- Metafluence shows post-volatility Crypto stability, suggesting it could quickly react to renewed trading interest and deliver sharp price movements.

- Quadrant Protocol’s price gain without trading volume demonstrates resilience and potential for stability in low-liquidity market conditions.

- Portuma maintains a strong microcap market position despite consistent price pressure, highlighting endurance in a competitive segment.

Several altcoins showed notable market moves that could position them among the three best cryptos to buy now for 2025’s most considerable profit potential. Metafluence, QuadrantProtocol, and Portuma displayed different trading patterns but maintained distinct market characteristics. Their liquidity levels, supply structures, and recent price actions indicate varying opportunities for growth in the coming years.

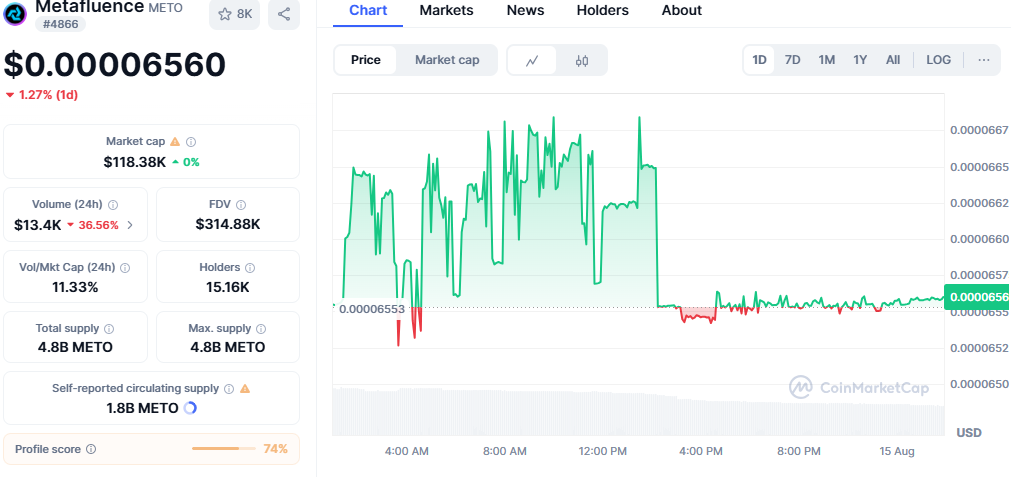

Metafluence Maintains Stability After Early Volatility

Metafluence traded at $0.00006560, recording a 1.27% decline over the past 24 hours. Market capitalization remained steady at $118.38, while the fully diluted valuation stood at $314.88K. Trading volume dropped by 36.56% to $13.4K, indicating reduced short-term activity.

The day’s price action showed heavy volatility during the morning and midday with multiple spikes and dips. This movement stabilized by the late afternoon, with prices holding close to $0.00006560 into the evening. Such consolidation suggests a temporary pause in speculative trading.

Metafluence has a total and maximum supply of 4.8 billion METO, with 1.88 billion in circulation. The volume-to-market cap ratio is 11.33%, reflecting moderate turnover. These figures, combined with earlier intraday volatility, show that renewed trading interest could trigger sharper price changes.

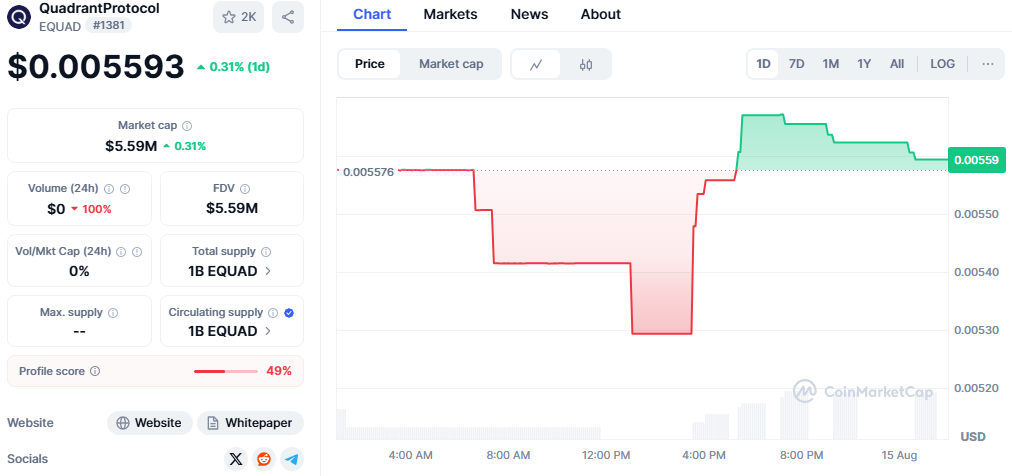

QuadrantProtocol Shows Modest Gains Despite No Trading Volume

QuadrantProtocol closed at $0.005593, showing a slight 0.31% gain over 24 hours. Market capitalization reached $5.59 million, with an equal FDV due to a fully circulating supply of 1 billion EQUAD. No 24-hour trading volume was recorded, resulting in a 0% volume-to-market cap ratio.

Price stability is maintained for most of the day until a midday drop pushes values lower. However, an afternoon rebound lifted the price to its peak for the session. The market then flattened out toward the evening, ending slightly higher.

Quadrant Protocol has no disclosed maximum supply figure, leaving room for potential future issuance. The lack of immediate turnover limits liquidity but also keeps prices stable in low-activity conditions. Even with minimal trading, the day’s close in positive territory highlights resilience.

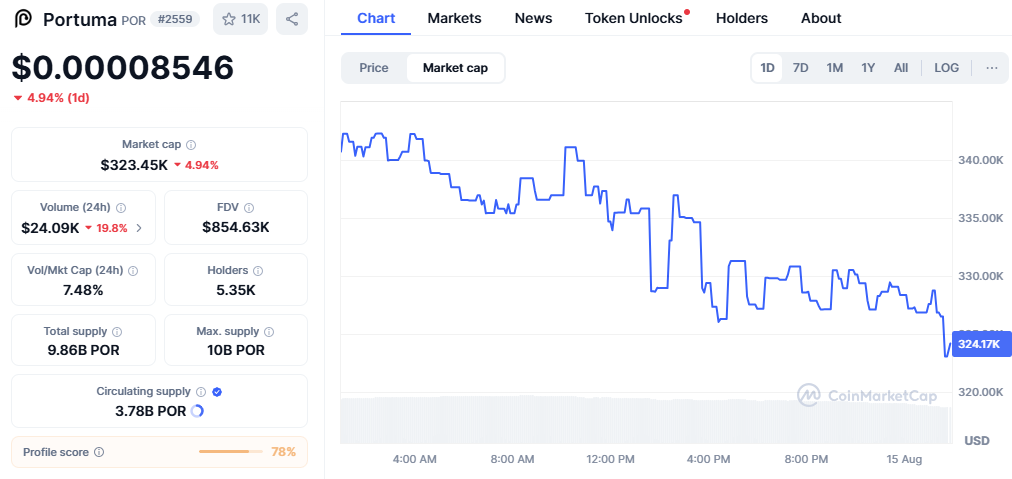

Portuma Declines but Retains Market Presence

Portuma traded at $0.00008546, marking a 4.94% daily decline. Its market capitalization fell to $323.45, while the FDV stood at $854.63K. Trading volume dropped 19.8% to $24.09, showing a slowdown in recent transactions.

The price chart showed early minor gains followed by consistent downward movement throughout the day. Small rebounds occurred but failed to shift the trend. By the evening, prices reached near the day’s lows, at $324.17 in market value.

Portuma’s total supply is 9.86 billion POR, with a maximum of 10 billion and 3.78 billion circulating. The volume-to-market cap ratio is 7.48%, indicating moderate liquidity. While the price has faced pressure, the token continues to hold a position in the microcap market segment.