Date: Thu, Aug 14, 2025 | 12:10 PM GMT

The cryptocurrency market is in full bullish swing as Bitcoin (BTC) surges to a new all-time high of $124,000 today, while Ethereum (ETH) climbs above $4,700 for the first time since 2021, posting an impressive 26% gain over the past week. This wave of bullishness has spilled over into major altcoins including – Avalanche (AVAX).

AVAX has gained 10% over the last seven days, and its latest price structure now reveals a key harmonic setup that suggests further upside could be on the horizon.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Hints at Bullish Continuation

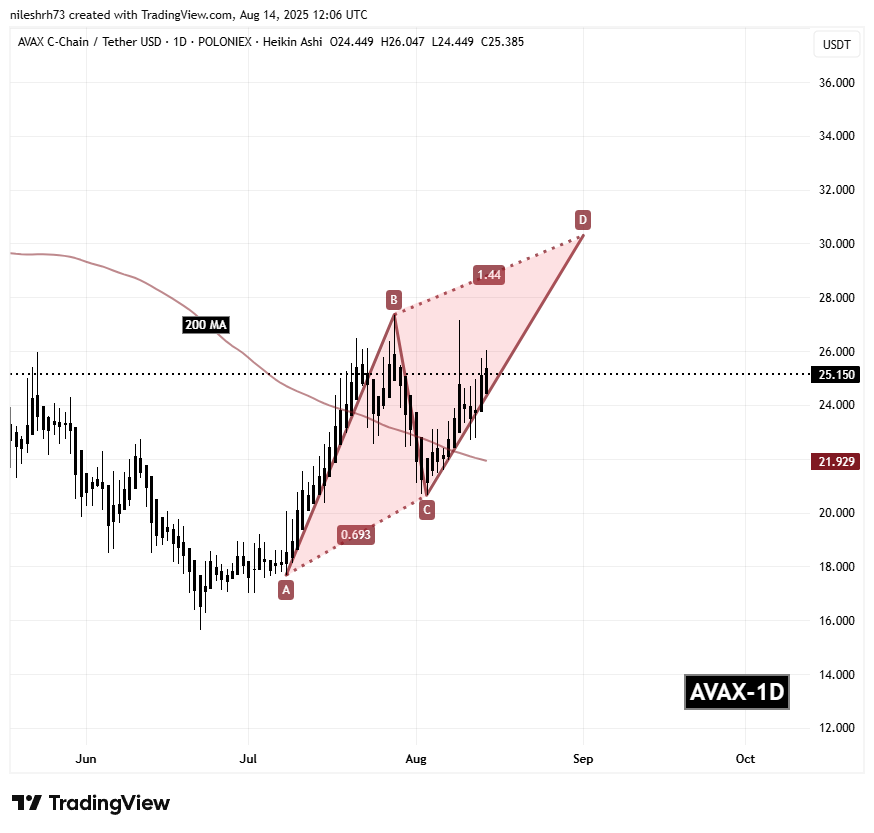

On the daily chart, AVAX is forming a Bearish ABCD harmonic pattern — a formation that, despite its bearish label, often delivers a strong rally during the CD leg before the final target is reached.

The move began with a surge from Point A near $17.68 to Point B, followed by a corrective drop to Point C around $20.64. From there, buyers regained control, driving prices higher to the current $25.15 area, signaling that the CD leg is already in motion.

Avalanche (AVAX) Daily Chart/Coinsprobe (Source: Tradingview)

Avalanche (AVAX) Daily Chart/Coinsprobe (Source: Tradingview)

If the pattern continues to follow the classic ABCD playbook, the CD leg could extend toward the 1.44 Fibonacci projection of the BC leg, targeting the Potential Reversal Zone (PRZ) around $30.30 — representing roughly 20% upside from current levels.

What’s Next for AVAX?

If bullish momentum holds and Bitcoin’s rally continues to lift the broader market, AVAX could make a push toward the $30.30 PRZ. However, this zone will be critical — historically, harmonic patterns often meet heavy resistance there, triggering either consolidation or a short-term pullback.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.