XRP’s Bullish Pattern Meets Profit-Hungry Sellers—Will the Price Hold?

XRP price is riding a bullish chart pattern, yet on-chain data shows profit-taking may already be in play. Rising exchange reserves and shrinking short-term holder groups could test the rally’s strength.

XRP price has climbed close to 10% in the past week, riding the broader crypto rally as the total market cap pushes above $4.13 trillion.

But the jump has also brought sellers into the picture, and on-chain data suggests short-term holders may already be cashing out.

Short-Term Holders Start to Exit

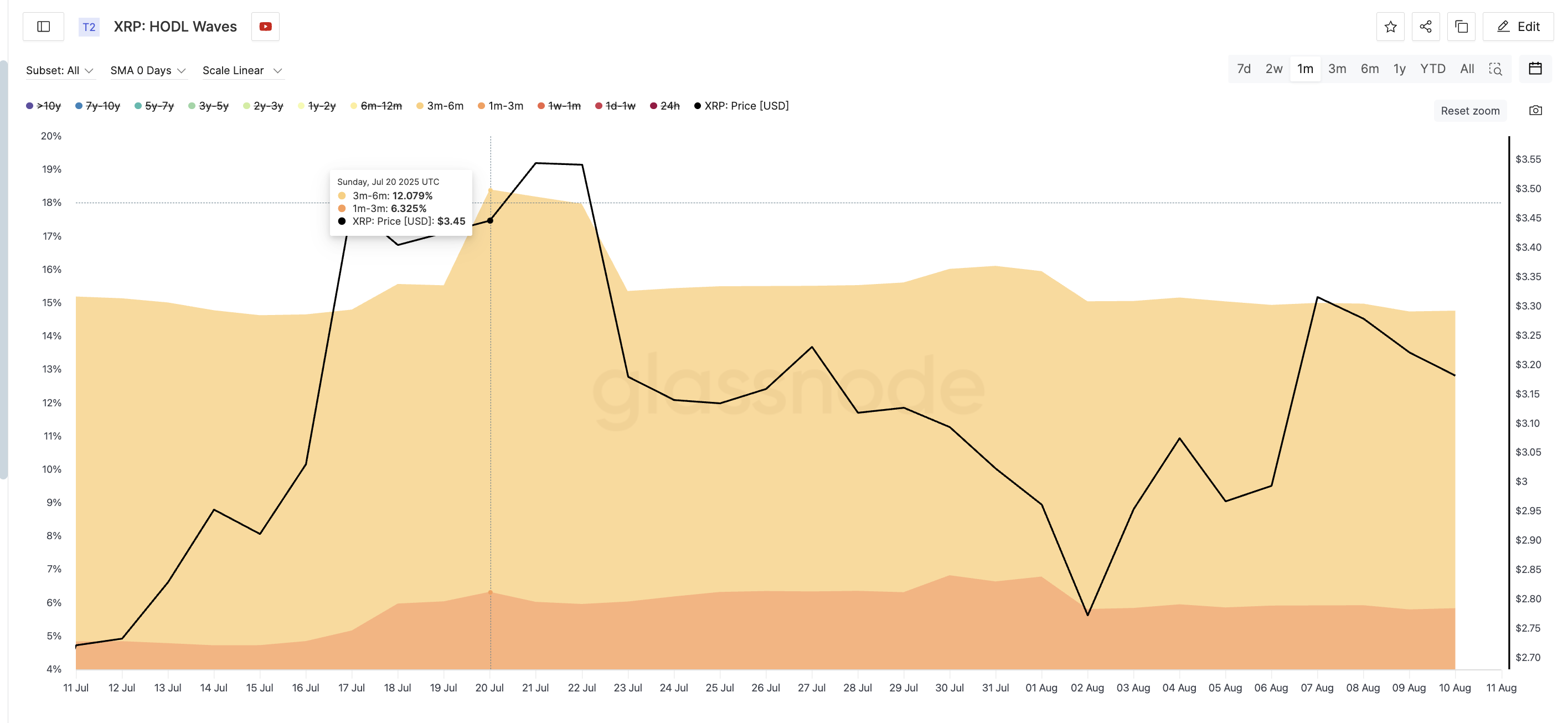

HODL Waves, a metric that groups coins by how long they’ve been held, shows two key cohorts shrinking fast.

On July 20, wallets holding XRP for 3–6 months controlled about 12.07% of the supply. By August 10, that number had dropped to 8.93%. The 1–3 month XRP wallets group tells the same story, falling from 6.78% on August 1 to 5.83% at the time of writing.

The 1-3 month cohort’s monthly accumulation peaked when the XRP price was around $2.77. As they keep dumping their shares, the profit-hungry narrative gets a clear validation.

XRP price and short-term holder exit:

Glassnode

XRP price and short-term holder exit:

Glassnode

HODL Waves matter because they reveal investor behavior over time. A falling share for recent holders usually means they are selling, often to lock in profits after a price jump. This can signal a short-term shift in sentiment before the broader market trend changes.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Exchange Reserves Point to More Selling Pressure

When we connect the HODL Wave drop to exchange reserve data, the picture becomes clearer. Over the past week, XRP reserves on exchanges have been climbing. Historically, rising reserves paired with falling short-term HODL groups have preceded price pullbacks.

XRP price and rising exchange reserves:

Cryptoquant

XRP price and rising exchange reserves:

Cryptoquant

We saw this pattern as recently as July 22, when reserves spiked and the XRP price dropped from around $3.55 to $3.17 in one session. The logic is simple: coins moving onto exchanges are easier to sell. When that happens while certain holder groups are shrinking, it often means profit-taking is in motion.

XRP Price Structure Still Bullish; For Now

On the 4-hour chart, the XRP price is still respecting an ascending triangle pattern. The bullish setup has clear levels to watch. Resistance sits at $3.34; a break above could open the door to $3.57 and the all-time high near $3.66.

XRP price analysis:

TradingView

XRP price analysis:

TradingView

On the downside, support holds at $3.15. A drop below that would bring $3.07 into play and turn the short-term structure bearish.

For traders, the current thesis, that we might see short-term consolidation before another leg up, gets invalidated if the price closes above $3.34. Until then, the mix of profit-taking signals and climbing exchange reserves suggests caution.

In short, XRP’s chart still favors the bulls, but the behavior of short-term holders and rising reserves hints that momentum may stall before any run to new highs. Traders should watch $3.15 on the downside and $3.34 on the upside for the next big move.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Durov's new project: Want to mine TON on Cocoon? Ordinary people can't afford to play

Want to mine TON on Cocoon? The starting capital is 250,000; ordinary people shouldn't dream of becoming a "computing power landlord."

"If you're afraid, buy bitcoin": BlackRock CEO calls bitcoin a "panic asset", says sovereign funds have quietly increased their holdings

BlackRock CEO Larry Fink defines Bitcoin not as a "hope asset," but as a "panic asset."

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.