SOL price stalls despite Solana’s DeFi TVL nearing record highs

Solana’s DeFi ecosystem has seen explosive growth, nearing all-time high levels, but SOL continues to lag behind.

- Solana’s DeFi TVL is at $11.725 billion, nearing its all-time high in January

- Despite that, SOL price is lagging behind, far from the January ATH

- DeFi metrics suggest that SOL may continue to lag behind its DeFi ecosystem

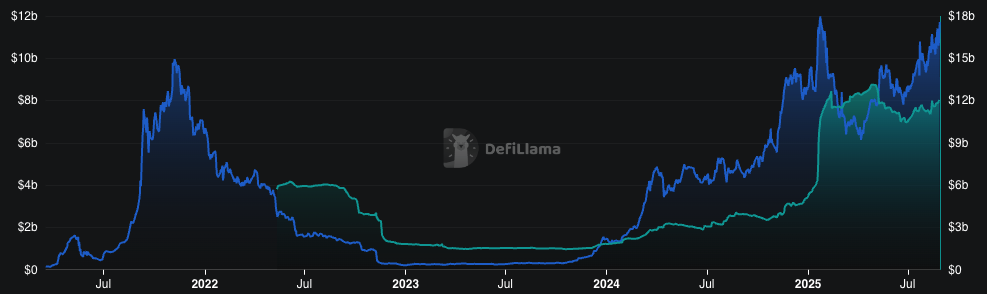

Solana (SOL) is attracting near-record amounts of capital, but its price continues to lag behind. On Thursday, August 28, the total DeFi value locked on Solana reached $11.725 billion , near the record figures in January. At the same time, the total stablecoin market cap was at $12 billion, while bridged TVL amounted to $42 billion.

Solana’s DeFi TVL and stablecoin market cap | Source: DeFiLlama

Solana’s DeFi TVL and stablecoin market cap | Source: DeFiLlama

Yet despite strong metrics, SOL’s price is still hovering around $200, far below its January ATH at $294.33. At the time, Solana’s DeFi TVL was near its current August peak, suggesting that DeFi TVL and the price have started to diverge.

Why SOL price lags behind its DeFi ecosystem

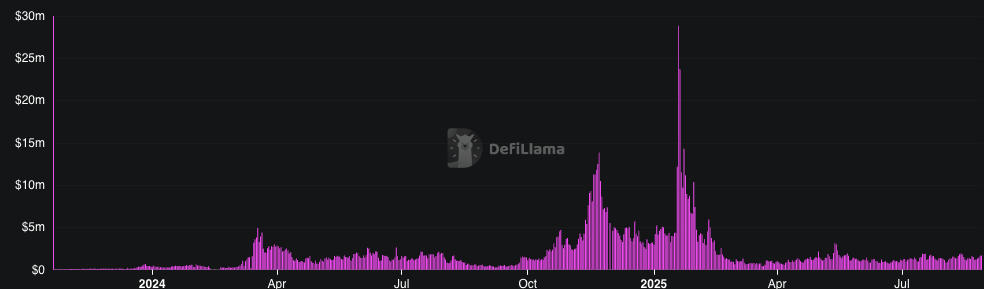

At the same time, the fees generated on Solana remain at a relatively modest $1.68 million daily. This is far from the record $28.89 million in January. Low on-chain revenue is the likely reason why SOL lags behind the growth of its DeFi ecosystem.

On-chain fees on Solana | Source: DeFiLlama

On-chain fees on Solana | Source: DeFiLlama

Currently, much of Solana’s ecosystem activity goes through platforms that prioritize low cost. This includes DEX aggregators like Jupiter, which accounts for much of the trading activity on Solana. For these protocols, high TVL equals higher liquidity and better trading conditions.

Still, this does not translate to higher revenue for the Solana network, which is one of the key metrics for Solana’s price performance. Higher revenue translates to higher staking rewards, making Solana more valuable. Due to gains in efficiencies, SOL will likely continue to lag behind its DeFi TVL, at least until fees pick up.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

It's already 2025, and this billionaire collector is still buying NFTs?

Adam Weitsman recently acquired 229 Meebits, further increasing his investment in the NFT sector.

Why do traditional media professionals criticize stablecoin innovation?

Are stablecoins truly "the most dangerous cryptocurrencies," or are they "a global public good"?

Crypto Market Faces Intense Pressure from Massive Coin Unlocks

In Brief Cryptocurrency market faces over $566 million in coin unlocks next week. Single-event and linear unlocks may impact market supply and investor sentiment. Investors are wary of potential short-term price fluctuations.

For BlackRock, Bitcoin is not ready for everyday payments