XRP Accumulation Hits 2-Year High, Is Price About To Rebound?

XRP is seeing record accumulation, fueling hopes of a breakout above $3, though elevated NVT signals could slow near-term momentum.

XRP has seen its recent decline slow, allowing the altcoin some breathing room in a volatile market.

Investors appear to be taking advantage of these lower prices, accumulating XRP in large volumes in hopes of capturing future gains.

XRP Investors Move To Accumulate

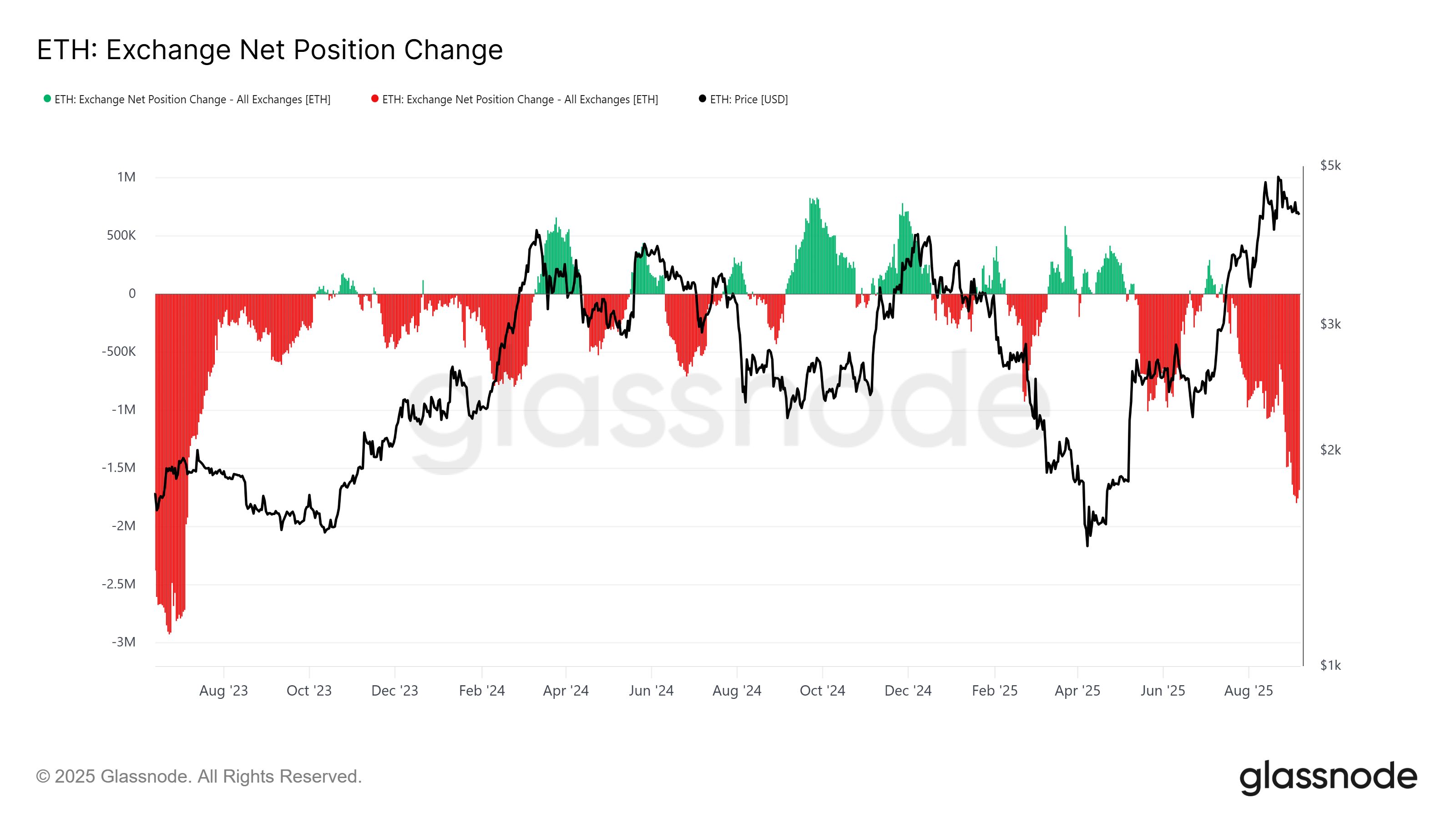

The exchange net position change data highlights that the recent XRP accumulation is the largest in more than two years. This renewed interest suggests that market participants are confident in the asset’s potential recovery and are preparing for a price breakout.

Over the past month, investors have accumulated approximately 1.7 million XRP, reflecting optimism despite broader market uncertainty. Such strong accumulation at current price levels highlights a belief that XRP has room for growth and could soon test higher resistance levels.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

XRP Exchange Net Position Change. Source:

Glassnode

XRP Exchange Net Position Change. Source:

Glassnode

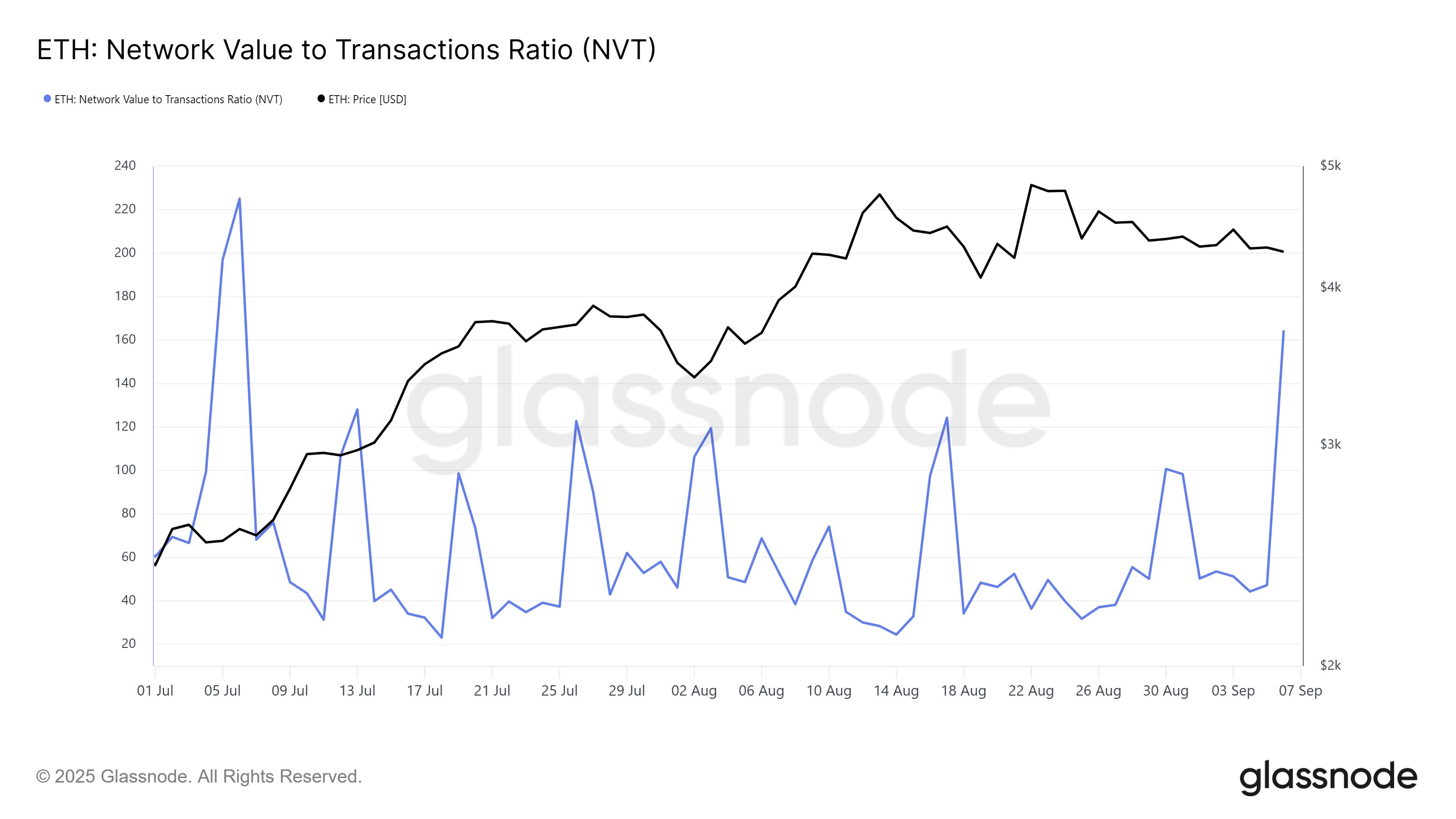

From a macro perspective, the Network Value to Transactions (NVT) ratio has spiked in the past 24 hours. This surge pushed the indicator to its highest point in two months, hinting that XRP’s network valuation is exceeding its transaction activity.

Historically, such spikes can signal that accumulation momentum is cooling in the short term. While sentiment remains bullish, a high NVT ratio can indicate overvaluation, potentially creating a temporary hurdle for XRP’s price trajectory in the near future.

XRP NVT Ratio. Source:

Glassnode

XRP NVT Ratio. Source:

Glassnode

XRP Price Is Looking At A Rise

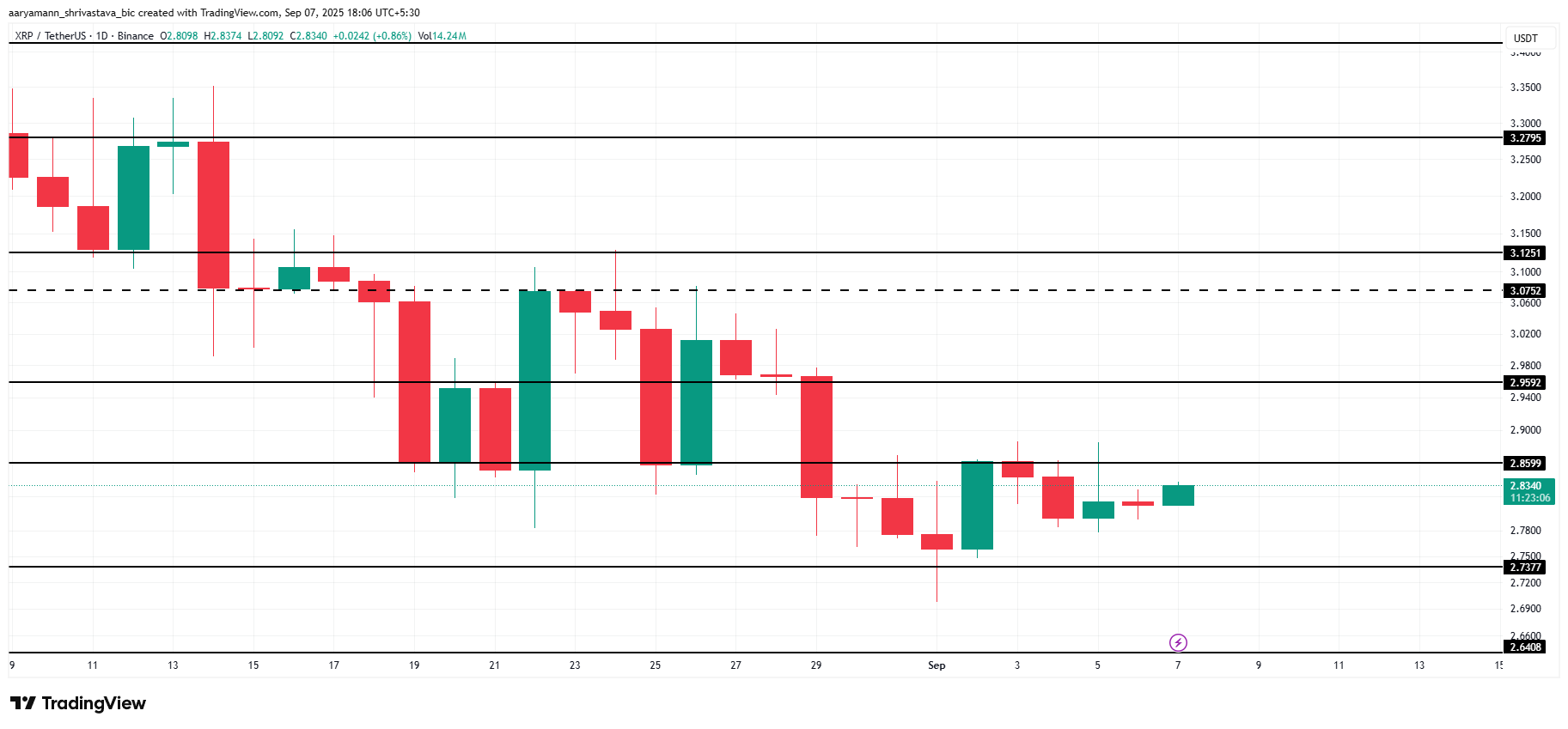

XRP is currently trading at $2.83, positioned just below the $2.85 resistance. Thanks to the sharp surge in accumulation, the altcoin is looking to break out.

If XRP flips $2.85 into support, it could climb toward $2.95 and potentially breach $3.07. Crossing this milestone would signal renewed strength in market momentum and validate the confidence shown by long-term holders.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, if XRP faces pressure from the elevated NVT ratio, it may struggle to maintain gains. A rejection at resistance could push the price down to $2.73, or even further to $2.64, which would invalidate the bullish outlook and extend the consolidation phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"Validator's Pendle" Pye raises $5 million, enabling SOL staking yields to be tokenized

There are truly no creative bottlenecks in the financialization of Web3.

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.