Crypto Market Outlook After US Inflation Data: Bitcoin Eyes $125K as CPI Hits 2.7%

US CPI Data Comes in Slightly Below Expectations

Today’s US inflation report landed at 2.7% year-over-year, just under the forecasted 2.8%. According to the pre-announcement framework from Ash Crypto (@Ashcryptoreal), this reading leans bullish for risk assets like crypto. Core CPI, however, remained elevated at 3.1%, slightly above estimates.

Markets reacted positively — US stock index futures climbed, and rate cut bets for September strengthened. The crypto sector followed suit, with Bitcoin holding near $119K and Ethereum edging higher.

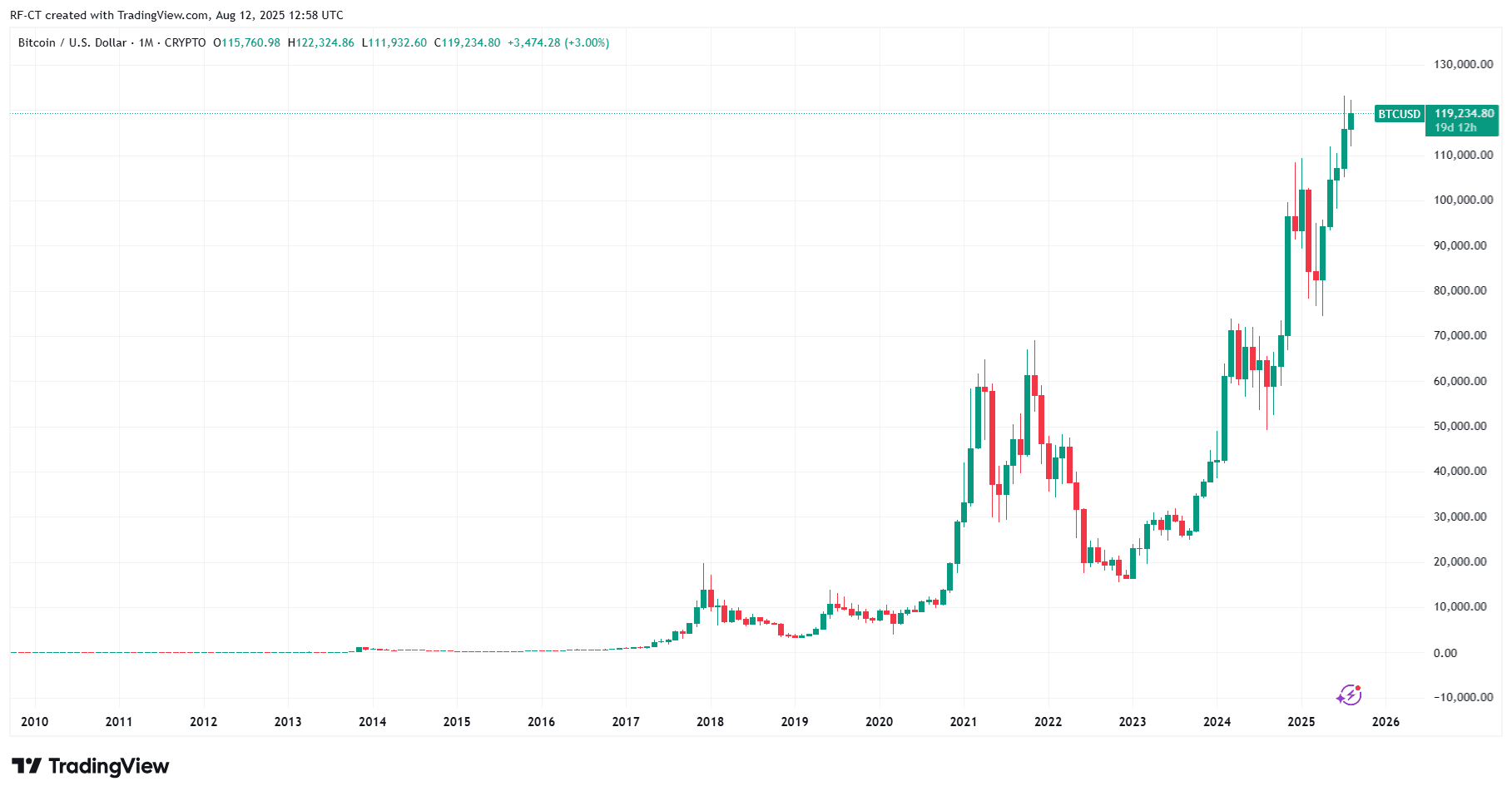

Bitcoin Price Prediction: Path to $125K?

Bitcoin ($BTC) briefly spiked above $119K after the CPI release before consolidating. The lower-than-expected inflation reading has reinforced the possibility of a 75 basis points Fed rate cut by year-end, starting as early as September.

By TradingView - BTCUSD_2025-08-12 (All)

By TradingView - BTCUSD_2025-08-12 (All)

- Bullish Scenario: If the Fed confirms a September cut, Bitcoin could break the $120K resistance and aim for $125K by Q4 2025.

- Neutral Scenario: A pause in Fed action could keep BTC range-bound between $116K–$120K.

- Bearish Scenario: Any uptick in inflation or hawkish Fed stance could push BTC back toward $112K support.

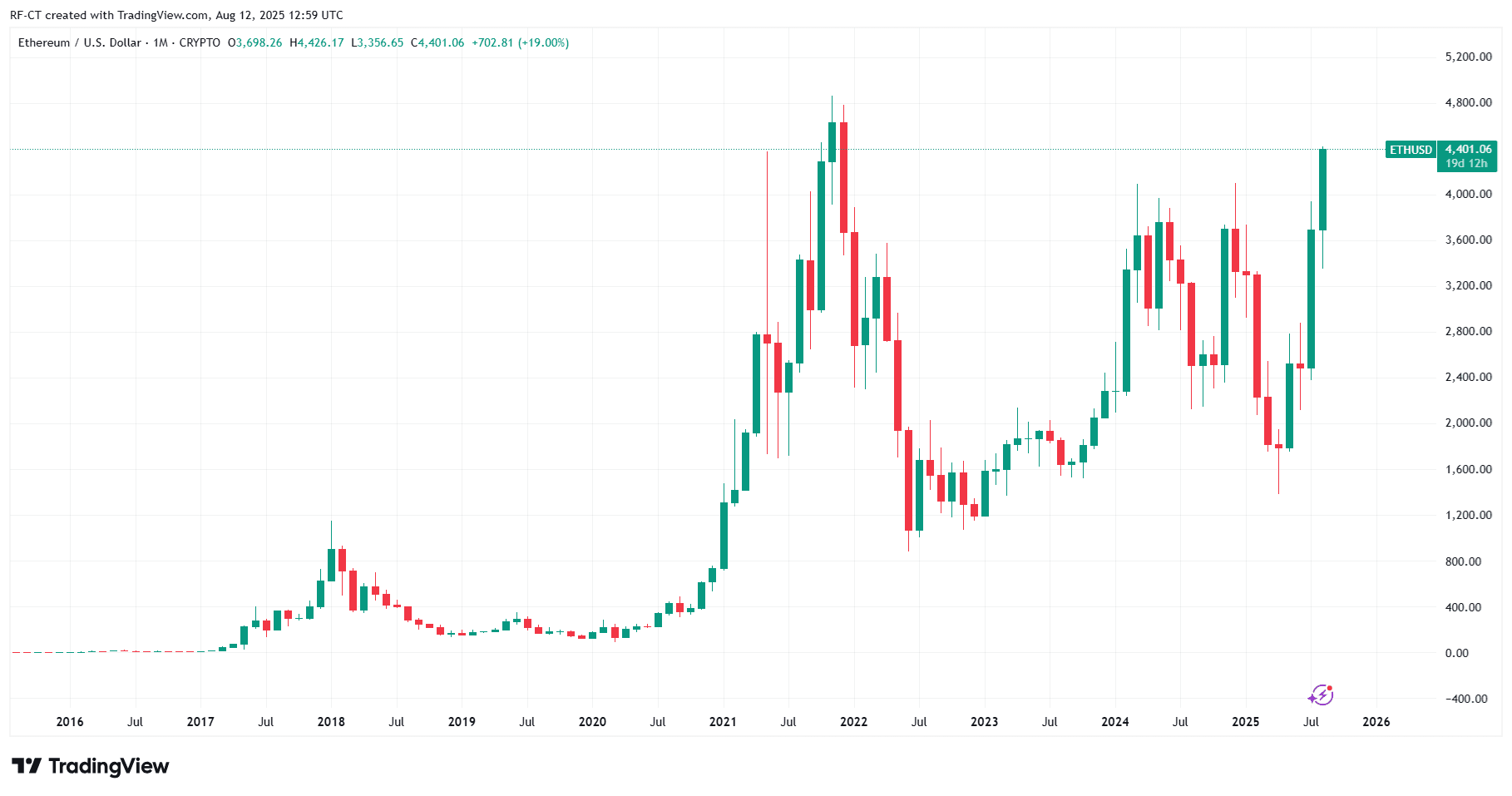

Ethereum and Altcoins: Rally Potential

Ethereum ($ETH) has shown resilience, trading near key support levels above $4,000. If the rate cut narrative gains momentum, ETH could target $4,500 in the coming weeks.

By TradingView - ETHUSD_2025-08-12 (All)

By TradingView - ETHUSD_2025-08-12 (All)

Altcoins like Cardano ($ADA) and Solana ($SOL) stand to benefit from increased liquidity and renewed investor appetite. Short-term volatility is still expected, but a dovish Fed would generally favour higher beta assets.

Macro Takeaway for Crypto Investors

The CPI outcome provides a cautiously bullish backdrop. The headline number supports rate cut hopes, but sticky core inflation means the Fed may move slower than markets want. This sets the stage for short bursts of volatility, especially around Fed communications.

For traders, the next major catalyst will be the FOMC meeting in mid-September. Until then, Bitcoin and altcoins may trade within a tighter range, with potential breakouts if macro sentiment shifts further toward easing.

$BTC, $ETH, $ADA, $SOL

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.