Key Notes

- Over $354M liquidated as Bitcoin crossed $115K, hitting a daily high of $116,317.

- Fed expected to cut rates by 25bps on Sept.

- 17, with up to three cuts possible this year.

- CryptoQuant indicators show 8 out of 10 bearish, warning of cooling momentum.

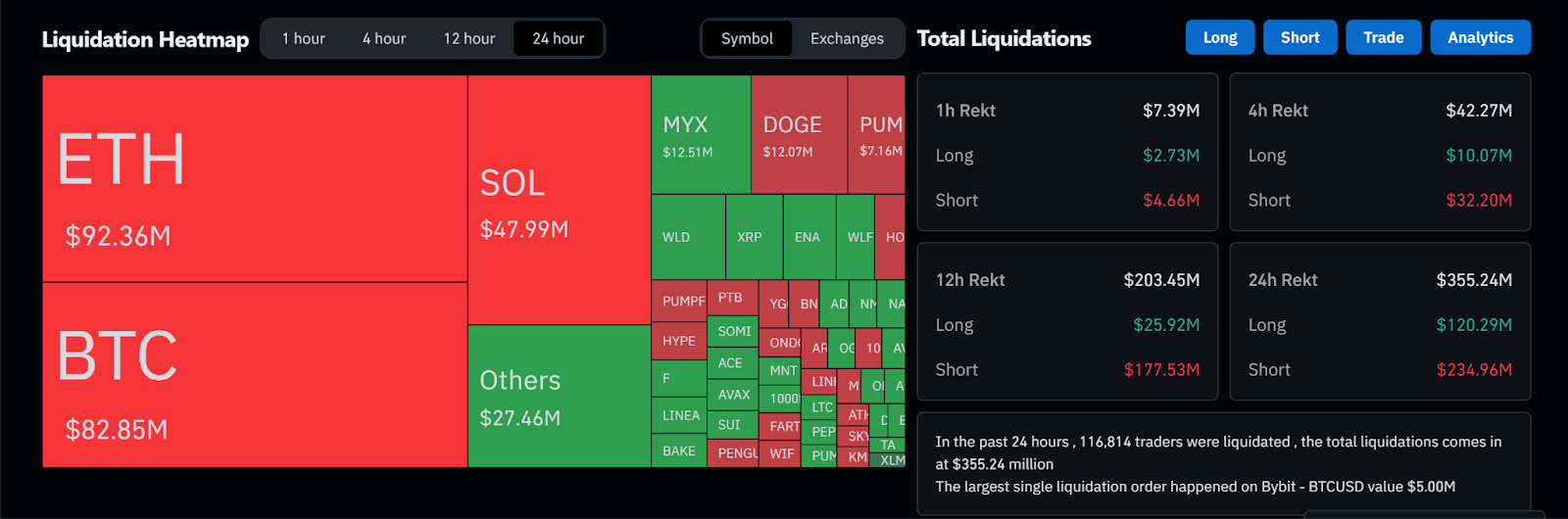

Bitcoin’s BTC $115 186 24h volatility: 0.5% Market cap: $2.29 T Vol. 24h: $44.39 B latest price surge turned expensive for leveraged traders with more than $354 million in liquidations swept across the crypto market, wiping out $121 million from longs and $233 million from shorts.

Crypto market liquidations in the past 24 hours | Source: CoinGlass

According to CoinMarketCap data , Bitcoin pushed past $115,000, claiming a daily high of $116,317, marking a nearly 3% weekly gain as investors brace for a pivotal Federal Reserve meeting next week.

Fed Rate Cuts in Focus

As a Reuters survey of 107 economists revealed, 105 expect the Federal Reserve to cut rates by 25 basis points on September 17, lowering the target range to 4.00%–4.25%.

Weak labor market data, including stalling job growth and downward revisions in payroll figures, has shifted sentiment toward a more aggressive easing path.

According to a Reuters survey, 105 out of 107 economists expect the Federal Reserve to cut interest rates by 25 basis points to 4.00%-4.25% on September 17, as labor market weakness outweighs inflation risks. Most respondents also anticipate another rate cut next quarter, with…

— Wu Blockchain (@WuBlockchain) September 12, 2025

Markets have already priced in at least one cut, with expectations for up to three reductions by year-end. Some analysts even flagged the possibility of a 50 bps cut next week, though most agree the Fed will tread cautiously.

President Donald Trump has also kept the pressure on Jerome Powell, criticizing his reluctance to cut rates more aggressively. Trump has a dvocated strongly for Powell’s removal as the Fed Chairman.

Bitcoin Rally vs. Bearish Signals

CryptoQuant’s Bull Score Index , which tracks ten core market indicators, shows eight flashing bearish, with only “demand growth” and “technical signal” holding bullish ground.

Historical trends back up the concern. The last time eight out of ten indicators were bearish was in April, when Bitcoin plunged to $75,000. On the other hand, July saw most indicators in the green as BTC peaked at $122,800.

Similarly, the CoinGlass Bull Run Index (CBBI) sits at 74, indicating that the market is about three-quarters through the current bull cycle. Yet, only one of its 30 peak signals , the altcoin season index, has triggered, pointing to a rally that still lacks confirmation of a final blow-off top.

Can the Fed Carry the Rally?

With $355 million wiped from traders and technical indicators cooling, Bitcoin’s short-term outlook looks fragile.

However, macro conditions could provide support. If the Fed cuts rates as expected and signals a dovish stance for the rest of the year, liquidity could fuel another leg higher for risk assets, including Bitcoin.