3 Warning Signs of a US Recession — And What It Means for Crypto Markets

Key data—weak payrolls, rising long-term joblessness, and falling construction—point to a looming US downturn. In a recession, risk-off flows typically hit crypto first, pressuring BTC and most altcoins.

As of September 2025, mounting evidence suggests the US economy may be closer to a recession, with several key indicators raising alarms among economists and market observers.

The fallout could extend well beyond traditional markets. Crypto assets, often treated as high-risk, will likely come under heavy pressure as investors shift to safer holdings, setting the stage for heightened volatility and potential sell-offs.

Is the US in a Recession?

The most striking indicator is the job market data. nonfarm payrolls slowed considerably in August, with only 22,000 jobs added compared to the projected 75,000.

Of ~598,000 jobs added in President Donald Trump’s second term so far, 86% were in healthcare and social assistance. Outside healthcare, job creation has nearly stalled, signaling fragility.

The US economy has entered a jobs recession.

— Mark Zandi (@Markzandi) September 5, 2025

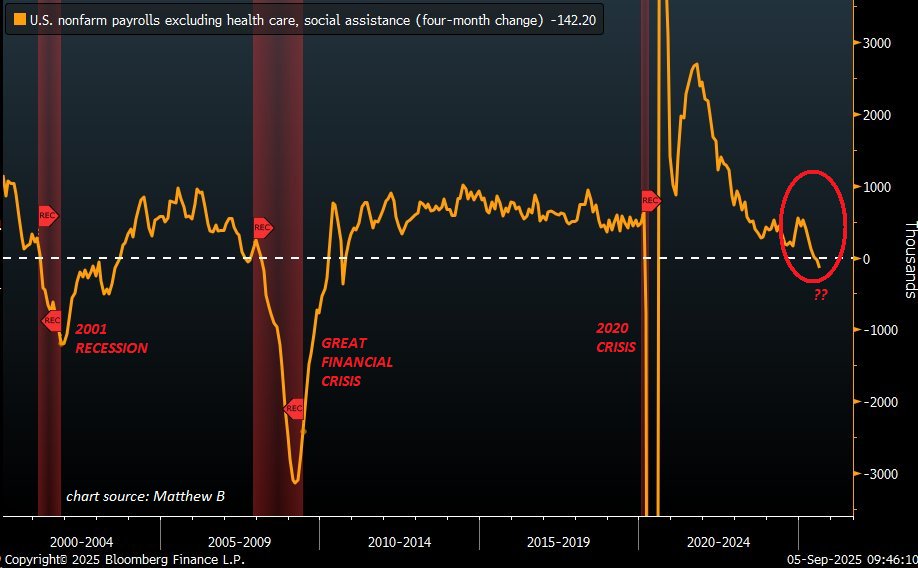

Furthermore, in a post on X, Global Markets Investor noted that the US economy has shed 142,200 jobs over the past four months, marking the largest drop since the 2020 crisis.

“In the past, such a drop has usually happened at the onset of a recession,” the post read.

Declining Jobs in The US. Source:

Declining Jobs in The US. Source:

In another post, the analyst pointed to the alarming rise in the long-term unemployment rate. The count of Americans who have been jobless for 27 weeks or more has more than doubled since December 2022. The number reached 1.9 million in August, marking the highest level in four years.

“The share of Americans unemployed for over 27 weeks hit 25.7%, in line with DEEP recession levels,” Global Markets Investor added.

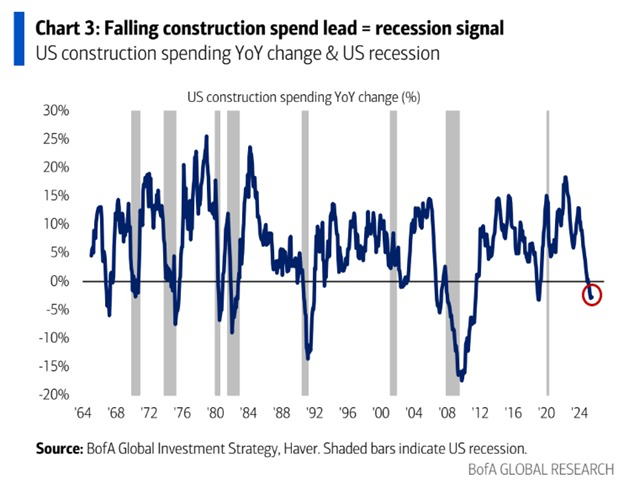

A second worrying sign is the steep decline in construction spending. The Kobeissi Letter highlighted that July 2025 figures showed a 2.8% decline year-over-year.

This was among the steepest drops since the 2008 financial crisis. On a monthly basis, spending has fallen in 10 of the past 11 months, marking the longest slide in 15 years.

“Over the last 50 years, such a sustained decrease in construction expenditures has occurred only during recessions, except in 2018. Meanwhile, construction employment has fallen for 3 consecutive months, the longest streak since 2012,” The Kobeissi Letter stated.

Construction, a key driver of economic activity, often serves as an early barometer of financial health. When investment in construction slows, it suggests weaker demand for housing, commercial projects, and infrastructure.

This decline reflects reduced confidence among developers and businesses and ripples into related industries like materials, labor, and financing. In addition to weaker construction activity, real consumer spending has decelerated this year.

US Construction Spending Performance. Source:

US Construction Spending Performance. Source:

While economic indicators shape the technical definition of a recession, public perception provides a complementary signal.

A recent Wall Street Journal–NORC poll highlights a sharp decline in economic optimism among Americans. Only 25% now believe they have a ‘good chance’ of improving their living standards, the lowest level recorded since 1987.

More than three-quarters doubt that future generations will be better off, while nearly 70% say the American dream no longer holds true or never did — the most pessimistic outlook in almost 15 years.

“Republicans in the survey were less pessimistic than Democrats, reflecting the longstanding trend that the party holding the White House has a rosier view of the economy,” WSJ reported.

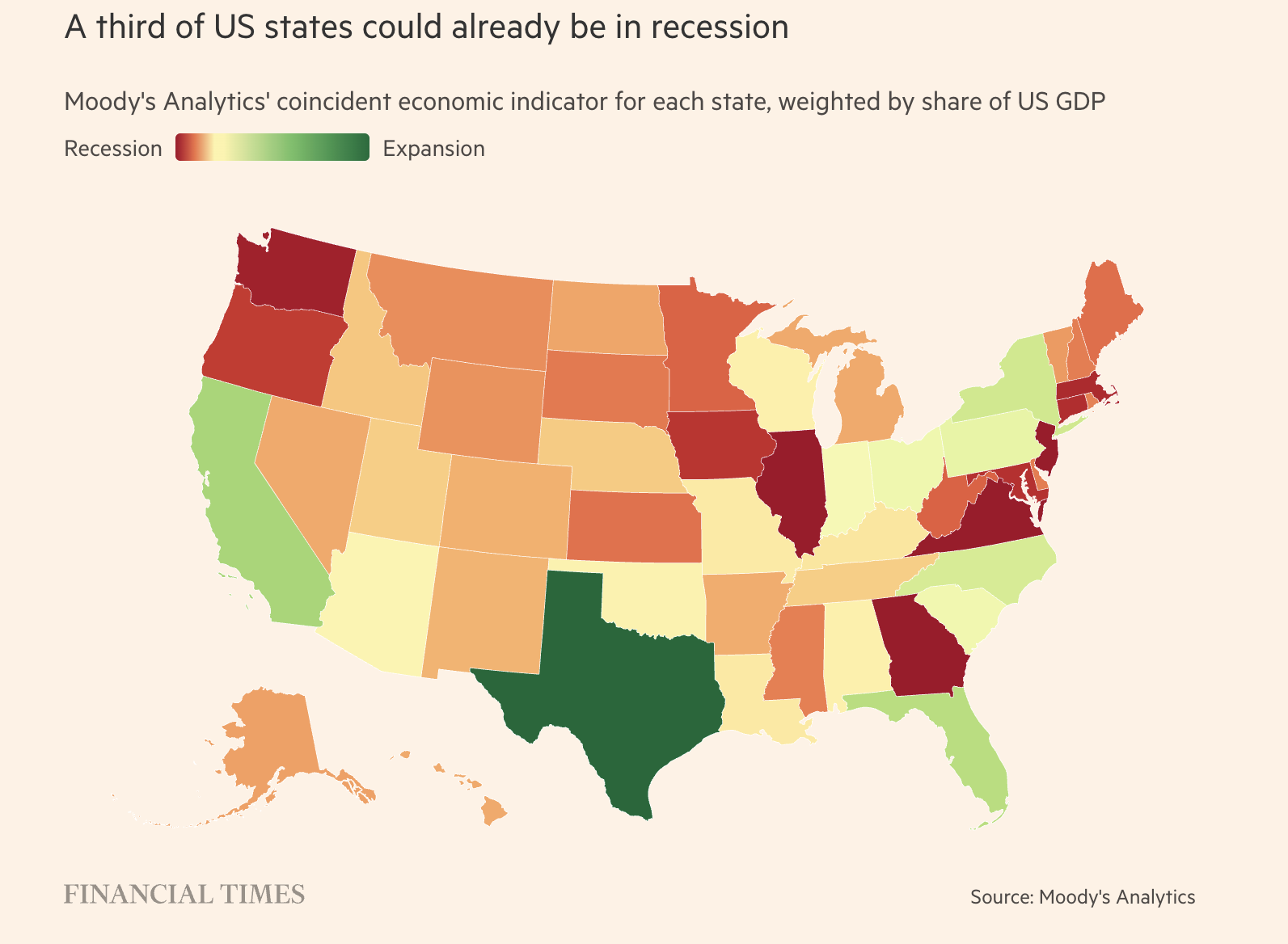

Meanwhile, a Financial Times report highlighted regional disparities in economic performance. The report suggests that several states, including Illinois, Washington, New Jersey, Virginia, and others, may already be in recession.

Potential US States in Recession. Source:

Potential US States in Recession. Source:

However, several major states—New York, Texas, Florida, and California—appear to sustain economic stability, potentially delaying a nationwide downturn.

Why a US Recession Could Trigger Crypto Sell-Offs

The data paints a bleak picture, but where does crypto fit into this? Financial trader Matthew Dixon explained that a recession generally weighs on assets like Bitcoin (BTC). As growth slows, company profits decline, and consumer demand weakens.

“Risk assets (stocks, crypto) price in future growth. If growth expectations shrink, valuations contract,” he remarked.

At the same time, investors often move funds into safe-haven assets like Treasuries, gold, or stable currencies, draining liquidity from crypto markets. Lending becomes more restrictive, borrowing costs rise, and speculative activity is pressured.

Even before fundamentals fully deteriorate, negative sentiment often pushes investors to cut risk, creating additional selling pressure on digital assets.

For months everybody counted on bitcoin shooting up because of the expanding money supply. But the money supply has flatlined.With employment cooling and delinquencies rising, the growing gap between M2 and TMS suggests the US is entering a period of serious economic weakness.…

— Dr Martin Hiesboeck (@MHiesboeck) September 3, 2025

Therefore, it’s clear that a US recession would weigh heavily on crypto. In the short term, risk aversion and tighter liquidity drain capital from digital assets, pressuring prices. Nonetheless, over time, monetary easing or growing distrust in fiat could reignite Bitcoin’s appeal as a hedge, while altcoins remain more vulnerable.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$1.3 million in 15 minutes, the ones who always profit are always them

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.