Institutional Investors Seize Ethereum Dip with Nearly $900 Million in New Buys

Analysts say the scale and timing of these acquisitions highlight disciplined accumulation, strengthening Ethereum’s role as a leading macro asset.

Several major institutional investors are seizing the recent dip in Ethereum’s price to expand their holdings, signaling a focus on long-term exposure rather than short-term gains.

This activity suggests that the institutions are positioning for long-term exposure rather than short-term gains.

Ethereum’s Market Sentiment Edges Past Bitcoin as Accumulation Grows

Blockchain analytics from Lookonchain reveal that one unnamed institution created three new wallets last week. The firm also withdrew 92,899 ETH, worth roughly $412 million, from Kraken.

Typically, market analysts interpret such withdrawals as a bullish signal, indicating that investors are moving coins into self-custody with a long-term holding strategy.

Meanwhile, Donald Trump’s DeFi venture World Liberty also joined the buying spree.

On-chain data shows that the firm spent $8.6 million USDC to purchase 1,911 ETH at around $4,500 each. At the same time, the firm allocated another $10 million to acquire 84.5 Wrapped Bitcoin (WBTC) at $118,343 per coin.

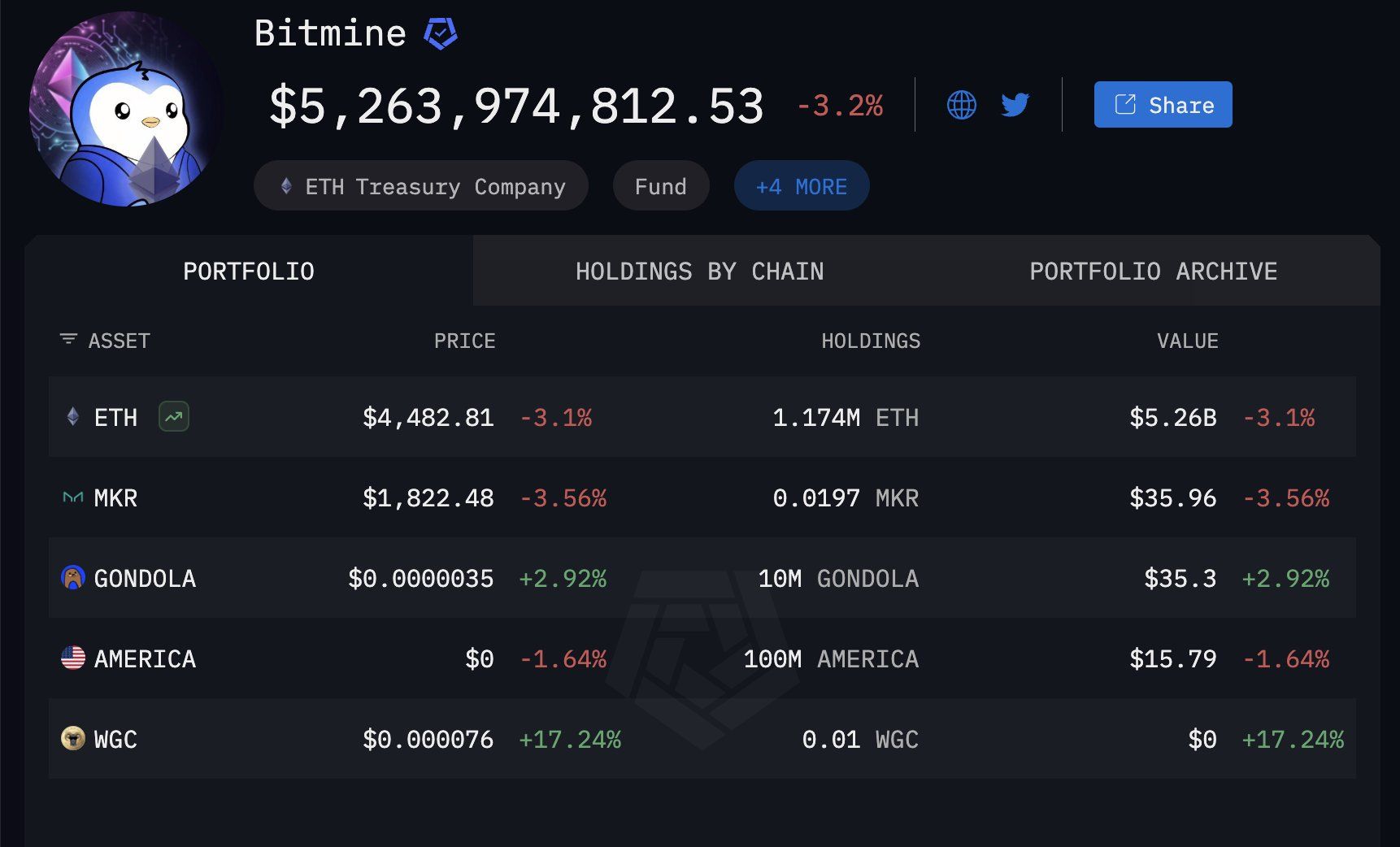

Additionally, the Ethereum-focused firm BitMine made the most significant single move during the period. Lookonchain reported that the company added 106,485 ETH to its balance sheet at a cost of $470 million.

This brings BitMine’s Ethereum treasury to 1.17 million ETH, which is now valued at roughly $5.3 billion. The Tom Lee-led firm is the largest corporate holder of an Ethereum reserve.

BitMine Ethereum Holdings. Source:

Arkham Intelligence

BitMine Ethereum Holdings. Source:

Arkham Intelligence

These institutional moves follow Ethereum’s recent correction after weeks of upward momentum that nearly brought ETH to its all-time high.

Market analysts note that the timing and scale of these institutional purchases point to a calculated accumulation strategy rather than speculative trading.

Notably, the institutional appetite is driven by rising ETF exposure and the rise of treasury companies. Together, these entities have accumulated over 10 million ETH, or around $40 billion, of the digital asset.

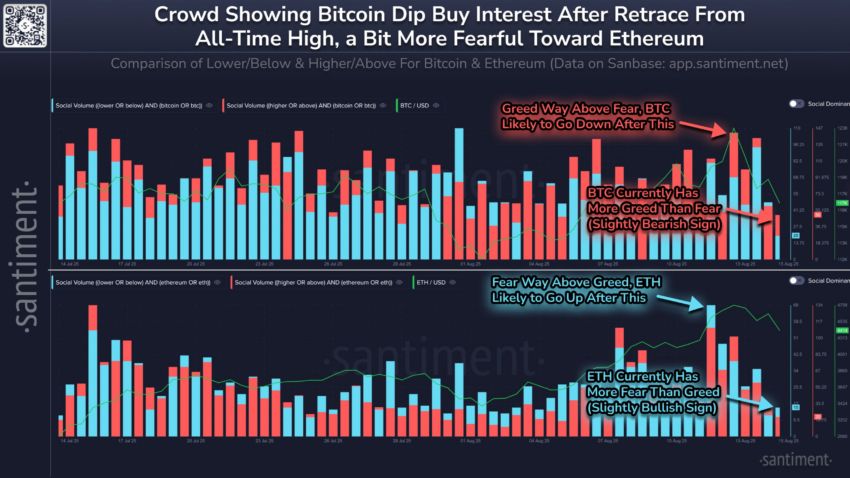

Considering this, the blockchain analytics platform Santiment suggests that Ethereum currently maintains a modest short-term advantage over Bitcoin in market sentiment.

Bitcoin and Ethereum Market Sentiments. Source:

Santiment

Bitcoin and Ethereum Market Sentiments. Source:

Santiment

Santiment’s analysis shows that Bitcoin’s rallies often generate social media hype. In contrast, Ethereum’s consistent performance over the past three months has attracted measured, patient accumulation by whales rather than public frenzy.

According to the firm, this disciplined approach suggests that institutions are positioning for sustained growth. It also reinforces Ethereum’s role as a leading macro play in the digital asset market over the next decade

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.