Will Ethereum Price Hit $5,000 This Cycle? A Technical Breakdown

Ethereum’s recent rally past the $4,000 mark has crushed short sellers and attracted renewed institutional interest, driving futures open interest higher. Holding strong support near $3,909, ETH could push toward $4,430 resistance and possibly retest its all-time high, provided buying momentum continues.

Ethereum’s rally above the $4,000 mark has triggered a significant wave of short liquidations, reflecting the strengthening demand for the leading altcoin.

On-chain data reveals a resurgence in interest and accumulation, suggesting that short sellers could face continued losses if Ethereum’s price momentum holds.

ETH Surges Past $4,000 on Renewed Buying Momentum

The surge in new demand for ETH has driven its price up by 18% over the past week. This strong buying momentum and improving market sentiment culminated in a move above the $4,000 price mark yesterday, sparking liquidations among short sellers.

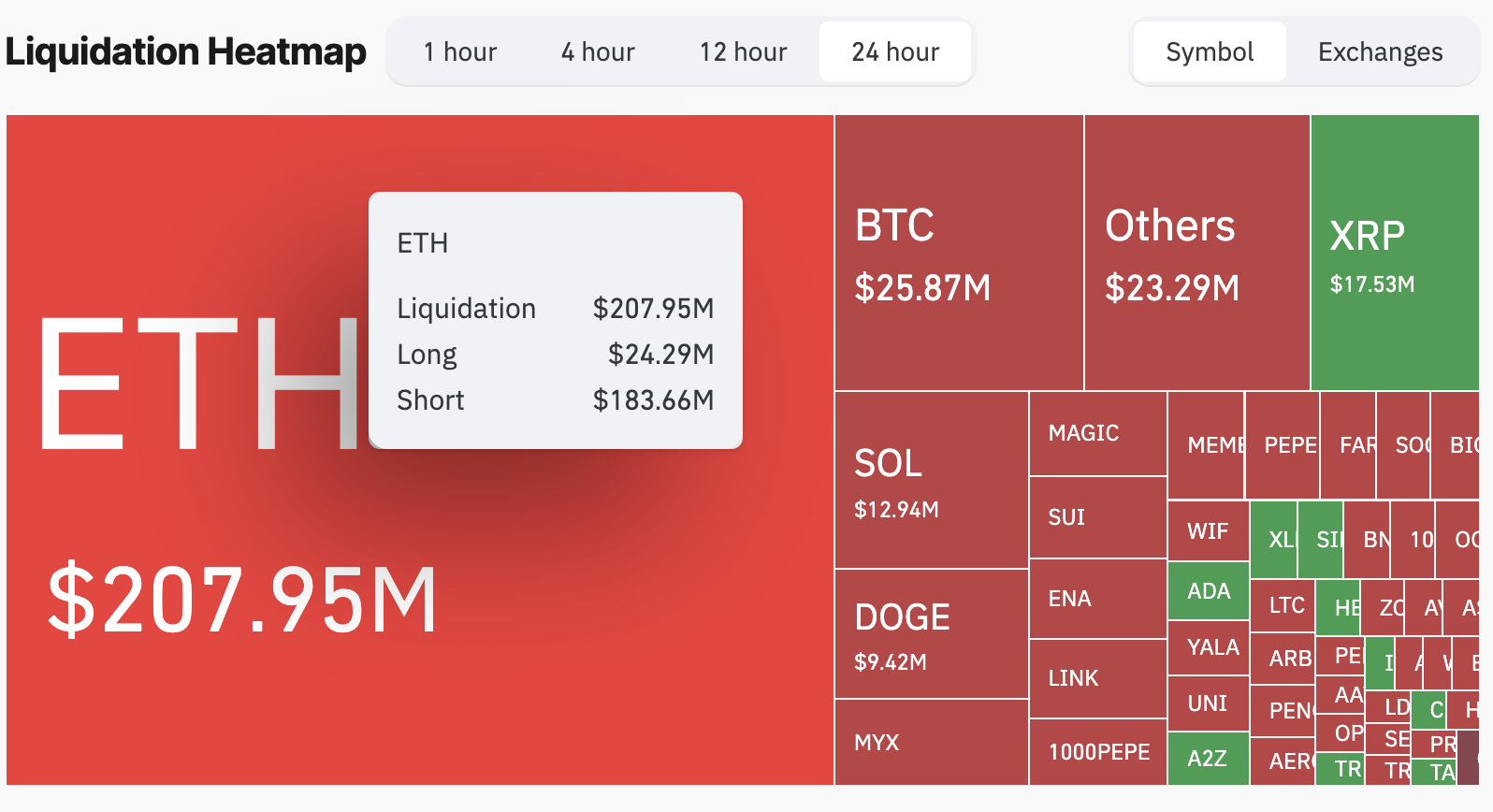

Data from Coinglass reveals that short liquidations have totaled $184 million in the past 24 hours, while long liquidations remain comparatively modest at around $24 million.

This highlights the intensity of the short squeeze as traders scramble to cover their positions amid the rally.

Crypto Liquidation Heatmap. Source:

Coinglass

Crypto Liquidation Heatmap. Source:

Coinglass

However, on-chain data signals that this investor cohort might experience more losses ahead, with ETH poised to keep climbing.

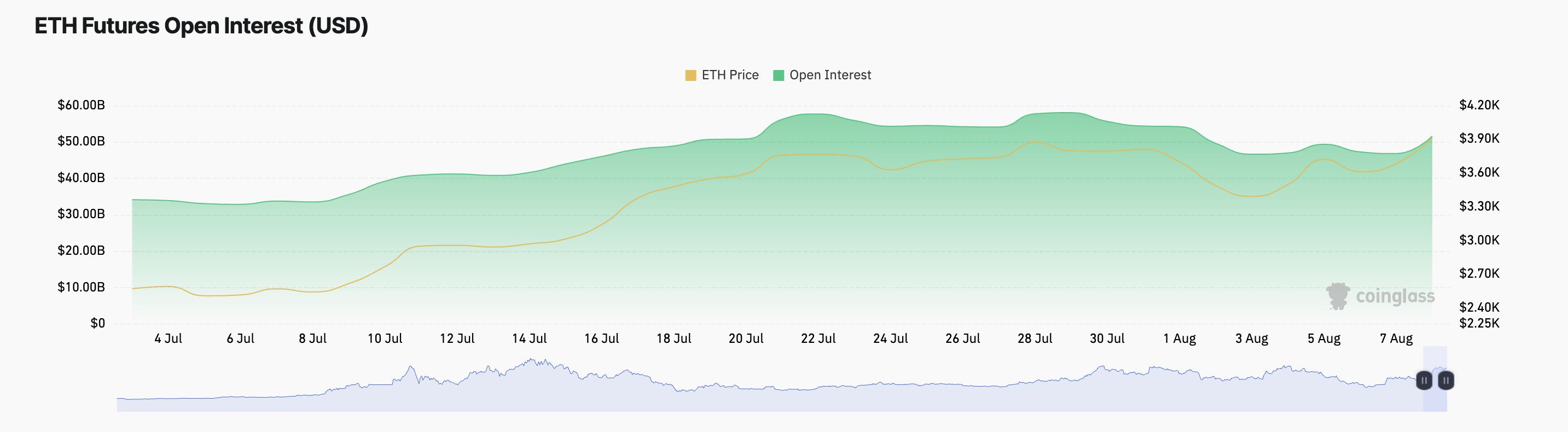

For example, ETH’s futures open interest has climbed with its price, signalling heavy market participation. At press time, this sits at $51.61 billion, up 10% in the past 24 hours.

ETH Open Interest. Source:

Coinglass

ETH Open Interest. Source:

Coinglass

An asset’s open interest measures the total number of outstanding futures or options contracts in the market. When both an asset’s price and its open interest rise simultaneously, it signals strong conviction among traders that the current trend will continue.

For ETH, this suggests that more investors are actively taking new positions and are confident in the ongoing price momentum.

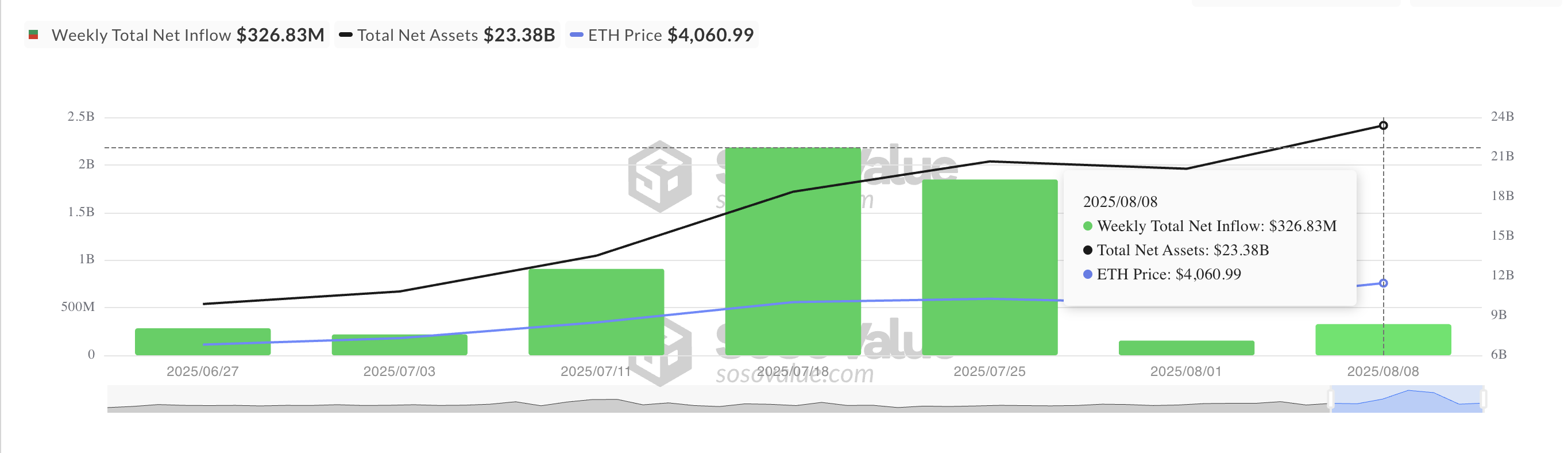

Moreover, the resurgence of institutional interest adds credence to this bullish outlook. Per SosoValue, this week has seen renewed inflows into ETH-backed exchange-traded funds (ETFs) as market sentiment improves.

Between August 4 and 8, these funds recorded inflows totaling $326.83 million.

Total Ethereum Spot ETF Net Inflow. Source:

SosoValue

Total Ethereum Spot ETF Net Inflow. Source:

SosoValue

The fresh wave of institutional capital shows the renewed confidence from larger investors, providing an important support layer that could sustain ETH’s upward trajectory in the near term.

Ethereum Holds $3,909 Support — Next Target $4,430 and Beyond

ETH trades at $4,160 at press time, maintaining a newly established support level near $3,909. Should this support strengthen and buying momentum increase, ETH’s price could rally toward $4,430, potentially testing and breaking through that resistance.

A successful breakout could set the stage for ETH to revisit its all-time high of $4,827.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

On the other hand, if buying pressure weakens, ETH may lose steam and reverse its current upward trend. Failure to hold the $3,909 support could cause the price to fall to $3,340.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.