PetroChina Joins Stablecoin Race to Challenge Dollar Dominance

- PetroChina explores stablecoins for cross-border payments, aligning with HKMA's licensing framework to reduce costs and streamline transactions. - The company's feasibility study follows Shenzhen Metro's pilot showing stablecoins cut exchange rate losses compared to SWIFT transfers. - Hong Kong's six-month transition period for stablecoin licenses has drawn major firms like JD Coin and Ant Group to apply for yuan-backed projects. - China's cautious approach to stablecoins aims to challenge dollar dominan

PetroChina is actively exploring the potential use of stablecoins for cross-border payments, signaling a strategic shift in the company’s approach to international financial transactions. At its mid-year results conference, the state-owned energy giant revealed it is closely monitoring the Hong Kong Monetary Authority’s (HKMA) stablecoin licensing framework and plans to conduct a feasibility study on the adoption of stablecoins in cross-border trade [1]. The HKMA’s Stablecoin Ordinance, which became effective on August 1, outlines a regulatory structure for stablecoin issuers, aiming to foster innovation while ensuring financial stability [2]. PetroChina’s initiative positions it among the first major Chinese state-owned enterprises to publicly express interest in stablecoin technology.

The company’s Chief Financial Officer highlighted the growing interest in leveraging stablecoins to reduce costs and streamline international transactions. Cross-border trade, which accounts for a significant portion of PetroChina’s operations, could benefit from the efficiency and speed of stablecoin-based settlements. A pilot project by Shenzhen Metro Line 8 demonstrated that stablecoins reduced exchange rate losses in cross-border transactions compared to traditional SWIFT transfers, indicating potential cost savings for large-volume traders like PetroChina [1].

Hong Kong has emerged as a focal point for stablecoin development in the region, with several major financial institutions and technology firms expressing interest in the HKMA’s licensing process. Companies including JD Coin, Ant Group, Standard Chartered, and Telecom have all indicated plans to issue yuan-backed stablecoins under the new regulatory regime. While no licenses have been granted yet, the HKMA has initiated a six-month transition period, requiring interested institutions to submit applications by September 30 [1]. Market expectations suggest that the first round of licenses could be issued before the end of 2025, providing a clear timeline for companies like PetroChina to proceed with their feasibility studies.

China’s broader approach to stablecoins remains cautious and evolving. Although the country has begun testing renminbi-backed stablecoins, government officials have at times urged state-owned companies to halt discussions on the matter due to concerns over potential misuse. However, recent developments indicate a warming stance, with officials seeking expert input on how to issue and regulate stablecoins pegged to the local currency [1]. This shift is partly driven by a strategic interest in reducing the dominance of the U.S. dollar in global trade and finance. Japan and South Korea are also advancing similar efforts, reinforcing the regional momentum toward stablecoin adoption.

As part of its strategic review, PetroChina is examining how stablecoins could support its extensive international operations, which span over 50 countries and involve the trade of approximately 300 million tons of hydrocarbons annually. The company’s exploration aligns with global trends, as the U.S. and other countries push for regulatory clarity around stablecoins. With PetroChina’s announcement, it is likely that other state-owned enterprises will follow suit, further embedding stablecoins into the fabric of China’s cross-border financial infrastructure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How We Build: Boundless Product Engineering and the Post-TGE Era

Now, thanks to the team's efforts, Boundless has become the first truly decentralized and permissionless protocol capable of handling any general-purpose ZKVM proof request.

Latest Global On-Chain Wealth Rankings: Who Are the Top Players in the Crypto World?

The latest on-chain rich list shows that crypto assets are highly concentrated in the hands of a few whales, making the wealth distribution pattern increasingly clear.

Monad mainnet launches tonight: key information you must know

Based on the pre-market price of around $0.032-0.034 at the time of publication, the public offering participants' notional returns are between 28% and 36%.

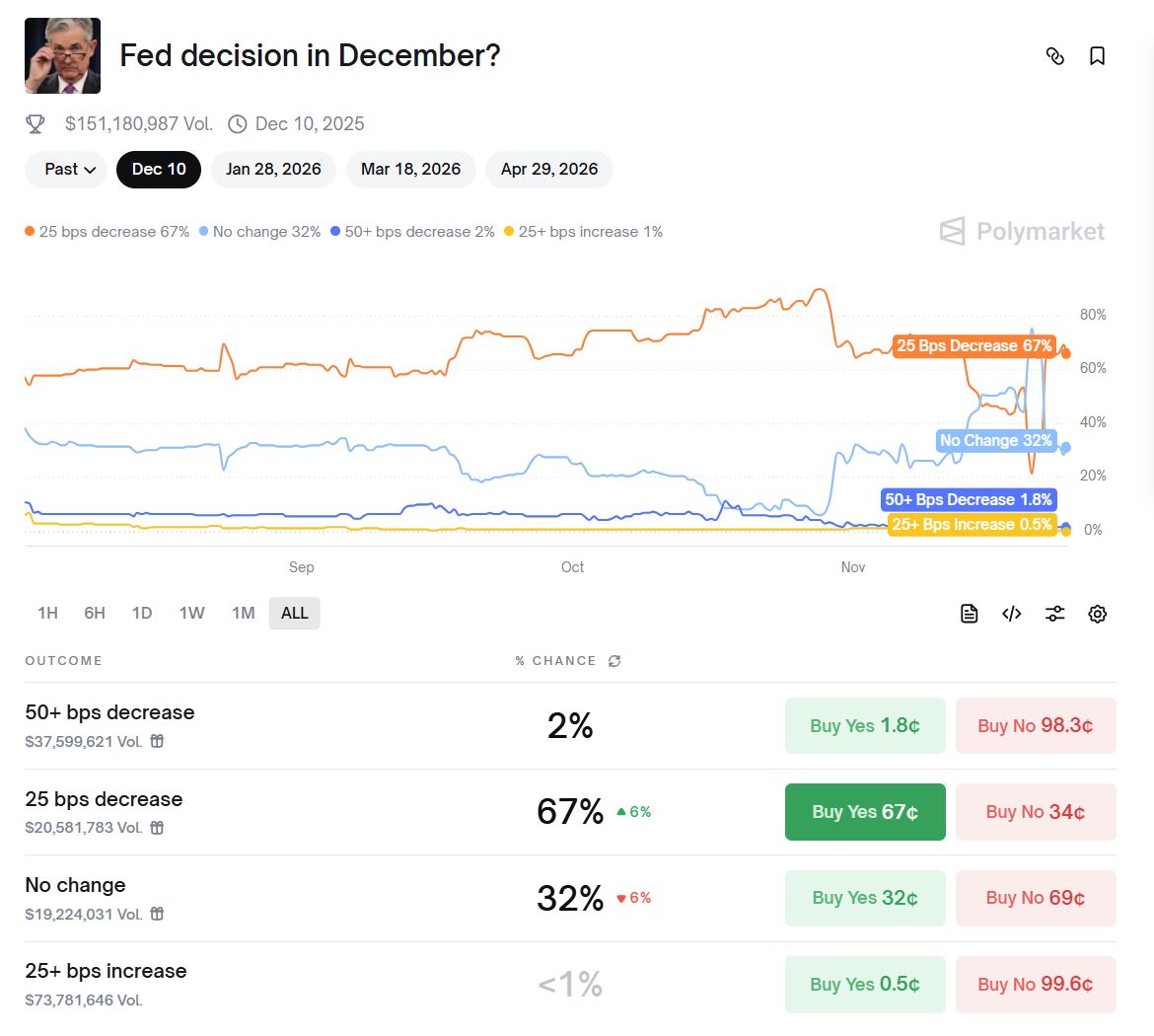

The Federal Reserve is deeply embroiled in an "internal war," making a December rate cut a "coin toss" bet.

Significant policy divisions have emerged within the Federal Reserve, making the question of whether to cut interest rates in December a key focus. Powell’s silence has increased market uncertainty, while political pressure and the lack of economic data have further complicated decision-making.