Solana Treasuries Are Growing, But Price Drops Take a Toll

Solana’s corporate treasury market is growing rapidly but is still small compared to Bitcoin and Ethereum. Upexi, a leading firm, aggressively expanded its holdings, only to face a significant loss due to a price drop. Despite the risks, these early investors could position themselves well if Solana rebounds.

CoinGecko released a report on Solana treasury firms, yielding several important insights. The sector is much less crowded than corporate Bitcoin and Ethereum investors, but interest is rapidly growing.

However, Solana’s price has been more volatile. In July, its largest corporate holder lost $.09 million on this investment. So far, a handful of companies have exhibited a race to outdo each other, establishing a firm head start.

Corporate Solana Treasuries

In the race for corporate crypto acquisition, Bitcoin is the most popular asset, but other tokens are becoming more prominent. Earlier this week, two new standouts became clear: Ethereum and Solana are the most popular altcoins for private treasury firms.

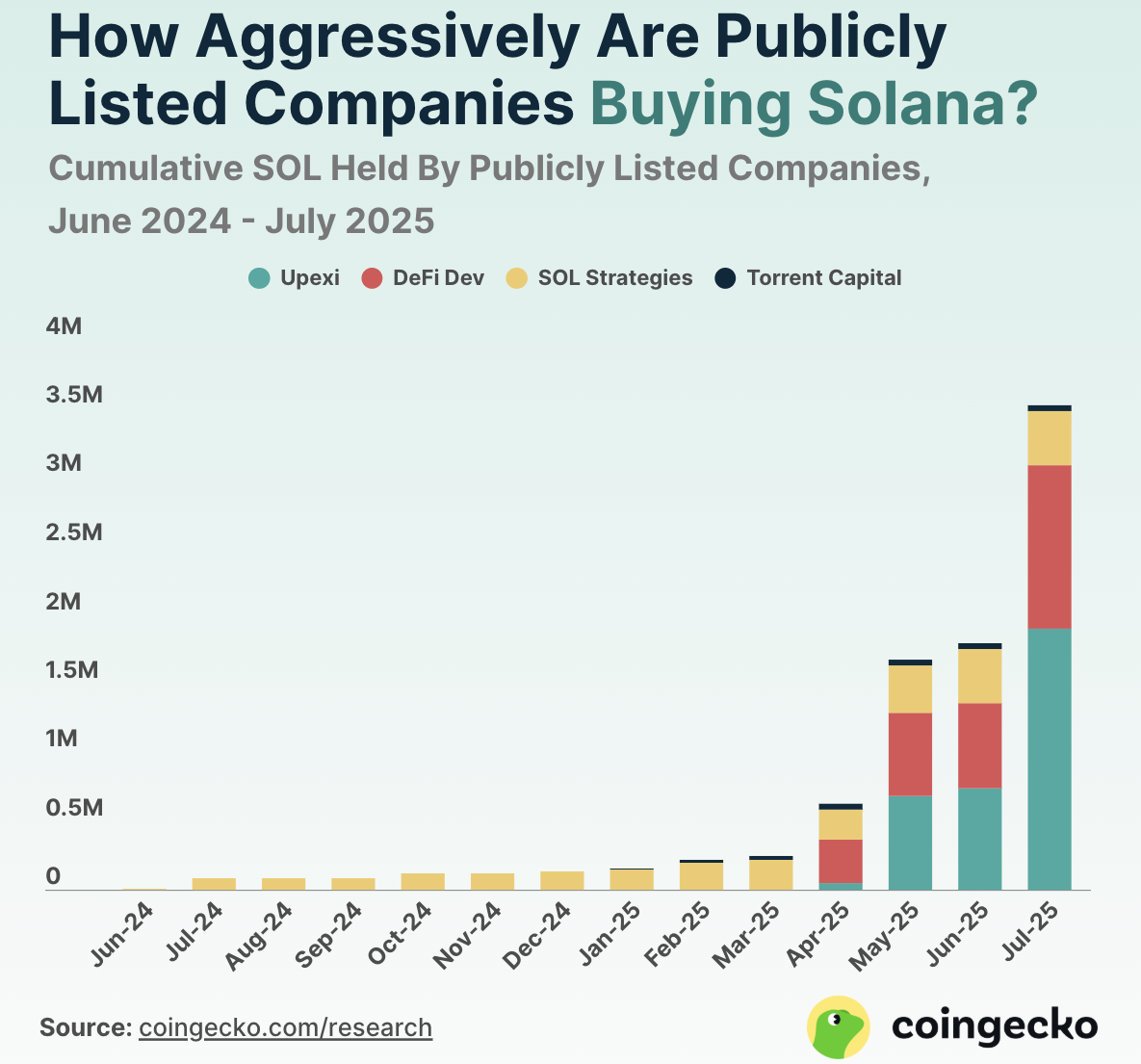

According to a report from CoinGecko, the rate of corporate SOL acquisition is increasing dramatically.

Corporate Solana Purchases. Source:

CoinGecko

Corporate Solana Purchases. Source:

CoinGecko

As this data shows, newcomers have repeatedly disrupted this market sector. SOL Strategies is by far the oldest player in this space, making substantial investments before this tactic was on anyone’s radar.

By April 2025, however, DeFi Development rebranded to become a Solana treasury firm, immediately surpassing the other company’s consumption.

Taking the moniker of ‘Solana’s MicroStrategy’, DeFi Development’s purchases have been accelerating.

Meanwhile, Upexi started small with its own Solana treasury, but supercharged its spending in July. The firm currently holds 1.9 million SOL, towering above DeFi Development’s 1.1 million.

Solana’s Volatility Remains a Challenge

Clearly, the Solana treasury market is defined by fierce competition, but it remains quite small. There are only four serious stockpilers, and Torrent Capital holds only 40,000 SOL.

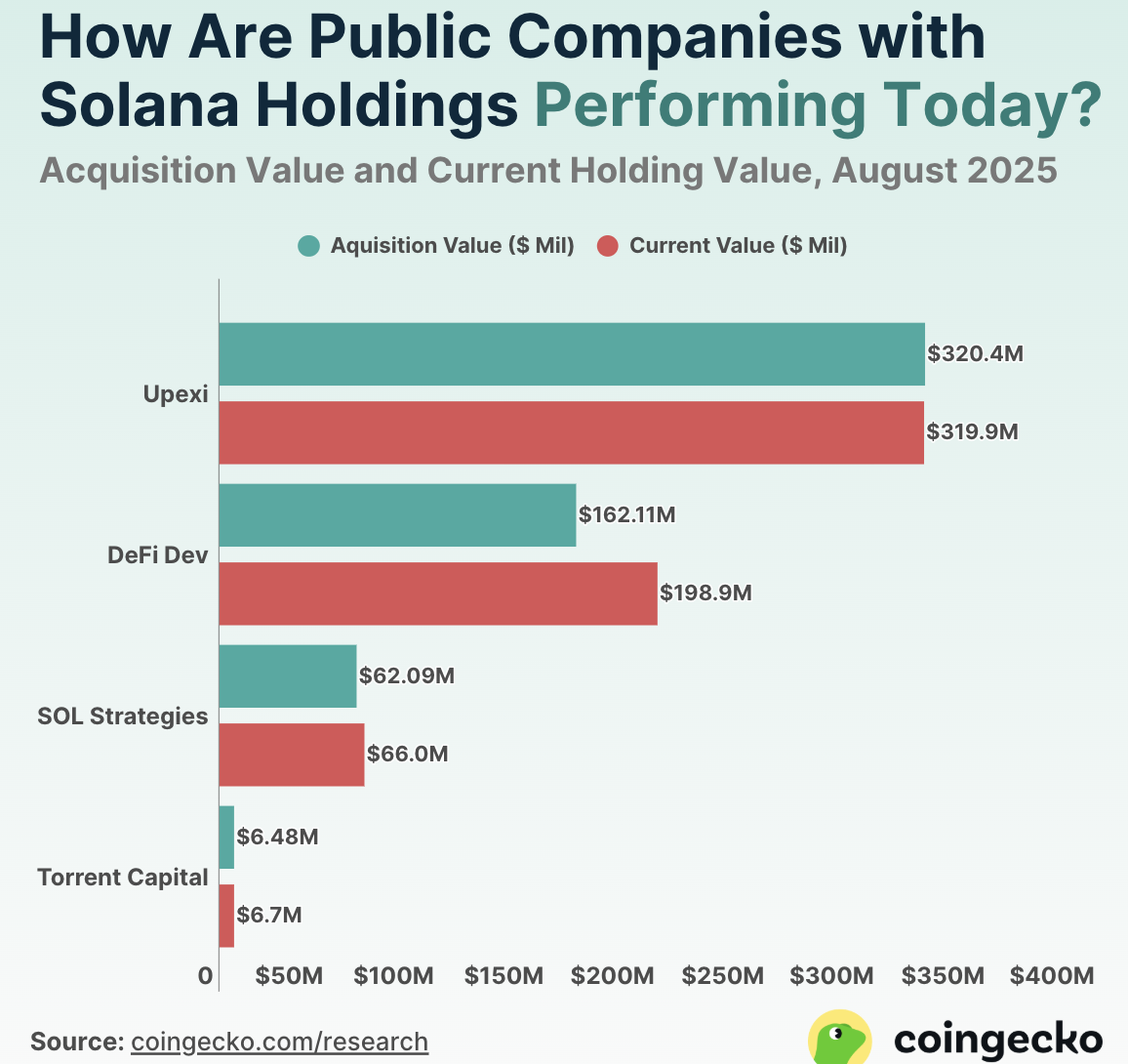

This begs a simple question: are these Solana buys a good investment? Prices have fallen considerably since late July, and it’s unclear when a rebound might happen.

Solana Treasury Firms’ Performance Metrics. Source:

CoinGecko

Solana Treasury Firms’ Performance Metrics. Source:

CoinGecko

So far, Upexi’s aggressive expansions have come at a cost. By stockpiling so much Solana directly before a downturn, the firm actually lost around $0.9 million.

The other companies performed better, but nothing like MicroStrategy’s wild returns. BTC treasury investors frequently expect a stellar performance, but Solana isn’t there yet.

These metrics have provided some valuable information about Solana as a potential treasury asset. Ethereum has returned a better performance, but there’s no shortage of corporate investors.

Meanwhile, these SOL maximalists have a commanding head start in a tiny market. If Solana jumps back up soon, these firms could become trendsetters.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hopes for a December rate cut fade? Bitcoin erases its yearly gains

After the release of the delayed U.S. September non-farm payroll data, which was postponed by 43 days, the market has almost abandoned expectations for a rate cut in December.

Gold Rush Handbook | Circle Arc Early Interaction Step-by-Step Guide

Remain proactive even during a sluggish market.

Mars Morning News | Nvidia's impressive earnings boost market confidence, while growing divisions in the Fed minutes cast doubt on a December rate cut

Nvidia's earnings report exceeded expectations, boosting market confidence and fueling the ongoing AI investment boom. The Federal Reserve minutes revealed increased disagreement over a possible rate cut in December. The crypto market is seeing ETF expansion but faces liquidity challenges. Ethereum has proposed EIL to address L2 fragmentation. A Cloudflare outage has raised concerns about the risks of centralized services. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved during iteration.

Surviving a 97% Crash: Solana’s Eight-Year Struggle Revealed—True Strength Never Follows the Script

Solana co-founder Anatoly Yakovenko reviewed the origins, development process, challenges faced, and future vision of Solana, emphasizing the transaction efficiency of a high-performance blockchain and the comprehensive integration of financial services. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the iterative update stage.