XRP Price Faces Third Bearish Setup in a Week—What Traders Should Watch

XRP’s short-term outlook is weakening again, even as it bounces slightly on the daily chart. Whale exchange inflows are rising sharply, bearish EMA crossovers are lining up on the 4-hour chart, and price levels are slipping into danger zones. Together, these signs hint at growing downside risk; especially for short-term traders.

XRP is up just under 1% in the last 24 hours but remains down over 15% for the month. Despite a strong July, the asset is flashing multiple short-term bearish signals again.

Whale activity has picked up sharply, EMAs are close to confirming another bearish cross, and key price levels are under threat. All three signs point to potential short-term downside—especially for traders looking to play the next volatility wave.

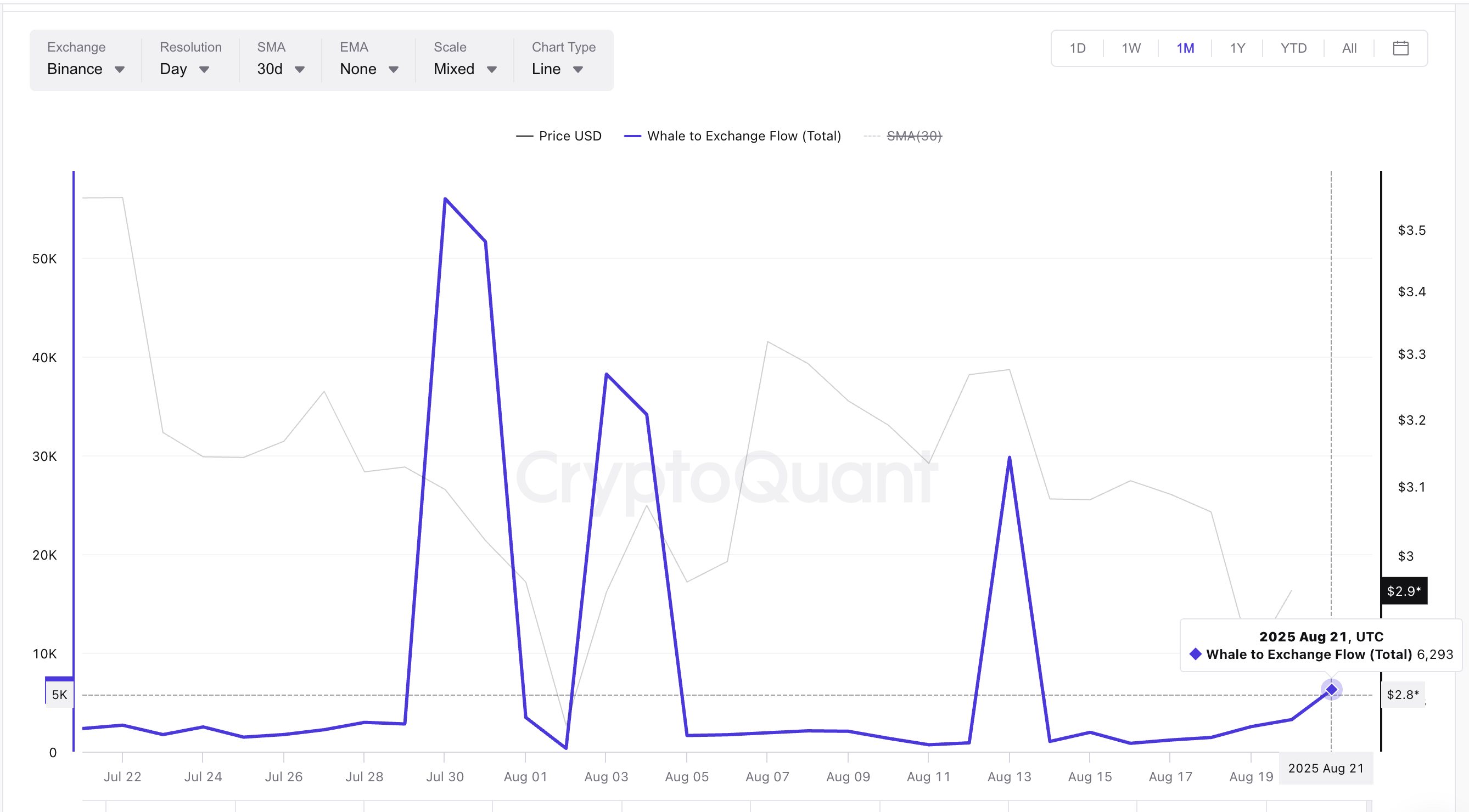

Whale-to-Exchange Spikes Have Historically Preceded Sell-Offs

Whale inflows to Binance have once again started rising after staying low since August 13. On that date, inflows peaked at around 29,805 XRP, and XRP’s price dropped from $3.27 to $3.08 shortly after.

XRP whales looking to sell:

Cryptoquant

XRP whales looking to sell:

Cryptoquant

By August 21, whale inflows had jumped 7x from the August 16 local low of 900 tokens to 6,293 XRP. Historically, these spikes have been followed by price dips:

- July 30 spike: Price fell from $3.09 to $2.76

- August 3 spike: Price fell from $3.07 to $2.96 (in the next few days)

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

If this new surge crosses the August 13 threshold, it would mark a higher high in whale flows, something we haven’t seen in this downtrend phase. That would likely trigger more aggressive selling, adding short-term pressure.

Whale-to-Exchange Flow tracks the volume of tokens large holders (whales) move to centralized exchanges—often signaling intent to sell.

XRP Just Logged Two Death Crosses; And a Third Is on Deck

The 4-hour chart for the XRP price shows bearish momentum building fast. Two EMA (Exponential Moving Average) death crossovers have already been marked on the chart (red arrows), and a third one is now forming. An EMA death crossover happens when a short-term moving average crosses a long-term one, often signaling a shift in trend direction.

If the third crossover is completed, the XRP price chart will see three bearish formations in under a week.

XRP price pattern turns bearish:

TradingView

XRP price pattern turns bearish:

TradingView

A rapid decline followed each of the previous two death crosses:

- August 15 (20/50 cross): Drop from $3.12 to $2.93

- August 18 (50/100 cross): Drop from $3.03 to $2.93

The third crossover, 50 EMA slipping below 200 EMA, is far more significant as it reflects a broader trend change, not just short-term weakness. With whale inflows spiking simultaneously, the bearish EMA setup strengthens the case for further downside.

The pattern means that short-term sellers are increasingly gaining momentum, aligning with the surge in whale-led sell pressure.

Key XRP Price Levels: $2.95 Resistance Holds, $2.81 Support at Risk

The daily chart shows that XRP continues to struggle near the $2.95 Fibonacci resistance. XRP briefly tested this level again but failed to flip it into support.

XRP price analysis:

TradingView

XRP price analysis:

TradingView

The next major support lies at $2.81, which has previously acted as a strong reversal zone. If this level breaks, the next downside target sits at $2.72, the final support before prices risk retracing lower.

Upside recovery is unlikely unless the XRP price can reclaim $3.16, the 0.618 Fib level that served as resistance through most of August. However, if that happens, the short-term bearish outlook will falter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.