Date: Fri, Sept 05, 2025 | 03:50 PM GMT

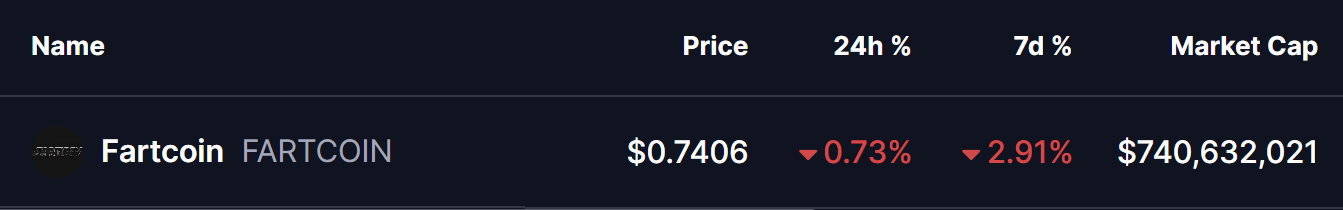

The cryptocurrency market is again showing volatility as Ethereum (ETH) dips below $4,300 today following the latest weak U.S. labor report , cooling off from its recent high of $4,954 — a drop of more than 13% in just weeks. This weakness has spilled over into major memecoins, including Fartcoin (FARTCOIN).

FARTCOIN saw a modest weekly decline, but beyond the red candles, its chart is now flashing a potentially bullish signal — the emergence of a “Power of 3” setup that could open doors for a strong bounce back.

Source: Coinmarketcap

Source: Coinmarketcap

Power of 3 Pattern in Play?

On the daily chart, FARTCOIN appears to be shaping into a textbook Power of 3 structure, which typically unfolds in three stages:

Accumulation Phase

For weeks, FARTCOIN consolidated inside a broad zone, ranging between $1.65 (resistance) and $0.89 (support). This sideways action suggested quiet accumulation by bigger players, as volatility tightened.

FARTCOIN Daily Chart/Coinsprobe (Source: Tradingview)

FARTCOIN Daily Chart/Coinsprobe (Source: Tradingview)

Manipulation Phase

Recently, the token slipped below the $0.89 support, dipping to lows of $0.74 and even testing near $0.68. This red-shaded zone reflects the manipulation phase, often meant to shake out weak holders and trigger false breakdowns before a potential reversal.

What’s Next for FARTCOIN?

At the moment, FARTCOIN remains inside the manipulation zone, leaving the door open for a further dip toward the $0.63 support. However, if buyers manage to defend this level and push price back above $0.89, or reclaim the 200-day moving average (MA) at $0.9185, the token could enter the expansion phase — the most bullish leg of the setup.

A confirmed breakout above $1.00 would further strengthen bullish momentum, with upside targets pointing back toward the $1.65 range, representing more than 120% potential gains from current prices.

That said, a decisive breakdown below $0.63 would weaken the bullish setup and risk dragging FARTCOIN into a deeper correction.