Ethereum ETFs Overtake Bitcoin in Institutional Inflows: A New Bull Cycle Begins?

- Institutional capital shifted $13.6B to Ethereum ETFs in three weeks, contrasting Bitcoin's $800M outflows as Ethereum gains structural advantages in 2025. - Ethereum's 4-6% staking yields, post-SEC regulatory clarity, and Dencun upgrades (94% cheaper L2 transactions) drive institutional adoption over Bitcoin's stagnant model. - A 60/30/10 allocation model (60% Ethereum) emerges, supported by $10B Ethereum derivatives open interest and BlackRock's $262.6M ETHA inflows versus Bitcoin's $50.9M. - Analysts

Institutional capital is reshaping the crypto landscape in 2025, with Ethereum ETFs capturing a staggering $13.6 billion in inflows over three weeks, while Bitcoin ETFs recorded over $800 million in outflows during the same period [4]. This seismic shift signals a structural reallocation of assets toward Ethereum-based products, driven by Ethereum’s yield-generating capabilities, regulatory clarity, and infrastructure dominance.

Structural Advantages: Staking Yields and Regulatory Clarity

Ethereum’s proof-of-stake model offers institutional investors a critical edge: annual staking yields of 4–6%, a stark contrast to Bitcoin’s zero-yield model [3]. These yields create a flywheel effect, where staking rewards reinforce network security and provide passive income, making Ethereum a more attractive allocation in low-interest-rate environments [1]. By August 2025, over $17.6 billion in corporate treasuries had been staked in Ethereum, further solidifying its role as a utility-driven asset [1].

Regulatory clarity has also accelerated Ethereum’s adoption. The U.S. SEC’s 2025 reforms, including the reclassification of Ethereum as a utility token and the approval of in-kind creation/redemption mechanisms for Ethereum ETFs, have eliminated legal ambiguity and boosted institutional confidence [5]. In contrast, Bitcoin ETFs remain in a regulatory gray zone, with ongoing debates over their classification deterring large allocations [6].

Product Superiority: Fee Efficiency and Scalability

Ethereum ETFs outperform Bitcoin ETFs in fee efficiency and scalability. The Dencun/Pectra upgrades reduced Layer 2 (L2) transaction costs by 94%, making Ethereum the preferred settlement layer for tokenized assets and decentralized finance (DeFi) [8]. This technical edge has driven Ethereum’s DeFi Total Value Locked (TVL) to $223 billion by July 2025, compared to Bitcoin’s negligible DeFi footprint [7]. Additionally, Ethereum’s energy consumption dropped 99% post-upgrade, aligning with institutional ESG mandates [4].

Capital Reallocation: The 60/30/10 Allocation Model

Institutional investors are increasingly adopting a 60/30/10 allocation model—60% Ethereum-based products, 30% Bitcoin, and 10% high-utility altcoins—reflecting Ethereum’s dominance in yield generation and infrastructure [5]. BlackRock’s iShares Ethereum Trust (ETHA) exemplifies this trend, capturing $262.6 million in inflows on August 27 alone, compared to Bitcoin’s $50.9 million [2]. This reallocation is further supported by Ethereum’s derivatives open interest, which reached $10 billion in Q3 2025, outpacing Bitcoin’s stagnant $12 billion [4].

Expert Validation and Future Outlook

Analysts project Ethereum could reach $6,100 by year-end 2025, with ambitious forecasts suggesting $12,000+ if institutional inflows continue [1]. Goldman Sachs’ Ethereum ETF holdings ($721.8 million) and the Altcoin Season Index (ASI) climbing to 44–46 in August 2025 underscore this optimism [3]. Meanwhile, Bitcoin’s market dominance has declined to 59%, reflecting waning institutional interest [1].

Ethereum’s structural advantages—yield generation, regulatory clarity, and infrastructure utility—position it to lead a new bull cycle. As institutional capital continues to reallocate, the gap between Ethereum and Bitcoin ETFs is likely to widen, cementing Ethereum’s role as the backbone of the tokenized economy.

**Source:[1] Ethereum's Institutional Adoption and Price Momentum in Q3 2025 [2] Spot Ethereum ETF Inflows Flip Bitcoin Once Again, Will ... [3] Ethereum's Strategic Ascendancy in Institutional Portfolios [4] Bitcoin News Today: Investors Flee Bitcoin ETFs, Flock to ... [5] SEC Permits In-Kind Creations and Redemptions for Crypto ETPs [6] Bitcoin vs. Ethereum in 2025: Comparison & Outlook [7] Ethereum's Derivatives Surge: A New Institutional Bull Market [https://www.bitget.site/news/detail/12560604937298][8] Ethereum ETFs Surpassing Bitcoin: A Structural Shift in Institutional Capital Allocation

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Monad mainnet launches tonight: key information you must know

Based on the pre-market price of around $0.032-0.034 at the time of publication, the public offering participants' notional returns are between 28% and 36%.

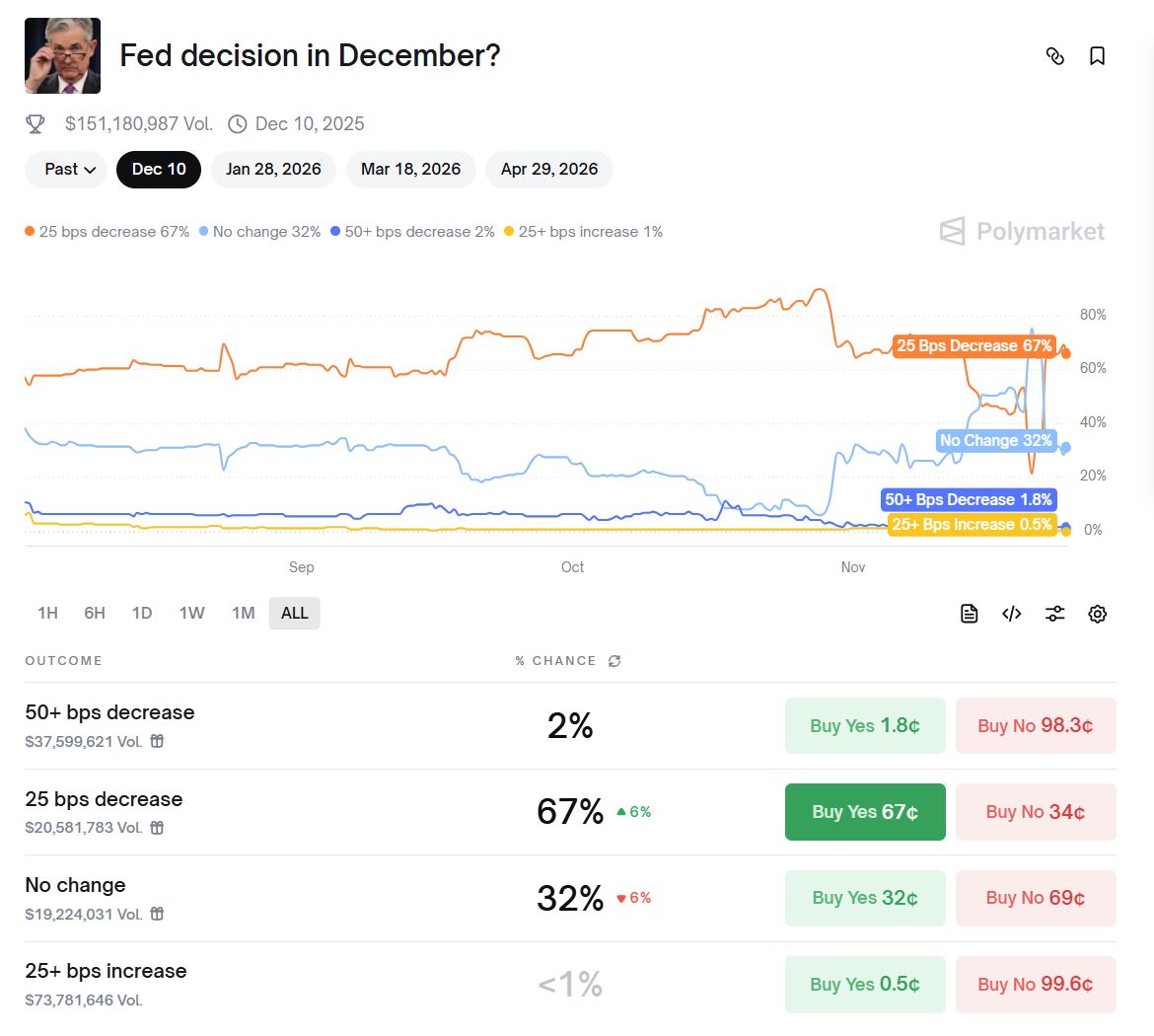

The Federal Reserve is deeply embroiled in an "internal war," making a December rate cut a "coin toss" bet.

Significant policy divisions have emerged within the Federal Reserve, making the question of whether to cut interest rates in December a key focus. Powell’s silence has increased market uncertainty, while political pressure and the lack of economic data have further complicated decision-making.

Filecoin Onchain Cloud: Application Case Analysis and Launch of Limited Edition NFT Program for Early CloudPaws Contributors

Filecoin is a protocol-based decentralized data storage network designed to provide long-term, secure, and verifiable data storage capabilities.

From Platform to Ecosystem, SunPerp Upgrades to SunX: Justin Sun Elaborates on DEX's "Long-termism" and Global Strategy

This upgrade marks SunX's transformation from a single trading platform to a self-circulating and self-growing decentralized ecosystem hub.