Ethereum reaching $25,000 by 2026 is unlikely but theoretically possible if global crypto capital flows surge, institutions lock up supply, and on-chain scarcity intensifies — a convergence that would require ETH market cap to expand several-fold from current levels.

-

Unprecedented capital inflows would be required to push ETH to $25,000.

-

Institutional control and ETF-like custody could severely reduce circulating supply.

-

Engineered scarcity plus mass adoption would need to lift ETH market cap by 4–6x.

Ethereum $25,000? Front-loaded analysis of drivers and risks — read our concise assessment and next steps for investors.

What would it take for Ethereum to reach $25,000 by 2026?

Ethereum $25,000 would require a multi-trillion-dollar reallocation into crypto, a sustained spike in adoption and a marked reduction in liquid ETH supply. Achieving that price implies ETH market capitalization rising several-fold and broader macro tailwinds favoring risk assets and crypto infrastructure integration.

How could institutional demand drive Ethereum to $25,000?

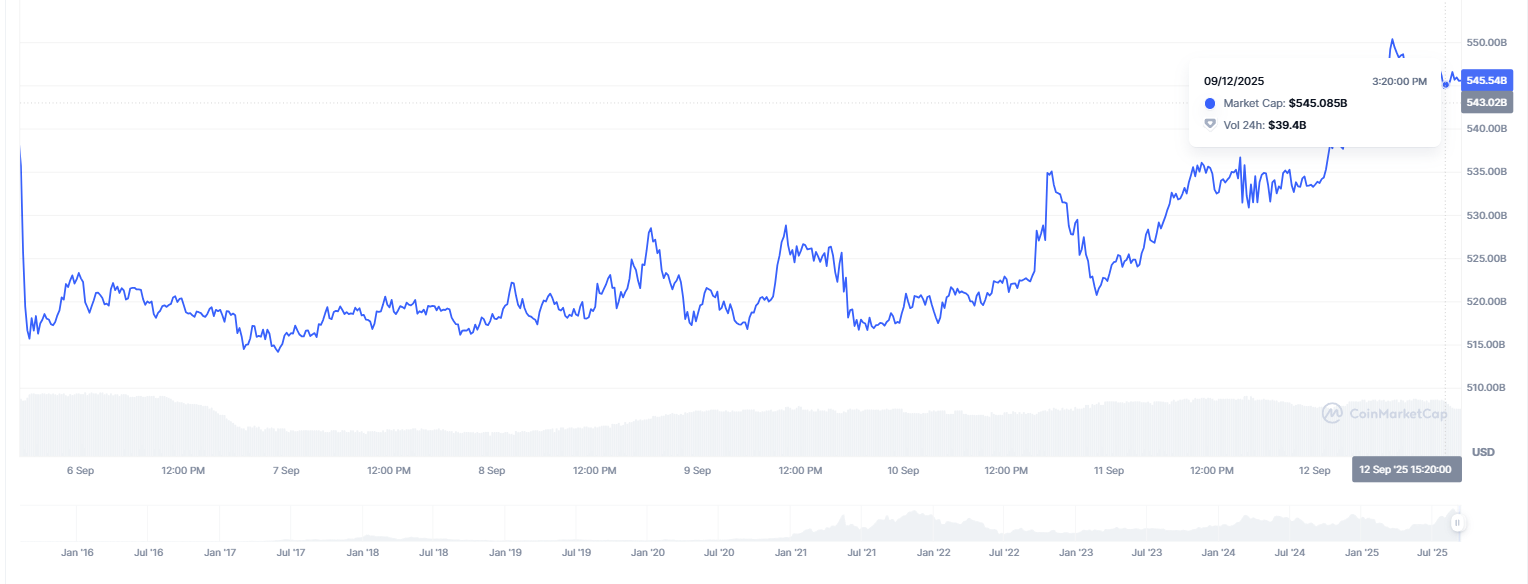

Institutional demand can push prices higher if large custodians, ETFs or funds accumulate ETH long-term. Reduced exchange-listed supply combined with programmatic buying would lower available liquidity. CoinMarketCap shows ETH market cap near $549 billion in the current cycle; scaling that toward $2.5–3 trillion would be necessary for a $25,000 price point.

-

Market capitalization gap: ETH market cap must expand roughly 4–6x from current levels.

-

Liquidity dynamics: Sustained off-exchange custody would compress tradable supply and amplify price moves.

-

Adoption vector: Widespread use of ETH in payments, DeFi and tokenized assets would underpin demand.

Source: Coinmarkecap

Why would engineered scarcity matter for Ethereum’s price?

Engineered scarcity increases price sensitivity to net inflows. If staking, custody or protocol changes remove a sizable share of circulating ETH, the float available for trading shrinks. With persistent demand from institutions and retail, a tighter float magnifies upward price pressure without requiring proportional increases in buyer count.

ETH/USDT Chart by TradingView

How realistic are supply manipulation scenarios?

Supply reduction via staking, long-term custody or protocol-level burn mechanisms can reduce liquid supply. However, deliberate “manipulation” is constrained by market oversight, regulatory scrutiny and the decentralized nature of ETH issuance. Historical precedents in equities and commodities show engineered scarcity can drive extreme valuations, but those outcomes often coincide with bubbles.

Frequently Asked Questions

Can Ethereum’s market cap reach $3 trillion by 2026?

Reaching a ~$3 trillion market cap by 2026 is theoretically possible but requires exceptional macro support, repeated capital inflows, and institutional adoption at scale. Investors should treat this as a low-probability, high-impact scenario rather than a base case.

What role do ETFs and custodians play in ETH price discovery?

ETFs and large custodians can remove tradable supply and create steady institutional demand. Their participation narrows spreads and increases price resilience, but they also face redemption and liquidity management constraints that can limit extreme price moves.

Key Takeaways

- Magnitude required: ETH needs multi-trillion market cap growth to reach $25,000.

- Primary drivers: Institutional accumulation, reduced float and broad adoption are essential.

- Investor action: Monitor custody flows, staking rates, and regulatory signals; position sizing should reflect low-probability, high-impact nature.

Conclusion

Ethereum reaching $25,000 by 2026 remains a low-probability outcome that would require extraordinary market conditions, including institutional dominance, engineered scarcity and dramatic adoption. Investors should weigh these drivers against regulatory and macro risks and use evidence-based monitoring — tracking custody flows, staking rates and market capitalization trends — before sizing exposure.