to A, climbed to B ($0.07500), and then corrected down to C ($0.04225). From that low, BRETT has reversed sharply and is now holding a bullish trajectory near $0.05617, trading well above its 200-day moving average (MA) at $0.04932.

Brett (BRETT) Daily Chart/Coinsprobe (Source: Tradingview)

Brett (BRETT) Daily Chart/Coinsprobe (Source: Tradingview)

What’s Next for BRETT?

If the harmonic structure continues to play out, the Potential Reversal Zone (PRZ) lies between $0.07949 and $0.09209, aligning with the 0.786 and 1.0 Fibonacci extensions. A rally into this zone would represent up to 65% potential upside from current levels.

For this bullish outlook to remain valid, BRETT must hold above its 200-day MA near $0.04932, which now acts as critical support. A retest of this level would be normal, but maintaining it is key for keeping the uptrend intact.