Date: Sun, Sept 14, 2025 | 12:50 PM GMT

The cryptocurrency market is making a slight pullback after a strong rally over the week where Ethereum (ETH) marked 7% gains before sliding by over 2% today. Following this, several major altcoins are also facing decline— including Polygon (POL).

POL is trading in red today, but beneath the surface, its price action suggests something bigger may be brewing — a textbook breakout and retest pattern, hinting at a potential upside continuation.

Source: Coinmarketcap

Source: Coinmarketcap

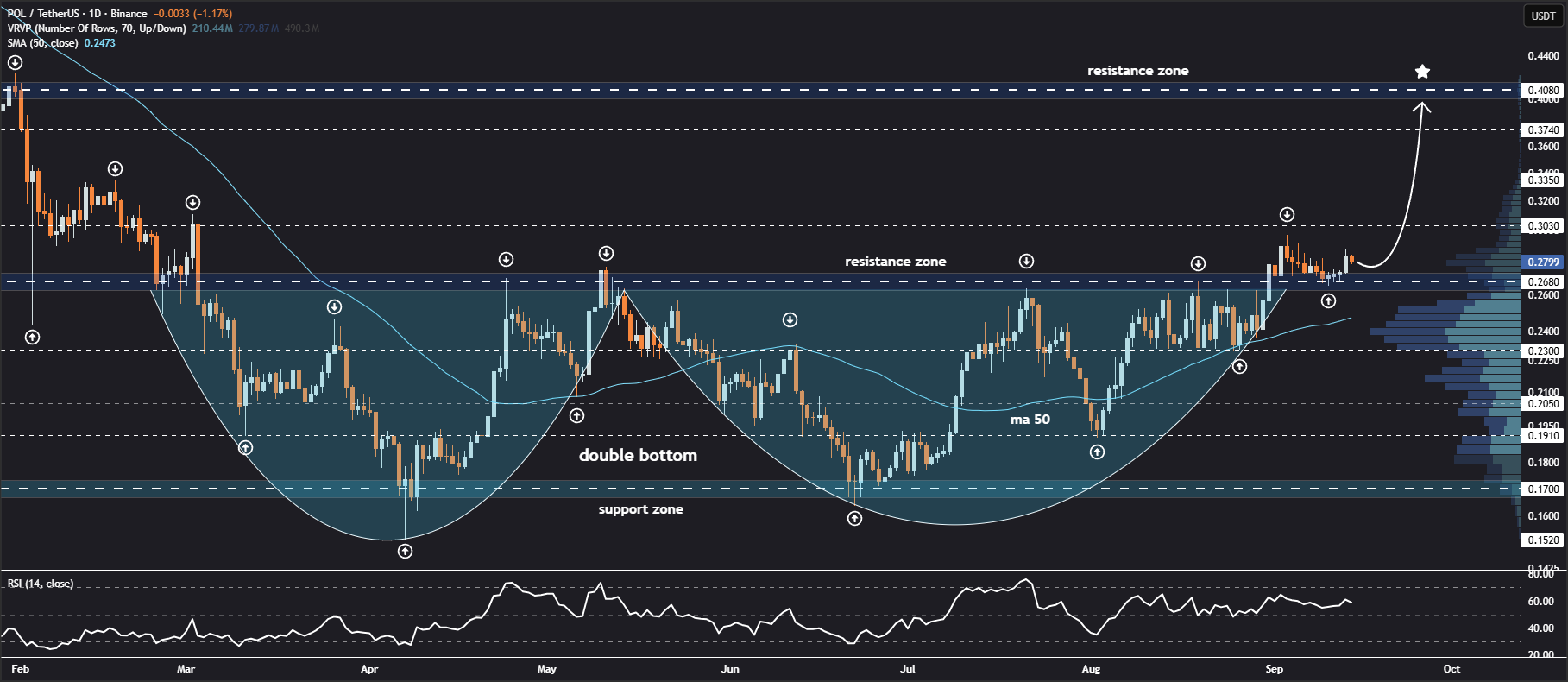

Retesting Double Bottom Breakout

According to the latest analysis shared by crypto analyst Jonathan , POL has demonstrated a classic double bottom breakout — a bullish reversal pattern. This formation occurred as the price bottomed twice near the $0.17 level (highlighted in the chart) before reversing upward.

The recent breakout above the neckline resistance at $0.2680 marked the completion of this pattern.

Polygon (POL) Daily Chart/Credits: @JohncyCrypto (X)

Polygon (POL) Daily Chart/Credits: @JohncyCrypto (X)

Following the breakout, POL surged to a local high of $0.2955, representing a significant upside move of nearly 9% from the breakout point. However, as is typical with such patterns, the token experienced a pullback, retesting the neckline level successfully by bouncing from the $0.2680 level.

What’s Next for POL?

So far, the retest appears constructive, as POL is now holding its ground at the neckline and showing resilience. The current price action suggests the bulls are still in control, and momentum could further build up.

A decisive move above $0.2955 — the recent swing high — would act as confirmation that bullish momentum is returning. Should that happen, the next logical targets according to the chart are:

$0.303 → $0.335 → $0.374 → $0.408, with the $0.408 resistance zone being particularly important to watch.

However, caution is advised. Any sustained drop below $0.26 could invalidate this bullish setup.