XRP news: XRP saw a sharp intraday volume surge (up to 44% to $6.57B) and a notable rise in CME open interest, while the XRP Ledger activated the XLS-70 credentials amendment — a development that could boost on‑chain identity and institutional activity.

-

XRP volume spike to $6.57B — a 44% increase in intraday trading.

-

Record CME open interest for XRP highlights growing institutional participation.

-

Credentials amendment (XLS-70) activated on XRP Ledger introduces new credential ledger objects.

XRP news: Volume surged to $6.57B, CME open interest hit record highs, and XLS-70 credentials went live — read the latest on market impacts and next steps.

What is the latest XRP news?

XRP news shows a mixed session: an intraday volume surge to $6.57 billion and higher open interest on CME, followed by a pullback that left XRP trading near $2.80. The XRP Ledger also activated the XLS-70 credentials amendment, adding on‑chain credential objects and new transaction types.

How did XRP volume and price move during the session?

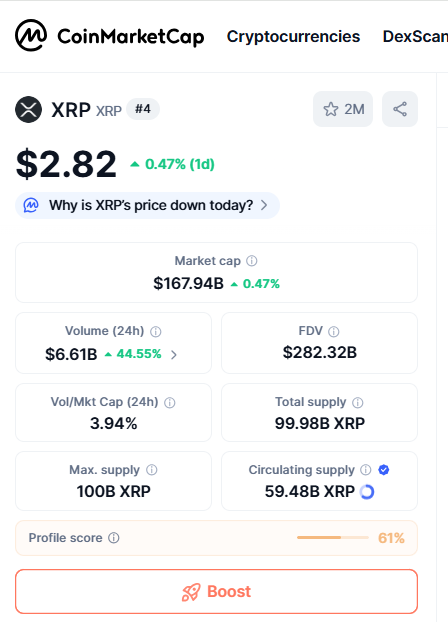

Front-loaded market reaction came after a weaker US jobs report heightened rate-cut expectations. XRP’s volume rose as much as 44% to $6.57 billion, according to CoinMarketCap plain-text data. Price briefly hit $2.88 before easing to $2.80 at press time, a 0.85% decline in 24 hours.

XRP Volume, Courtesy: CoinMarketCap

Why did CME open interest matter for XRP?

CME futures reported record August growth in crypto futures and options open interest (~$36 billion overall). Plain-text CME data showed XRP futures reached $1B in open interest faster than other contracts, a milestone highlighted by Ripple CEO Brad Garlinghouse in a public comment.

How does XLS-70 change the XRP Ledger?

The credentials amendment (XLS-70) is now active on mainnet. XLS-70 introduces a new “Credential” ledger object and transaction types for creating, accepting and deleting credentials. This lightweight addition aligns with DID concepts and makes on‑chain credential issuance and verification native to the ledger.

Frequently Asked Questions

How high did XRP volume rise and where does that data come from?

XRP’s intraday volume climbed as much as 44% to $6.57 billion. The volume figure is reported as plain-text CoinMarketCap data and reflects aggregated trading activity across listed venues.

How fast did XRP reach $1B in open interest on CME?

Per plain-text CME data highlighted by Ripple CEO Brad Garlinghouse, XRP futures reached $1B in open interest in just over three months — a record pace compared with other contracts.

Key Takeaways

- Volume spike: XRP volume rose up to 44% intraday to $6.57B, signaling heightened trading activity.

- Institutional interest: CME data shows record crypto open interest growth; XRP futures hit $1B in OI rapidly.

- Protocol upgrade: XLS-70 credentials are live on mainnet, enabling on‑chain credential objects and related transactions.

Conclusion

This XRP news update documents a brief but meaningful increase in market activity: a 44% volume surge, accelerated CME open interest, and the live activation of XLS-70 on the XRP Ledger. Together, these developments suggest both market reactivity to macro data and advancing protocol utility. Watch on‑chain metrics and CME flows for confirmation; COINOTAG will continue monitoring and reporting updates.