Profit Takers Hurt Solana Price — Here’s Why a Respite Might Be Far Away

The Solana Price has cooled after August’s sharp rally. With profit-taking active and money inflows drying up, the current move looks fragile. Resistance near $218 must break cleanly for any upside, but without whale support, a deeper pullback remains possible.

The Solana Price has cooled after a strong August. Over the past seven days, it has traded flat, and in the last 24 hours, it slipped 1.1%. By contrast, monthly gains still stand near 26%, and three-month gains are about 35.8%.

For traders reading this to see if the SOL Price can repeat those August-style gains, the answer may be disappointing. On-chain data shows profit booking is heavy, and another metric has quietly turned bearish. Together, these raise doubts over how fast Solana can move higher from here.

Two Metrics Hint At Active Selling

On-chain data shows that the percentage of supply in profit is still very high for Solana. As of September 3, nearly 95% of Solana holders were in profit, close to the six-month peak of 96.59% on August 8. Even at press time, the reading sits around 87%, still an overheated level. When such a high percentage sits on gains, the temptation to sell rises.

Solana Traders Have An Incentive To Sell:

Glassnode

Solana Traders Have An Incentive To Sell:

Glassnode

History backs this. The last time profit supply dropped hard, falling under 54% on August 2, Solana Price was about $158.53. From there, SOL Price climbed all the way to $214.51 by August 28 — a gain of roughly 35%. This indicates that Solana mostly rallies when fewer holders hold onto their profits. Otherwise, every move higher tends to get sold into strength.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Profit Booking Into Strength Continues:

Glassnode

Profit Booking Into Strength Continues:

Glassnode

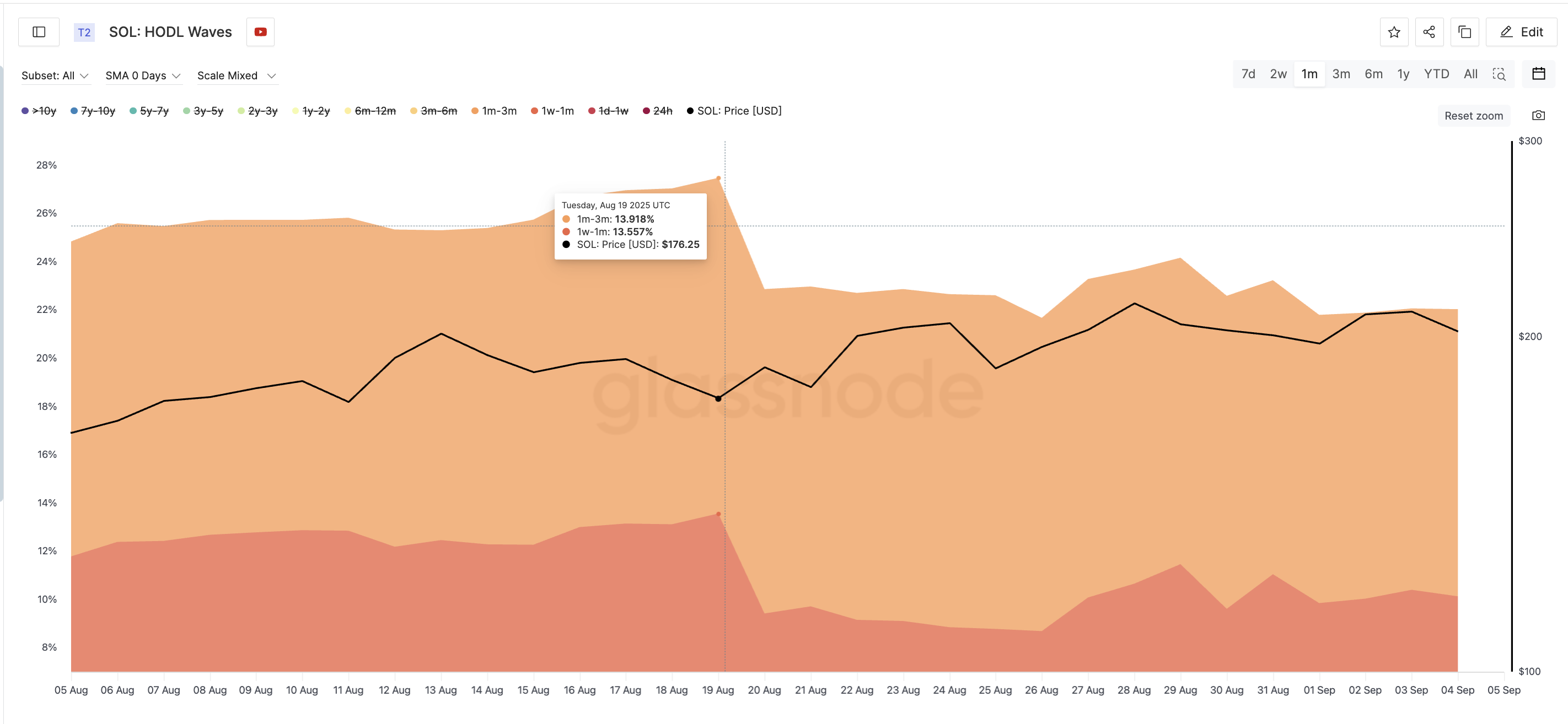

The HODL Waves metric, which tracks how long coins are held before moving, confirms this. Short-term holders — those who held between 1 week–1 month and 1–3 months — peaked on August 19, when Solana Price traded near $176.

Together, they controlled about 27% of the supply. Since then, their share has dropped to around 22%. These cohorts are selling into strength, showing profit-taking is active in real time.

Weak Money Inflows Reveal the Solana Price Fragility

On the price chart, the SOL Price faces heavy resistance at $218. A clean candle close above the latter would confirm a breakout and mark a new high, invalidating the bearish view.

However, the problem of money flow keeps the optimism low. The Chaikin Money Flow (CMF), which measures whether buying pressure or selling pressure dominates, has weakened sharply. On July 22, when the Solana Price hit a local high, CMF stood at 0.31, showing strong inflows. Since then, price has made higher highs, but CMF has dropped to –0.01.

Solana Price Analysis:

TradingView

Solana Price Analysis:

TradingView

This divergence means whales and institutions are not adding fresh money into SOL. Without these large inflows, profit-takers face little resistance when selling. The lack of offsetting demand leaves rallies fragile and makes a deeper pullback more likely than a respite if key supports fail.

On the downside, strong support sits at $194, with further levels at $186 and $173 if selling deepens. At present, the Solana Price is holding steady, but unless CMF improves, any respite looks far off.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.

Bitcoin Under Pressure Despite Fed Optimism