More People Worldwide Are Turning to Crypto Retirement, Here's Why

Crypto Gains Traction in Retirement Planning

Cryptocurrency is no longer viewed as just a speculative trade. Across the globe, more people are now considering digital assets as part of their retirement strategy. Surveys show that a significant portion of adults are open to allocating part of their pension savings to cryptocurrencies, while others are even willing to withdraw existing retirement funds to invest directly in Bitcoin and altcoins.

This shift highlights a growing belief that digital assets could play a role in long-term wealth accumulation, especially as inflation, debt crises, and shifting monetary policies reshape global financial markets.

Motivations: Higher Potential Returns

One of the strongest motivations behind this trend is the pursuit of higher potential returns . Many respondents in global surveys cited crypto’s growth potential as a key reason for considering it in retirement portfolios.

At the same time, the rise of government-backed pension funds, worth trillions worldwide, provides a huge pool of capital that could eventually flow into digital assets if adoption becomes mainstream.

Pension Withdrawals to Invest in Crypto

What’s particularly striking is that a sizable portion of individuals are considering taking funds out of traditional pension schemes altogether to allocate them into crypto. Among younger demographics, especially those aged 25–34, there is already evidence of people cashing out portions of their pensions to diversify into digital assets.

This trend underscores a generational divide: while older investors often prefer traditional pensions with tax benefits and employer contributions, younger investors are drawn to the higher risk-reward profile of crypto.

Growing Risks and Concerns

Despite the enthusiasm, concerns remain. Security risks such as hacking and phishing attacks rank among the top fears, alongside regulatory uncertainty and crypto’s notorious volatility. Many potential investors also admit they don’t fully understand what they might be giving up by moving away from traditional pension systems.

Banks and regulators have responded cautiously, with some financial institutions slowing or blocking crypto-related transactions. Meanwhile, governments are working on regulatory frameworks to balance innovation with investor protection.

A Global Shift in Retirement Investment

The trend isn’t isolated. In the U.S., new policies now allow retirement plans like 401(k)s to include Bitcoin and other cryptocurrencies, opening access to trillions in managed retirement funds. Europe and Asia are also exploring ways to integrate crypto into regulated financial products, suggesting that retirement planning is evolving on a global scale.

As Michele Golunska, Managing Director of Wealth and Advice at Aviva, has highlighted in past discussions: while crypto is appealing, traditional pensions still carry powerful advantages such as employer contributions and tax relief. The key will be finding the right balance between these two worlds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Monad mainnet launches tonight: key information you must know

Based on the pre-market price of around $0.032-0.034 at the time of publication, the public offering participants' notional returns are between 28% and 36%.

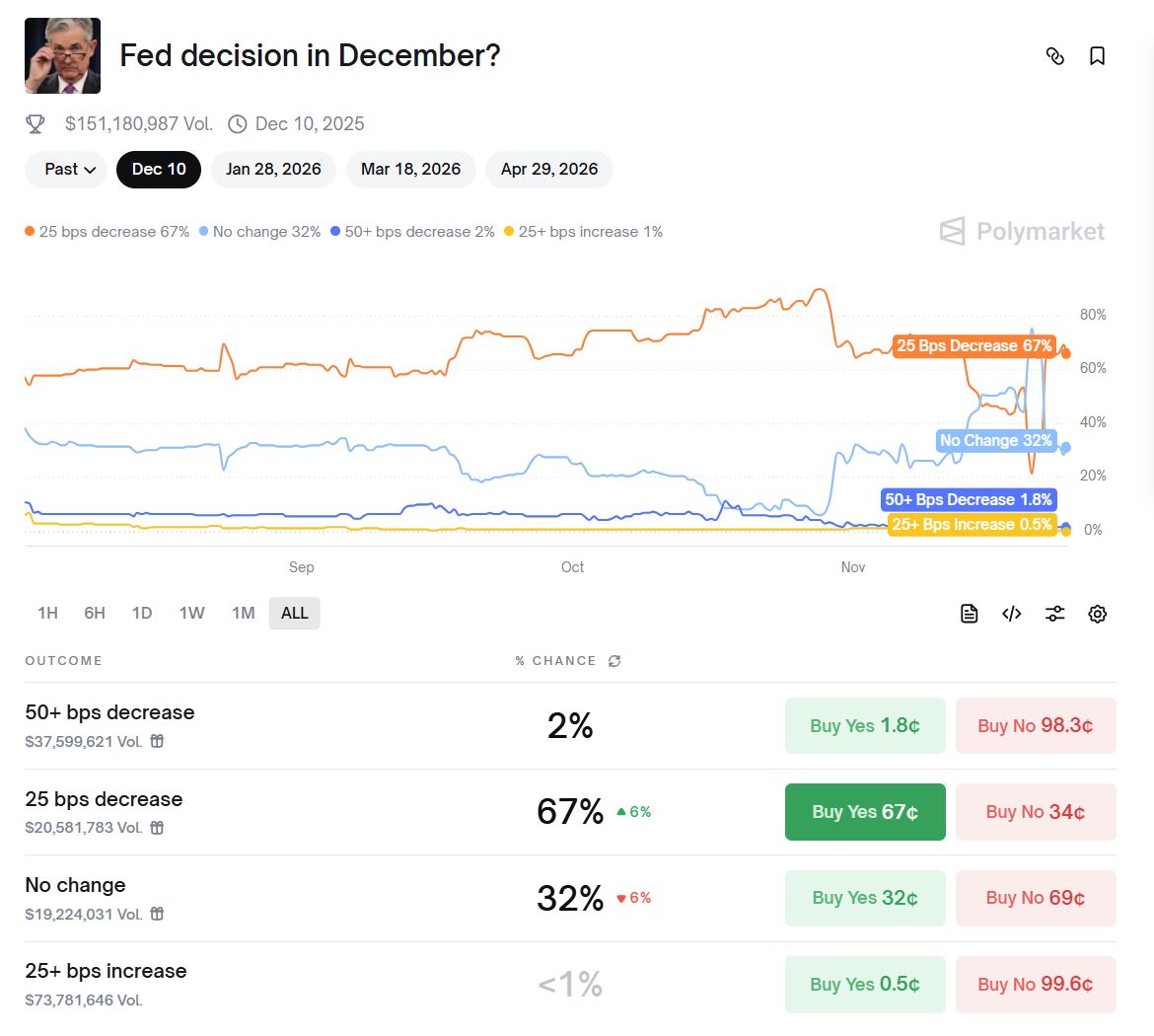

The Federal Reserve is deeply embroiled in an "internal war," making a December rate cut a "coin toss" bet.

Significant policy divisions have emerged within the Federal Reserve, making the question of whether to cut interest rates in December a key focus. Powell’s silence has increased market uncertainty, while political pressure and the lack of economic data have further complicated decision-making.

Filecoin Onchain Cloud: Application Case Analysis and Launch of Limited Edition NFT Program for Early CloudPaws Contributors

Filecoin is a protocol-based decentralized data storage network designed to provide long-term, secure, and verifiable data storage capabilities.

From Platform to Ecosystem, SunPerp Upgrades to SunX: Justin Sun Elaborates on DEX's "Long-termism" and Global Strategy

This upgrade marks SunX's transformation from a single trading platform to a self-circulating and self-growing decentralized ecosystem hub.