Chainlink Whale Activity Hit Seven-Month High — What’s Next for LINK Price?

Despite a recent price pullback, Chainlink’s whale transactions are at a seven-month high, suggesting confidence from large investors. If LINK holds the $22.21 support, it could target a breakout toward $25.55.

Chainlink’s price has stalled its rally since it hit an intraday peak of $24.74 on August 13. Now trading at $22.29, the altcoin’s price has since dropped 11%.

While LINK’s price has dawdled, large holders appear unfazed. They view the dip as a buying opportunity and are ramping up their accumulation as a result. What does this mean for the altcoin?

LINK Whales Make Big Moves

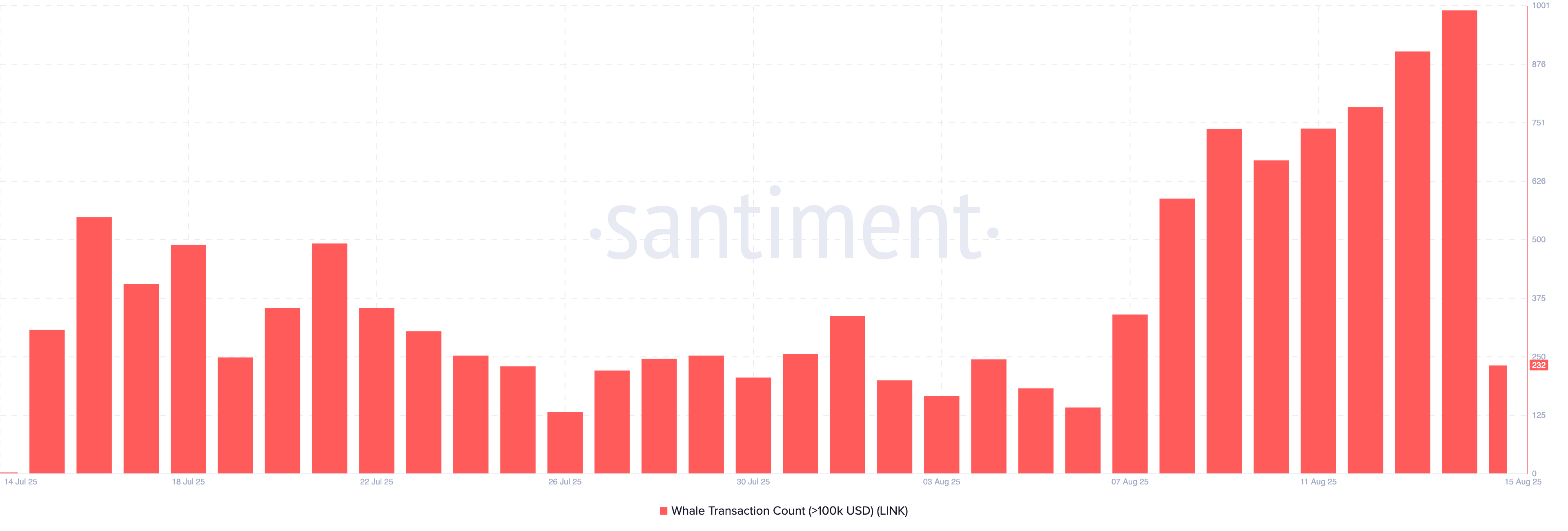

On-chain data has shown that the count of LINK whale transactions exceeding $100,000 soared to a seven-month high of 992 on Thursday.

— CryptosRus (@CryptosR_Us) August 14, 2025

LATEST: $LINK Rallies Nearly 40% in a Week as Whale Activity Surges

Whale transactions at their highest level in seven months, alongside profits not seen since late 2024.On the on-chain side, we're seeing the most active $LINK addresses in 8 months, and most whale…

This uptick in high-value transfers helped drive LINK’s price to a high of $24.31, just 2% shy of the previous day’s close, before easing lower.

As of today, 232 whale transactions worth more than $100,000 have already been recorded. This suggests continued interest from deep-pocketed investors despite today’s broader market consolidation.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

LINK Whale Activity. Source:

Santiment

LINK Whale Activity. Source:

Santiment

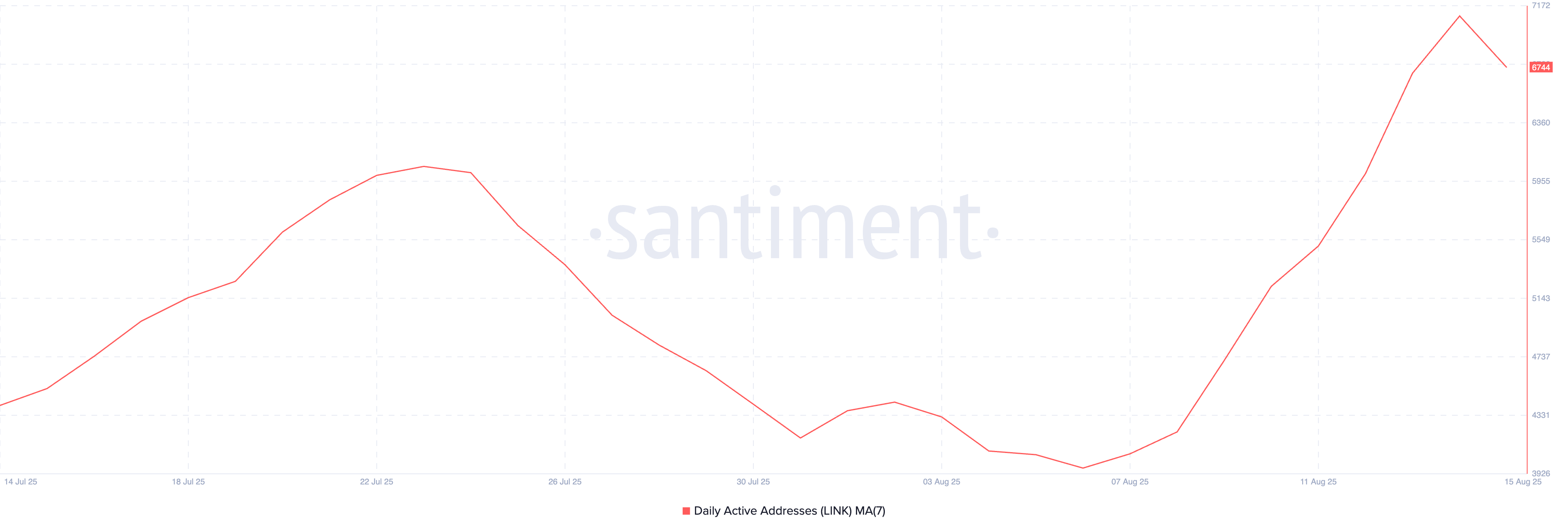

In addition, the number of daily active addresses trading LINK has also trended higher, signaling increased on-chain engagement. Per Santiment, this, observed using a seven-day moving average, has risen by 55% since the beginning of August.

LINK Daily Active Addresses. Source:

Santiment

LINK Daily Active Addresses. Source:

Santiment

This steady uptick suggests that while whales are active, broader participation from the LINK traders is also growing, confirming climbing interest in the asset despite recent market volatility.

LINK Price Poised for Breakout if $22.21 Support Holds

Higher active address counts reflect stronger network usage on Chainlink. If this trend continues alongside increased whale demand for LINK, it could strengthen the support at $22.21. In this scenario, LINK could rally toward $25.55.

LINK Price Analysis. Source:

TradingView

LINK Price Analysis. Source:

TradingView

Conversely, if the support floor weakens and gives way, LINK’s price could drop to $19.51.

Analyst George from CryptosRUs recently reviewed LINK as a token to watch in his latest YouTube video:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Monad mainnet launches tonight: key information you must know

Based on the pre-market price of around $0.032-0.034 at the time of publication, the public offering participants' notional returns are between 28% and 36%.

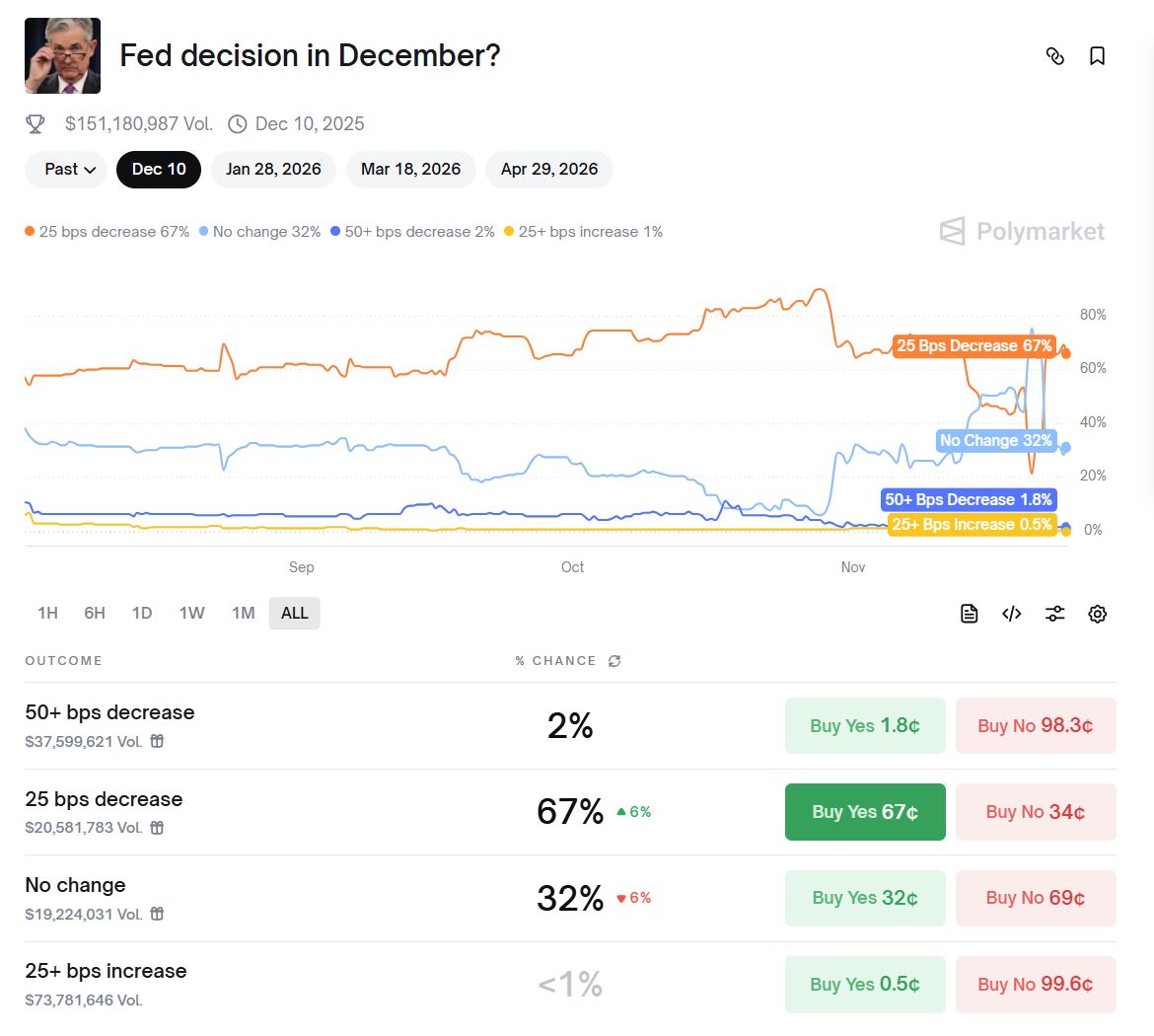

The Federal Reserve is deeply embroiled in an "internal war," making a December rate cut a "coin toss" bet.

Significant policy divisions have emerged within the Federal Reserve, making the question of whether to cut interest rates in December a key focus. Powell’s silence has increased market uncertainty, while political pressure and the lack of economic data have further complicated decision-making.

Filecoin Onchain Cloud: Application Case Analysis and Launch of Limited Edition NFT Program for Early CloudPaws Contributors

Filecoin is a protocol-based decentralized data storage network designed to provide long-term, secure, and verifiable data storage capabilities.

From Platform to Ecosystem, SunPerp Upgrades to SunX: Justin Sun Elaborates on DEX's "Long-termism" and Global Strategy

This upgrade marks SunX's transformation from a single trading platform to a self-circulating and self-growing decentralized ecosystem hub.