Dogecoin Whales Buy 680M DOGE as Open Interest Climbs 9%— Is a Bigger Breakout Coming?

Firms in the race include Bitwise, Grayscale, and Rex Shares. Back on August 3, the odds of an approval before year-end were sitting at just 56%. But in the days since, they’ve surged to 74%, a shift that’s not going unnoticed in the Dogecoin community.

- Whale investors have scooped up more than 680 million DOGE in August alone, pushing their holdings to the highest level since December.

- If current forecasts hold true, continued whale buying, despite the choppy macro backdrop, could propel DOGE into the $0.25–$0.26 range.

Bitcoin (BTC) hit $122,300 earlier today after tacking on another 3% over the weekend. Ethereum (ETH) wasn’t far behind in making headlines, breaking past $4,300 for the first time in four years. Meanwhile, Dogecoin is still sitting comfortably on the meme coin throne with a market cap hovering around $34 billion.

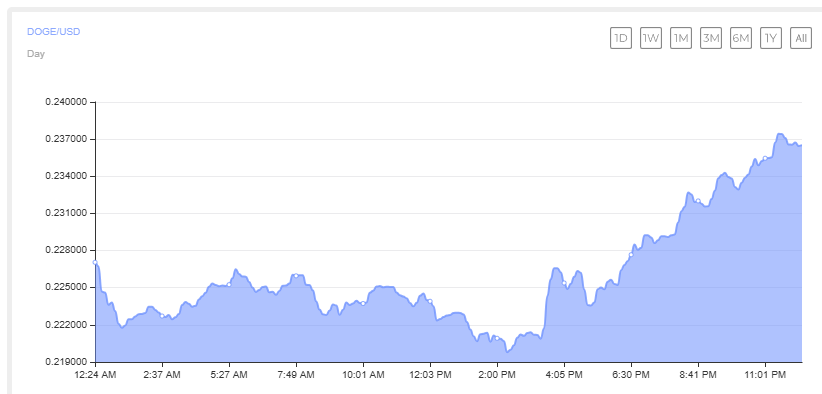

At the moment, DOGE is trading at $0.2264, a solid climb from recent lows, but still about 69% shy of its 2021 peak at $0.7076. Over the past week, it’s up 12%, although it did slip 3% in the past 24 hours. The coin has been wrestling with the $0.2407 resistance level, and it could slide back toward $0.2145, which was the closing price on May 17.

Addresses holding more than 100 million DOGE have scooped up another 680 million tokens since August 1, bringing their total stash to 98.56 billion DOGE. That’s the largest balance we’ve seen from this group since December 1. When whales start hoarding like this, they effectively take coins out of circulation, which can tighten supply and set the stage for a price rally.

Right now, DOGE’s Relative Strength Index (RSI) is sitting at 58 on the daily chart, still in neutral territory, but edging closer to levels that could signal stronger momentum. Over in the derivatives market, the picture is mixed.

CoinGlass data shows that open interest in Dogecoin futures has climbed 9%, suggesting more traders are taking positions. But the rest of the data tells a slightly different story. Derivatives trading volume, which tracks how much DOGE is actually changing hands in these contracts each day, has taken a noticeable dip, sliding 22.95% to $6.35 billion.

Options volume, the number of contracts bought and sold, has plunged a massive 68.20% to $406.99 million. That’s a sharp drop and could indicate that short-term speculation in the DOGE options market is cooling off. Still, options open interest actually rose 10.46% to $1.87 million, which means some traders are locking in positions for the longer game.

Breakout Potential

Crypto analyst Ali Martinez chimed in on X, declaring, “History says $DOGE to the moon next!” He added, “Once Dogecoin clears $0.36, the path is clear. Targets reset to $0.70.” Elevated volume combined with higher lows signals accumulation pressure, positioning DOGE for a potential breakout. Looking up, a decisive push above the $0.2407 neckline could extend the Dogecoin rally to the $0.2848. Others warn of a bearish scenario in the short term.

One potential catalyst lurking in the background? The approval of the first-ever spot Dogecoin Exchange Traded Fund (ETF) in the U.S. The Securities and Exchange Commission (SEC) has officially acknowledged multiple ETF filings and opened formal proceedings to review them.

The SEC has repeatedly extended decision deadlines, typically allowing the full 240-day review window. Now, the final decisions are likely to land between October 2025 and January 2026, with the 21Shares ETF specifically facing a January 9, 2026, deadline.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.