Crypto Whales Bought These Altcoins in the Third Week of August 2025

In the third week of August 2025, crypto whales have been strategically accumulating Arbitrum (ARB), Chainlink (LINK), and Cardano (ADA). This activity could signal potential price movements as retail demand follows the whales' lead.

The digital asset market has seen muted performance this week, with many tokens surrendering most of their July gains. Global crypto market capitalization has slipped 4% over the past seven days, reflecting waning bullish momentum and cautious sentiment among traders.

However, despite the broader downturn, on-chain data reveals that crypto whales have been actively accumulating select altcoins. This analysis takes a look at some of them.

Arbitrum (ARB)

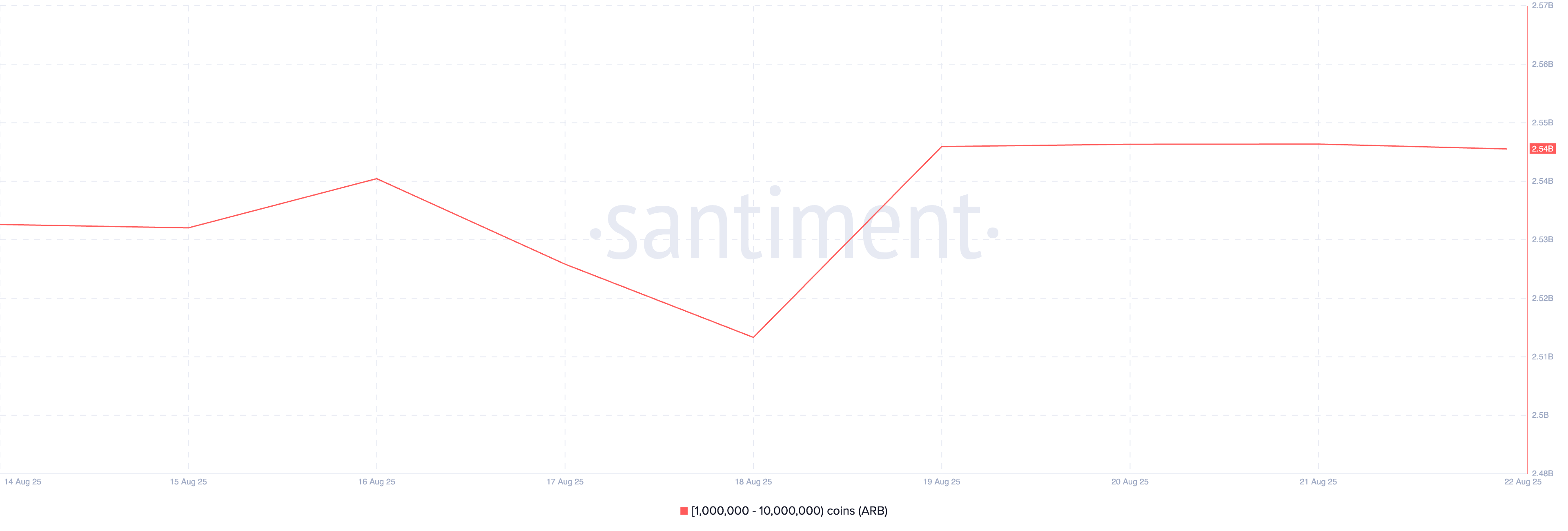

Layer-2 (L2) altcoin ARB has seen an uptick in crypto whale accumulation this week. According to Santiment, whales holding between 1 million and 10 million tokens have acquired 10 million ARB over the past week, pushing their collective holdings to 2.45 billion tokens at press time.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

ARB Supply Distribution. Source:

Santiment

ARB Supply Distribution. Source:

Santiment

This trend could boost confidence among smaller investors and spark increased retail participation. As retail demand builds alongside whale activity, it may create the momentum needed to break ARB from its sideways trend.

If demand grows, ARB eyes a break above the resistance formed at $0.52 and a push toward $0.57.

ARB Price Analysis. Source:

Tradi

ngView

ARB Price Analysis. Source:

Tradi

ngView

On the other hand, if selloffs continue, it could fall to $0.45.

Chainlink (LINK)

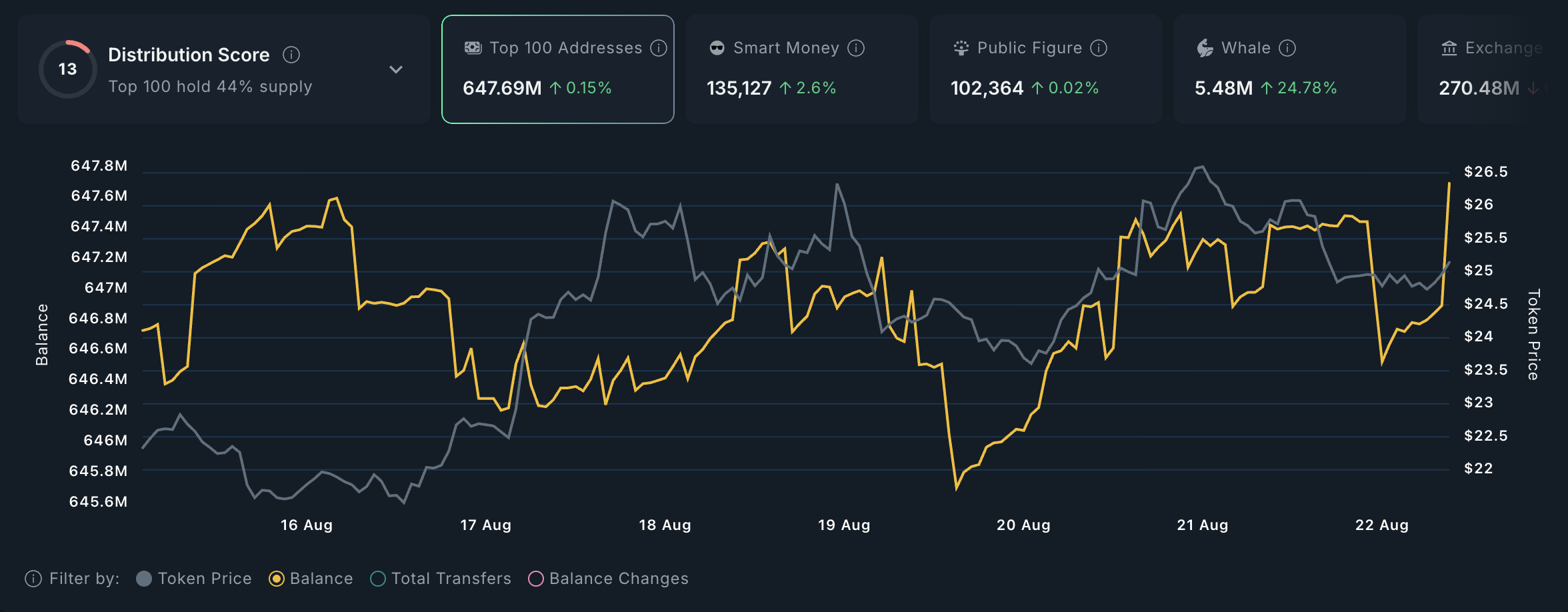

LINK, the native token of oracle network provider Chainlink, is among the altcoins crypto whales accumulated this week. On-chain data from Nansen shows a 25% increase in holdings among high-value wallets holding more than $1 million worth of LINK.

LINK Whale Activity. Source:

Nansen

LINK Whale Activity. Source:

Nansen

This surge in whale activity suggests growing confidence in the token’s near-term prospects. If accumulation persists, LINK could rally toward $26.89.

LINK Price Analysis. Source:

TradingView

LINK Price Analysis. Source:

TradingView

On the other hand, if demand weakens and whales begin reducing exposure, the token risks sliding to around $23.48.

Cardano (ADA)

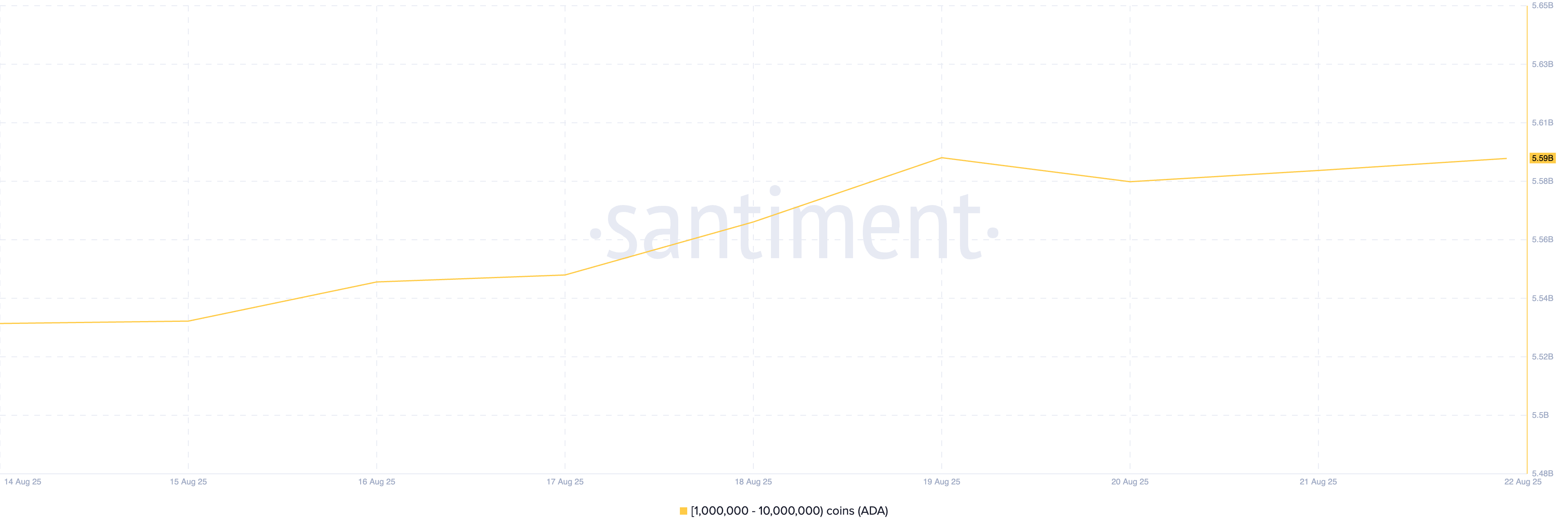

Layer-1 (L1) coin ADA has also noted strategic accumulation among crypto whales this week, despite the broader market dip. Per on-chain data, whales that hold between 1 million and 10 million coins have bought 60 million ADA coins during the week in review.

ADA Supply Distribution. Source:

Santiment

ADA Supply Distribution. Source:

Santiment

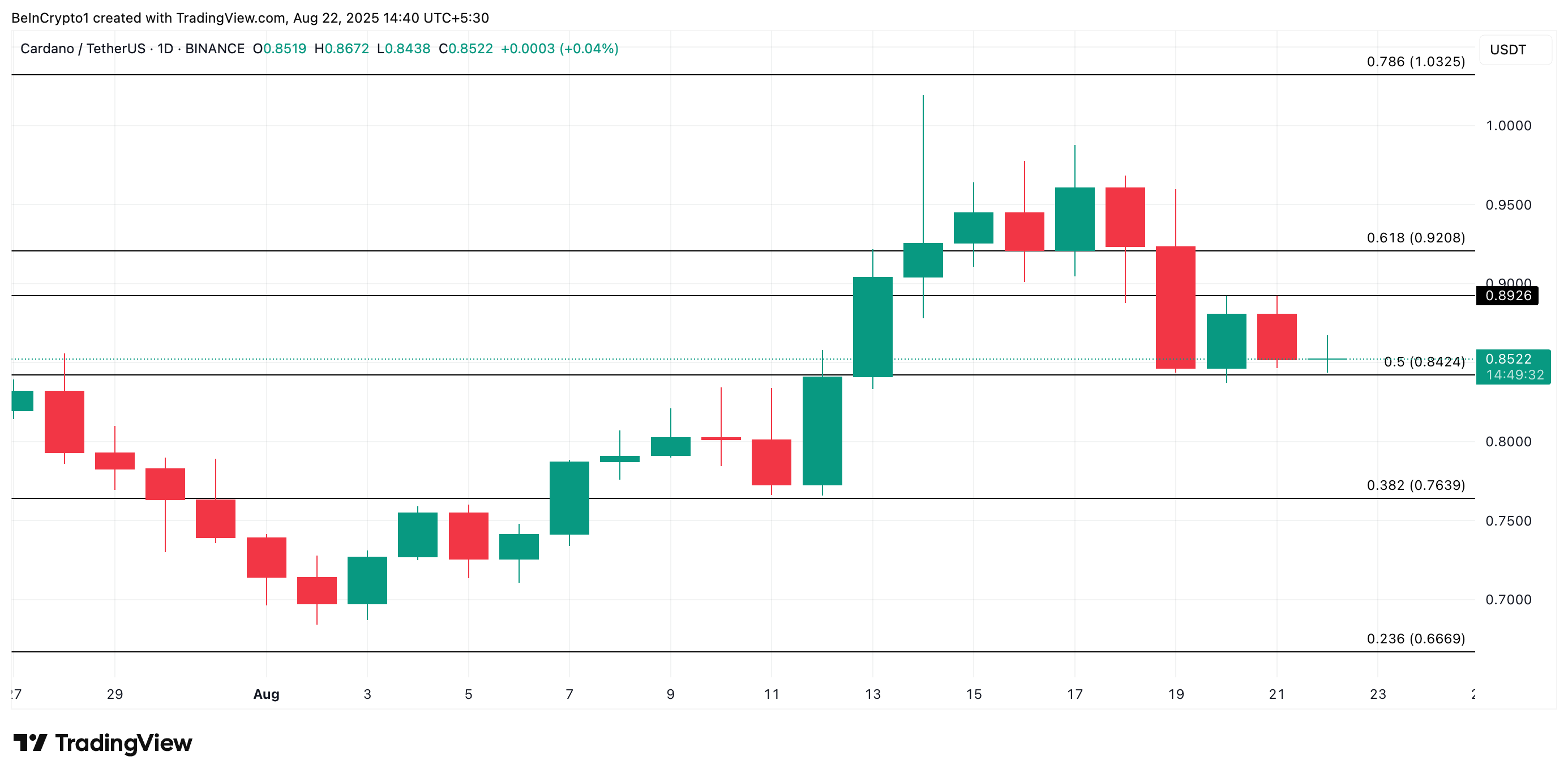

Although the wider market’s tepid performance has kept ADA in a range in the past few days, if whale accumulation grows, its price could test the resistance at $0.89 and attempt a break above it.

ADA Price Analysis. Source:

TradingView

ADA Price Analysis. Source:

TradingView

Conversely, if accumulation falls, the L1’s price could fall to $0.84.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After a 1460% surge, re-examining the value foundation of ZEC

History has repeatedly shown that extremely short payback periods (super high ROI) are often precursors to mining disasters and sharp declines in coin prices.

Tom Lee reveals: The crash was caused by the 1011 liquidity crunch, with market makers selling off to fill a "financial black hole"

Lee stated directly: Market makers are essentially like the central banks of crypto. When their balance sheets are damaged, liquidity tightens and the market becomes fragile.

Boxing champion Andrew Tate's "Going to Zero": How did he lose $720,000 on Hyperliquid?

Andrew Tate hardly engages in risk management and tends to re-enter losing trades with higher leverage.

New Beginnings in the Darkest Hour: Is the Dawn of Bitcoin in 2026 Already Visible?

Risk assets are expected to perform strongly in 2026, and bitcoin is likely to strengthen as well.