Germany may have access to ~45,000 BTC linked to the Movie2K piracy case, worth roughly $5 billion. If seized and sold, this stock could create significant market pressure; if retained or strategically reserved, it could avoid destabilizing Bitcoin prices.

-

45,000 BTC identified across 100+ wallets tied to Movie2K operators

-

Germany previously sold ~49,858 BTC in 2024 and realized around $2.9B at sub-$60K prices

-

Arkham analytics reports the new holdings; a repeat sale could create a substantial supply overhang

Meta description: Germany Bitcoin seizure: 45,000 BTC worth ~$5B linked to Movie2K identified; will authorities sell or hold? Read analysis and key takeaways.

What is the latest on Germany’s Movie2K Bitcoin holdings?

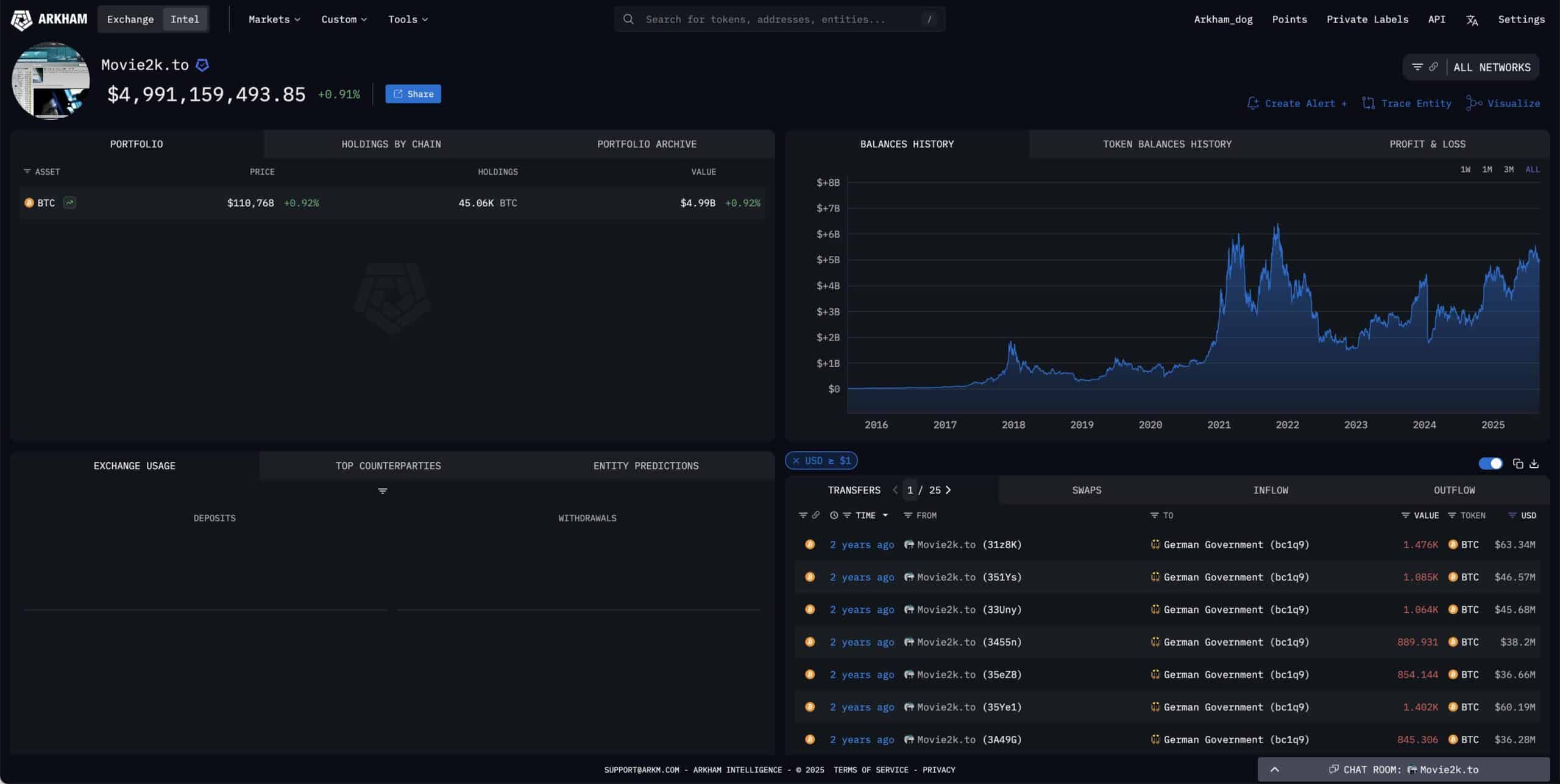

Germany Bitcoin seizure reports show blockchain analytics firm Arkham flagged about 45,000 BTC across more than 100 wallets connected to Movie2K operators. If authorities seize these funds and sell them immediately, they could reintroduce roughly $5 billion of supply into markets, risking renewed downward pressure on BTC prices.

How did Germany’s prior sell-off affect Bitcoin markets?

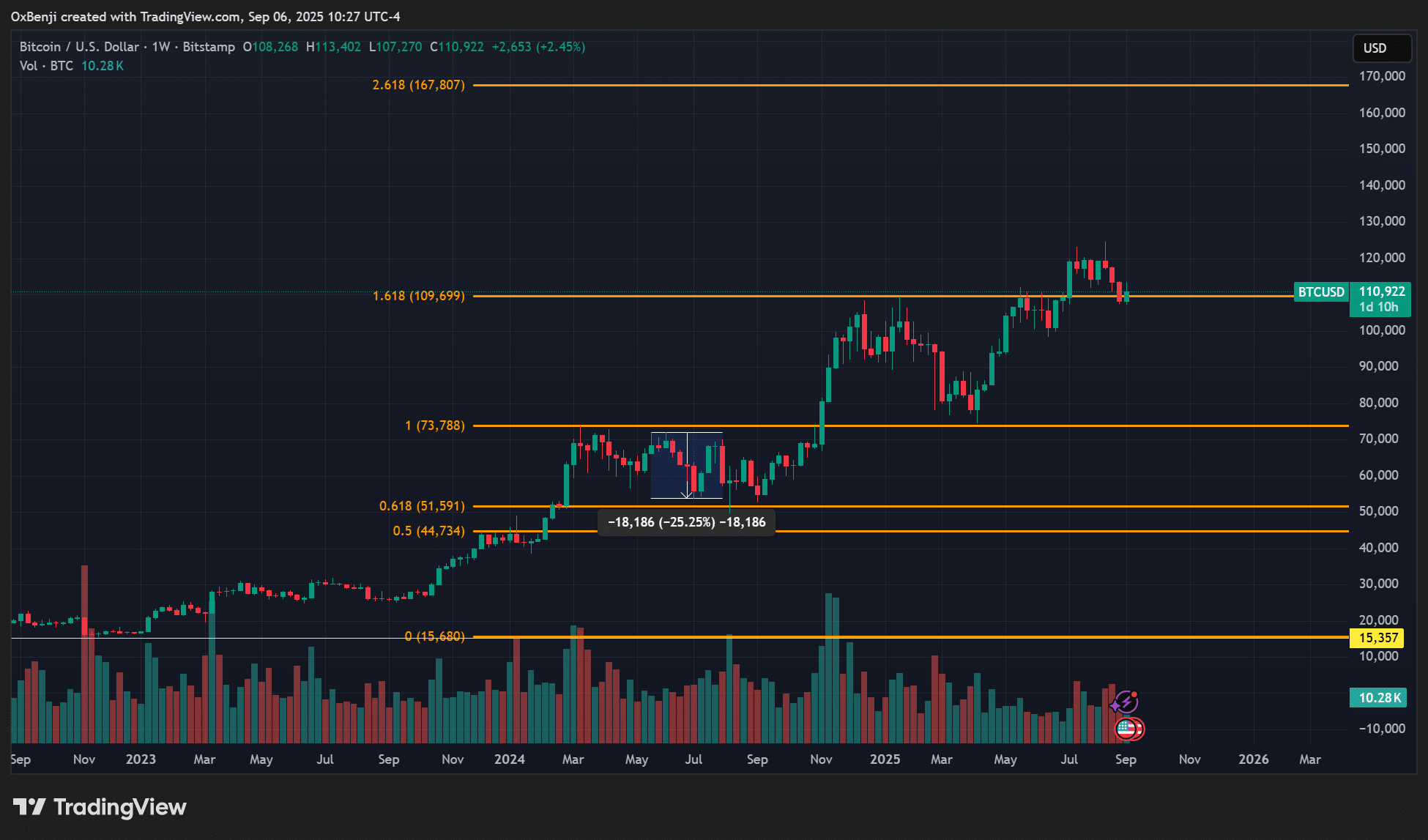

In mid-2024 German authorities disposed of 49,858 BTC from the Movie2K seizure when BTC traded below $60K. That sell-off coincided with a roughly 25% market drop and five months of consolidation. Had the state held those coins, the realized proceeds could have been materially higher when BTC later rallied above $120K.

Source: X

Why does Arkham say 45K BTC is likely still controlled by Movie2K operators?

Arkham’s on-chain analysis traced funds to clusters of addresses exhibiting coordinated behavior consistent with a single operator set. These addresses have not been flagged as custodial transfers to known government wallets, indicating the assets are likely still accessible to Movie2K-linked actors rather than already in state control.

That distinction matters: assets already in government custody would be subject to official disposition policies. Assets still controlled by private actors present the possibility of seizure, but also the potential for mixing, movement, or liquidation by the operators themselves.

Source: Arkham

When could Germany act on these wallets, and what options exist?

Timing depends on investigations and judicial decisions. If prosecutors obtain warrants and the assets are proven criminal proceeds, options include seizure followed by:

- Immediate auction or sale (likely to create market supply pressure)

- Gradual disposition over time to limit market impact

- Retention by state as a strategic reserve or conversion to euro reserves

Policy choices will determine whether the market sees a sudden supply injection or a managed release over months.

Source: BTC/USD, TradingView

How big is the potential market impact if 45K BTC is sold?

At current prices, 45,000 BTC is roughly a $5 billion position. An immediate block sale of that size could weigh on short-term liquidity and drive price volatility. Conversely, a staggered release or holding policy would reduce market disruption and potentially preserve greater value for the treasury.

Frequently Asked Questions

Could Germany create a strategic Bitcoin reserve with seized BTC?

Yes. Lawmakers previously proposed a strategic reserve after the 2024 sell-off. Creating a reserve would require policy approval and secure custody procedures but would avoid immediate market sell pressure and preserve asset value for public benefit.

How might the market react if the BTC are seized and sold quickly?

Markets typically respond negatively to large unanticipated supply events. A fast sale of tens of thousands of BTC could trigger short-term declines and increased volatility, especially if liquidity is thin at key price levels.

Key Takeaways

- Size of holding: Arkham identified ~45,000 BTC (~$5B) across 100+ wallets linked to Movie2K.

- Historical impact: A prior German sale of ~49,858 BTC in 2024 coincided with a notable BTC drawdown.

- Policy matters: A managed disposition or reserve would limit market damage; an immediate sale risks renewed volatility.

Conclusion

This development places Germany at a crossroads: a repeat of a quick disposition risks destabilizing the Bitcoin market, while a measured policy—such as a strategic reserve or phased sales—could secure higher proceeds and reduce volatility. Market participants and policymakers will watch legal steps and on-chain movements closely.