The politicization risk of the Federal Reserve may trigger inflation uncertainty and rising borrowing costs.

ChainCatcher news, according to Jinse Finance, UBS stated that Federal Reserve Chairman Powell's speech at Jackson Hole signaled an increased probability of a rate cut in September, but lacked guidance on a medium-term policy framework. UBS pointed out that Powell did not make a stronger defense of the Fed's independence, and that a politicized Fed under Trump in the future could reignite inflation uncertainty, increase real borrowing costs by 1 percentage point, and trigger a chain reaction affecting fiscal policy and household savings, among other areas.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A certain whale has rebuilt a position of 90.85 WBTC at an average price of $87,242.

Economist: December rate cut becomes highly probable again, Williams' remarks set the tone for the market

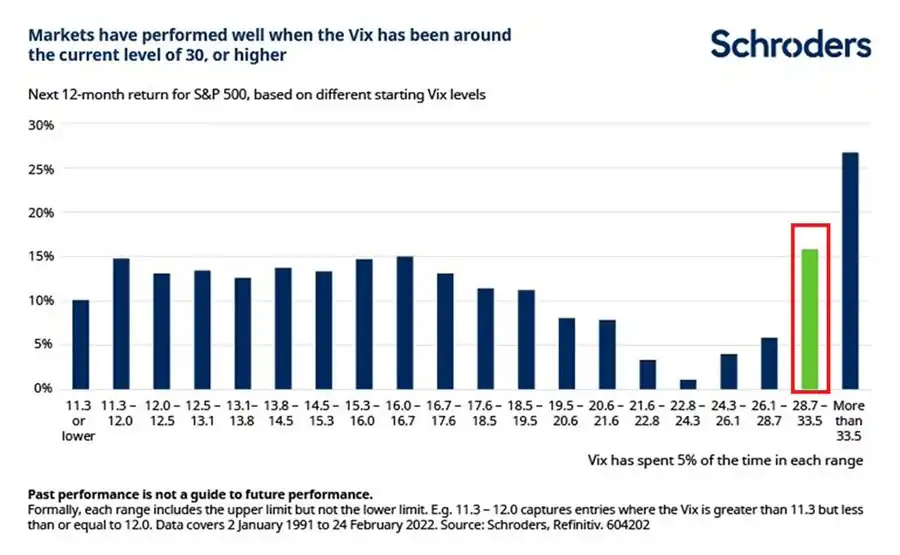

Analysis: When the volatility index VIX exceeds 28.7, the S&P 500 often delivers strong returns

Trading volume on BSC remains sluggish, with most popular meme tokens seeing transactions below $1 million.