Shiba Inu’s Holding Time Halves, Pushing Token Towards New Lows

SHIB’s holding time drops, signaling bearish sentiment, as the token risks falling below $0.00001295.

Buy-side pressure among Shiba Inu holders has weakened since its price hit an intraday high of $0.00001406 on Saturday.

Trading at $0.00001304 at press time and hovering just above a critical support level of $0.00001295, SHIB appears poised for further declines in the near term.

SHIB Investors Shift to Short-Term Profits

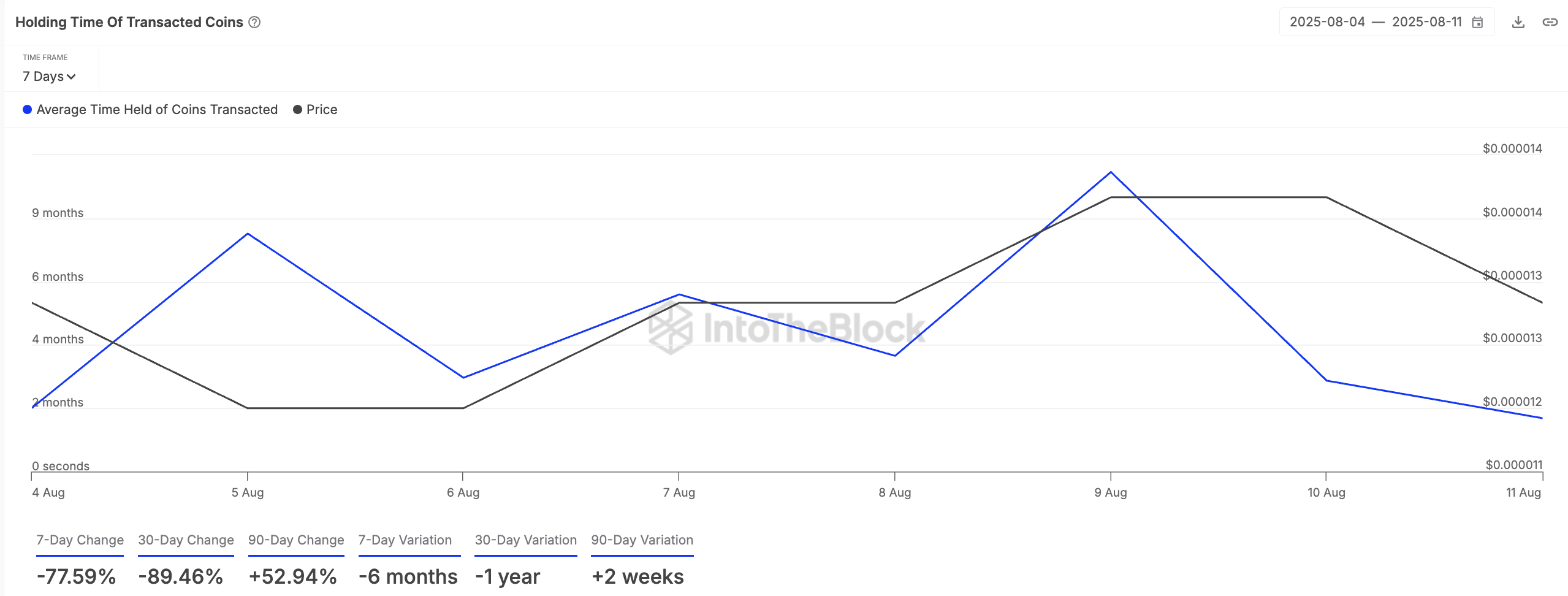

SHIB investors have reduced their holding time, a clear signal that bearish sentiment around the meme coin is growing. Data from IntoTheBlock shows that the average holding time for transacted SHIB tokens has plunged by 78% over the past seven days.

SHIB Holding Time of Transacted Coins. Source:

IntoTheBlock

SHIB Holding Time of Transacted Coins. Source:

IntoTheBlock

This sharp decline suggests that holders are increasingly opting to sell or move their SHIB tokens quickly to lock in recent gains rather than holding on for longer-term profit.

When an asset’s holding time falls, its investors are less confident about its future value and are more focused on short-term profits or minimizing losses.

In SHIB’s case, the trend confirms that many holders are reacting to recent price volatility by cashing out sooner, contributing to increased selling pressure in the market.

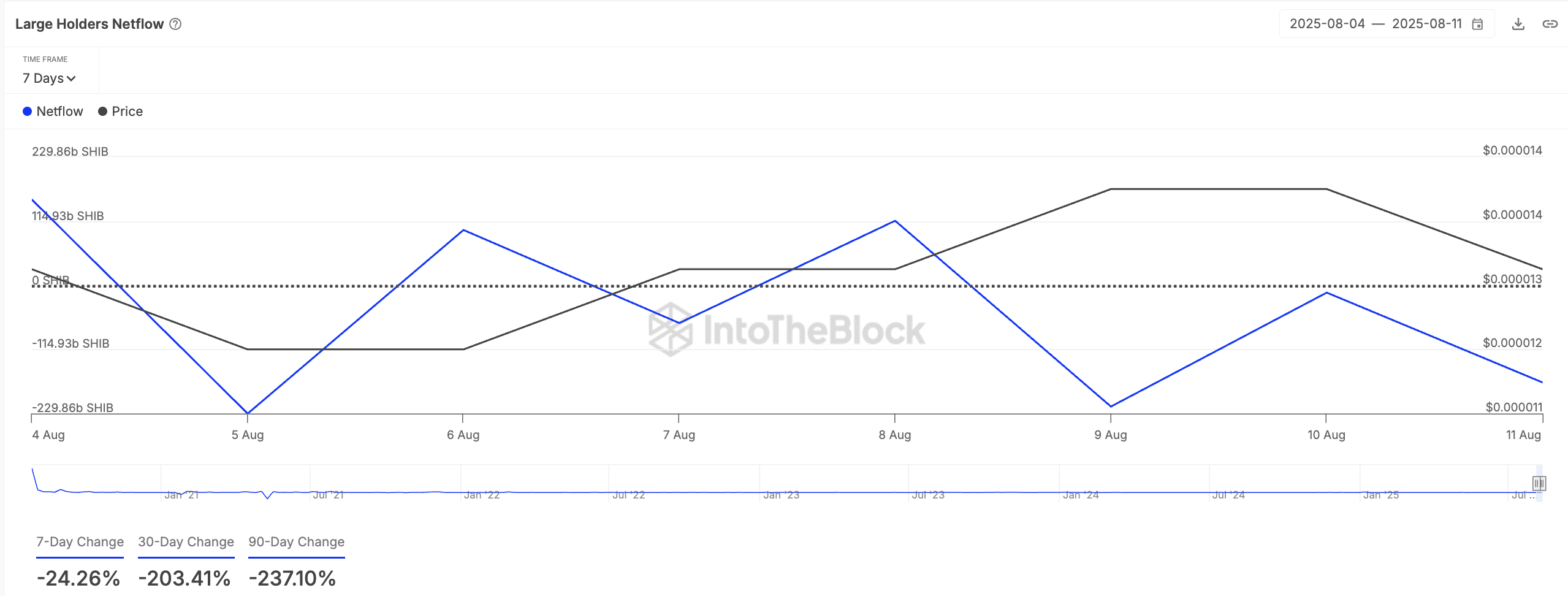

Further, the decline in SHIB whale activity during the review period compounds this bearish outlook. Per IntoTheBlock, the meme coin’s large holders’ netflow has plummeted 24% over the past seven days.

SHIB Large Holders Netflow. Source:

IntoTheBlock

SHIB Large Holders Netflow. Source:

IntoTheBlock

Large holders are whale addresses that hold more than 1% of an asset’s circulating supply. Their netflow measures the difference between the amount of assets they buy and sell over a specified period.

When this grows, these large holders are accumulating the asset by buying more than they are selling.

Conversely, when whale net flow is negative, these holders are offloading their positions by selling more tokens than they are buying. Such behavior reduces the upward buying momentum that whales typically provide, leaving SHIB more exposed to market volatility and bearish trends.

SHIB Risks Sliding Toward $0.00001167

The falling support from SHIB key holders and the shorter holding times by average investors hint at a potential continuation of SHIB’s downward price movement. In this case, the meme coin risks falling under $0.00001295 to reach $0.00001167.

SHIB Price Analysis. Source:

SHIB Price Analysis. Source:

However, if new demand re-emerges, SHIB could reverse its decline and climb to $0.00001385.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From "whoever pays gets it" to "only the right people get it": The next generation of Launchpads needs a reshuffle

The next-generation Launchpad may help address the issue of community activation in the cryptocurrency sector, a problem that airdrops have consistently failed to solve.

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.