The ETF + 401(k) Combination Ready to Transform Ethereum

Ethereum has just reached a decisive milestone. In a single day, August 11, inflows into its ETFs exceeded one billion dollars, a clear sign of institutional confidence. At the same time, an executive order signed by Donald Trump opens the American 401(k) plans — a pillar of retirement savings in the United States — to cryptocurrencies. Two events that, combined, could sustainably reshape the dynamics of the crypto market.

In Brief

- Ethereum ETFs record a net inflow record of 1 billion dollars in one day.

- American 401(k) plans are now allowed to include cryptos and private equity.

- The ETF + 401(k) combination could trigger a massive and lasting inflow of capital into Ethereum.

1 Billion in 24h: The Ethereum ETF Breaks All Records

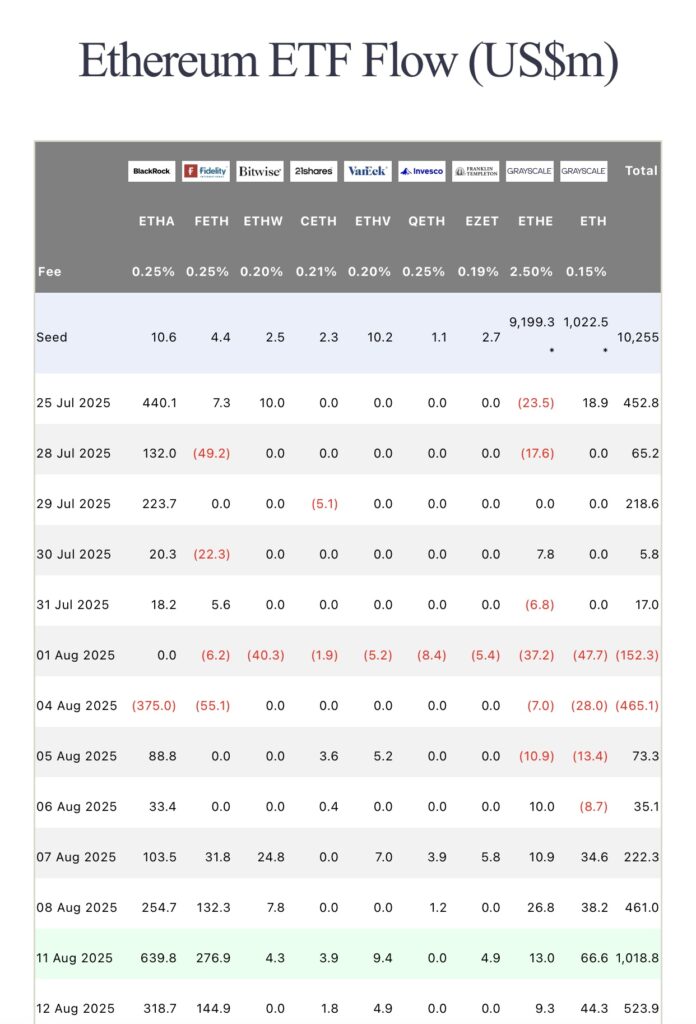

Ethereum ETFs recorded more than 1 billion dollars in net inflows on August 11, a historic record for the asset. BlackRock, with its ETHA product, captured 640 million dollars, while Fidelity, through FETH, attracted 277 million.

Inflows into Ethereum ETFs on August 11.

Inflows into Ethereum ETFs on August 11.

This enthusiasm for ETH is explained by several macroeconomic factors. US inflation stands at 2.8% year-over-year, strengthening expectations of Fed rate cuts. Investors are returning to risky assets, including cryptos, pushing Ethereum toward the 4,600 dollar zone, with bullish momentum in the short and medium term.

American 401(k) Plans Open Their Doors to Cryptos

The Trump administration has reached a milestone by allowing cryptos and private equity in 401(k) plans by repealing a directive dating from 2021. This change opens access to digital assets to millions of Americans via tax-advantaged accounts, a potentially colossal lever for long-term adoption.

This measure could replicate the impact that gold ETFs had in the 2000s, when the SPDR Gold Trust facilitated gold exposure for institutional and retail investors.

ETF + 401(k): The Duo That Could Transform Ethereum

The arrival of Ethereum ETFs strengthens the asset’s legitimacy with institutional investors. At the same time, opening 401(k) plans to crypto creates an unprecedented retail investment channel. This dual dynamic is amplified by cash strategies of companies like BitMine Immersion Technologies, which now holds 1.15 million ETH.

This mix of institutional flows, corporate accumulation, and retirement savings could inject tens or even hundreds of billions into the Ethereum ecosystem. As Ryan Lee, chief analyst at Bitget, points out:

This combination will strengthen the role of cryptocurrencies as an alternative to traditional financial investments, paving the way for sustainable capital inflows in the coming months.

Despite this optimism, several points of caution remain:

- Ethereum remains a highly volatile asset, susceptible to sharp corrections.

- Integration into 401(k) plans raises questions about liquidity and risk management for retirement portfolios.

- The SEC and Congress may still clarify the regulatory framework, notably regarding eligibility criteria for crypto assets in retirement accounts.

Bullish signals are multiplying for Ethereum . The combination of institutional adoption through ETFs and massive retail opening via 401(k) plans could be the catalyst for a structural bull cycle for Ethereum. If the trend is confirmed, this year could be retrospectively seen as the moment when ETH transitioned from an innovative asset to a cornerstone of global financial allocation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Talus (US)

Five charts to help you understand: Where does the market go after each policy storm?

After this regulatory crackdown, is it a harbinger of an impending downturn, or the beginning of a new cycle where all negative news has been fully priced in? Let’s examine the trajectory after the storm through five key policy milestones.

Mars Morning News | The crypto market rebounds across the board, Bitcoin rises above $94,500; The "CLARITY Act" draft is expected to be released this week

The crypto market has fully rebounded, with bitcoin surpassing $94,500 and US crypto-related stocks rising across the board. The US Congress is advancing the CLARITY Act to regulate cryptocurrencies. The SEC chairman stated that many ICOs are not securities transactions. Whales are holding a large number of profitable ETH long positions. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model is still being iteratively updated.

Federal Reserve’s Major Shift: From QT to RMP, How Will the Market Transform by 2026?

The article discusses the background, mechanism, and impact on financial markets of the Federal Reserve's introduction of the Reserve Management Purchases (RMP) strategy after ending Quantitative Tightening (QT) in 2025. RMP is regarded as a technical operation aimed at maintaining liquidity in the financial system, but the market interprets it as a covert easing policy. The article analyzes RMP's potential effects on risk assets, the regulatory framework, and fiscal policy, and provides strategic recommendations for institutional investors. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.