XRP Ledger (XRPL) Q2 2025 : Record RWAs, XRP Growth, and Stablecoin Momentum

The XRP Ledger (XRPL) recorded strong performance in the second quarter of 2025, according to research firm Messari. The network saw fresh issuances of tokenized real-world assets, steady growth in the market capitalization of XRP, and an expanding footprint for Ripple’s stablecoin RLUSD. At the same time, network fee revenue fell, reflecting XRPL’s unique fee structure.

In Brief

- XRPL saw strong growth in Q2 2025, with new RWAs issued and rising token activity.

- Real-world assets on XRPL reached a record market cap of $131.6M in Q2 2025.

- XRP closed Q2 2025 as the fourth-largest crypto at $132B, up 8.5% from the previous quarter.

Real-world assets reach new highs

Messari’s “State of XRP Ledger Q2 2025” noted that the market capitalization of real-world assets (RWAs) issued on XRPL climbed to an all-time high of $131.6 million by the end of the quarter.

The increase was driven by several issuances first announced at the XRPL Apex event in Singapore in June. These included :

- Tokenized real estate from Ctrl Alt ;

- Digital commercial paper from Guggenheim ;

- The OUSG tokenized Treasury fund from Ondo.

Each of these offerings expanded the scope of what can be represented and transacted on XRPL.

Infrastructure has also improved. In March, the analytics provider RWA.XYZ integrated the XRPL into its platform, making it possible to monitor performance and activity of RWAs issued on the network. At present, thirteen RWAs have been added to the platform, with more integrations expected.

XRP closes Q2 as fourth-largest cryptocurrency

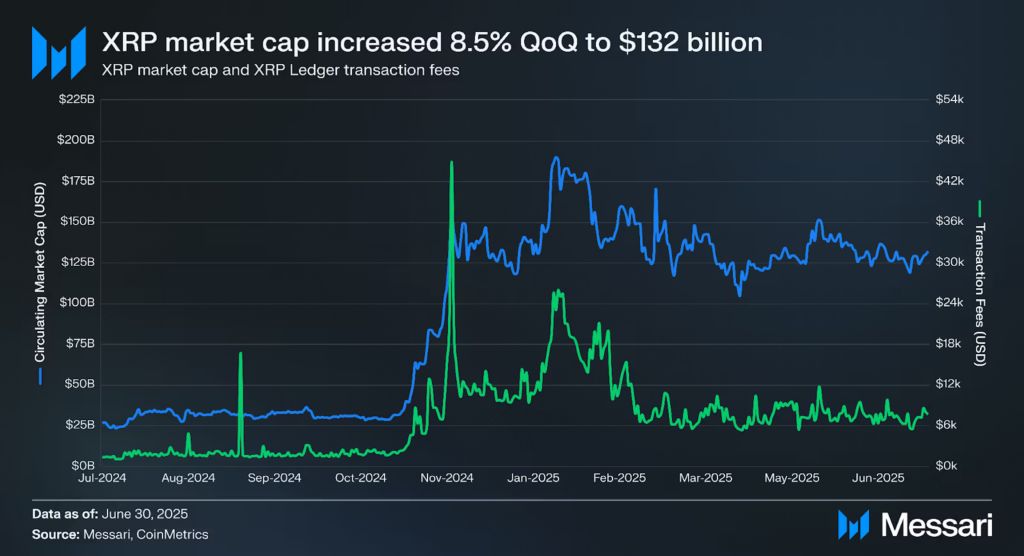

The quarter also reflected continued strength for XRP, the native token of the ledger. By the end of Q2 2025, XRP closed as the fourth-largest cryptocurrency by market capitalization, with a value of $132 billion. That represented an 8.5% increase from the previous quarter, while the price of XRP rose by 7.1% over the same period.

Momentum carried beyond the quarter’s close. At the time of writing, XRP’s market capitalization had risen further to $166.8 billion, reinforcing its position among the top digital assets.

XRP market cap rises 8.5% to $132B as fees drop.

XRP market cap rises 8.5% to $132B as fees drop.

Transaction Fees Decline on XRPL

While value on the ledger expanded, fee revenue declined. Messari emphasized that XRPL differs from many other networks in how it handles fees. Rather than rewarding validators or stakers, XRPL permanently removes transaction fees from circulation.

During the second quarter of this year, fees collected in U.S. dollars fell 38.7% quarter-over-quarter, from about $1.1 million to $680,900, while fees measured in XRP dropped 27.4%, from 425,300 XRP to 308,700 XRP

Stablecoin Growth on XRPL and Ethereum

Alongside these developments, Ripple’s stablecoin RLUSD gained further ground, ending Q2 with a combined market capitalization of $455.2 million across XRPL and Ethereum.

Subsequent data from RWA.XYZ indicated continued growth. At the time of writing, RLUSD’s total market value has reached $701.6 million, up more than 16% in the last 30 days .

On XRPL specifically, RLUSD ended the quarter with $65.9 million in market capitalization, a 49.4% rise compared to the previous quarter. This made it the leading stablecoin on the ledger. Current data places its XRPL share at $85.9 million, with another $615 million issued on Ethereum.

Taken together, the expansion of RLUSD , the record high for real-world assets, and the steady rise of XRP all signaled strong momentum. XRPL ended the second quarter of 2025 on a high note, and the months ahead will show how the network can leverage this foundation while navigating its distinctive fee model in the face of growing asset demand.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.