Date: Sat, Aug 16, 2025 | 07:45 AM GMT

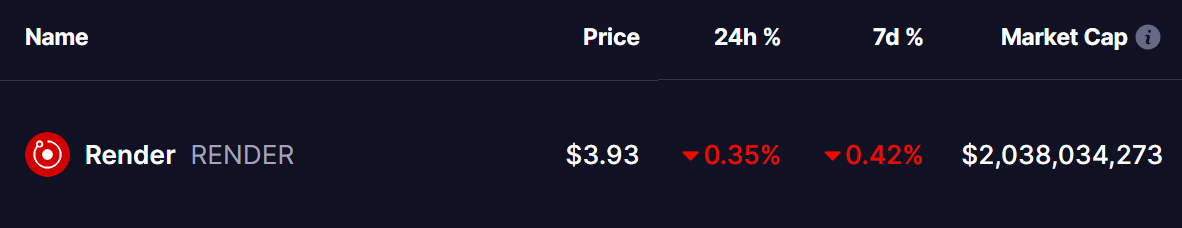

The cryptocurrency market is undergoing a healthy cooldown as Ethereum (ETH) eases to $4,440 from its recent peak of $4,780. The pullback has weighed on most major altcoins — including Render (RENDER).

RENDER has turned red today, and its current chart structure reveals a familiar price behavior, which may offer clues about what’s next.

Source: Coinmarketcap

Source: Coinmarketcap

Familiar Pattern Hints at Potential Pullback

On the daily chart, RENDER continues to trade within a falling wedge formation — a structure that often resolves bullishly over the long run. But in the short term, a repeating fractal raises caution.

In June, RENDER broke below both its 100-day moving average and RSI-based support. That breakdown triggered a sharp 34% decline, sending price to the wedge’s lower support near $2.75.

Render (RENDER) Daily Chart/Coinsprobe (Source: Tradingview)

Render (RENDER) Daily Chart/Coinsprobe (Source: Tradingview)

Fast forward to now, and the setup looks strikingly similar. RENDER is again testing its 100-day moving average around $3.91, along with the RSI’s moving average line near 49.57. This confluence of supports mirrors the June setup almost exactly.

What’s Next for RENDER?

If history repeats, a breakdown beneath these levels could spark another correction, dragging RENDER toward the wedge’s lower boundary around $2.70 — a decline of nearly 30% from current prices.

For now, RENDER sits at a critical inflection point, and traders will be watching closely to see which side gains control.