Tokenized Assets Hit $270 Billion Record as Institutions Standardize on Ethereum

ETH hosts 55% of $270B tokenized assets as institutions adopt stablecoins and tokenized funds, cementing Ethereum’s finance role.

The market for tokenized assets has quietly reached a new milestone, with assets under management (AUM) soaring to an all-time high.

This surge highlights how Ethereum’s infrastructure increasingly becomes the settlement layer of choice for stablecoins and institutional-grade tokenization.

Tokenization Reaches Historic Scale

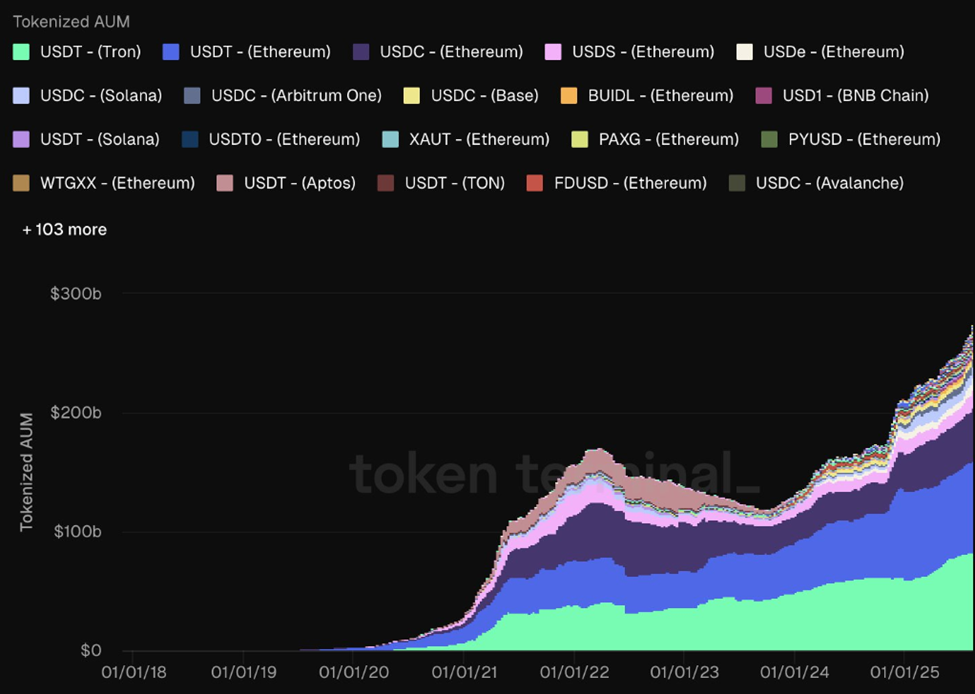

Token Terminal reports that the AUM of tokenized assets is at an all-time high of approximately $270 billion.

Tokenized Assets AuM. Source:

Token Terminal

Tokenized Assets AuM. Source:

Token Terminal

The on-chain data platform highlights tokenized assets spanning a wide spectrum, ranging from currencies and commodities to treasuries, private credit, private equity, and venture capital.

Much of this growth is driven by institutions adopting blockchain rails for efficiency and accessibility, with Ethereum emerging as the dominant platform.

Ethereum hosts approximately 55% of all tokenized asset AUM, ascribed to its smart contract ecosystem and widely adopted token standards.

Tokens like USDT (Ethereum), USDC (Ethereum), and BlackRock’s BUIDL fund represent some of the largest pools of value, built on the ERC-20 framework.

Meanwhile, specialized standards such as ERC-3643 enable tokenization of real-world assets (RWA) like real estate and fine art.

With $270 billion already tokenized, continued momentum could see tokenized asset markets swell into the trillions as Ethereum cements its role as the backbone of tokenized finance.

Financial Giants Quietly Back Ethereum

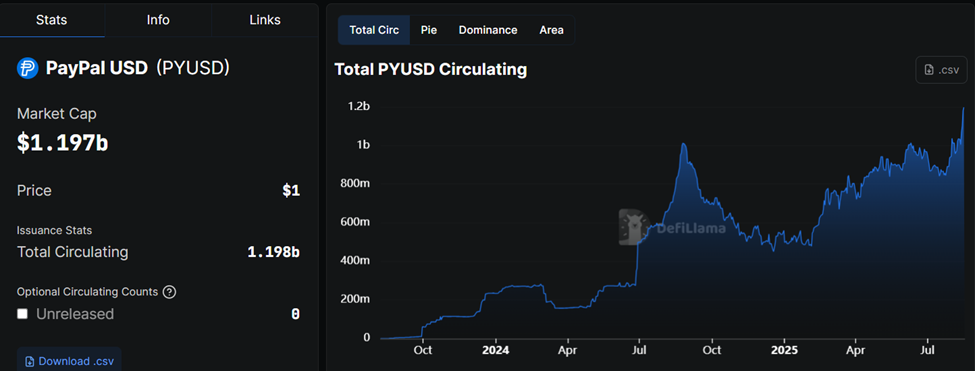

One of the most telling signs of this shift is the rise of PayPal’s PYUSD stablecoin, which has exceeded the $1 billion market in supply while entirely issued on Ethereum.

PYUSD Supply. Source:

DefiLlama

PYUSD Supply. Source:

DefiLlama

For institutions, PYUSD’s fast growth proves that Ethereum’s rails are liquid, secure, and trusted enough for a global fintech leader to scale on.

“PayPal’s PYUSD exceeding $1 billion supply cements Ethereum as the settlement layer for major finance. Stablecoin scale like this deepens liquidity and utility. Institutions are quietly standardizing on ETH,” one user observed in a post.

Beyond PayPal, traditional asset managers are also leaning into Ethereum. BlackRock’s tokenized money market fund, BUIDL, has been cited as a landmark case of institutional adoption. This demonstrates how traditional financial (TradFi) instruments can be issued and managed seamlessly on-chain.

Meanwhile, Ethereum’s dominance in tokenization comes down to its network effects and developer ecosystem. The ERC-20 standard has become the lingua franca for digital assets, ensuring compatibility across wallets, exchanges, and DeFi protocols.

Meanwhile, Ethereum’s security, liquidity, and scalability improvements through upgrades like Proof-of-Stake (PoS) and rollups enhance institutions’ confidence.

Ethereum’s flexibility allows it to serve retail and institutional needs. Stablecoins like USDT and USDC fuel global payments and DeFi liquidity. Meanwhile, tokenized treasuries and credit instruments appeal directly to institutional portfolios seeking yield and efficiency.

However, analysts urge caution for Ethereum traders, with the largest altcoin on market cap metrics facing the second-highest sell wave. Similarly, warning signs are flashing despite 98% of the Ethereum supply sitting in a profitable state.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.