Litecoin Surges 40 Percent in a Month. Here’s Why

Litecoin just saw its strongest price spike in months, and it’s not hard to see why. A powerful mix of speculative energy, corporate action, and ETF optimism has lit a fire under LTC, pushing it to a five-month high of $128.40. But is this LTC price momentum sustainable , or is the market getting ahead of itself?

Let’s break it down.

Litecoin Price Prediction: What’s Driving the Price Surge?

First, the numbers. Litecoin is up over 41 percent this month and nearly 6 percent in the past 24 hours alone. As of now, it’s holding around $123, giving it a market cap close to $9.4 billion. That move isn’t random. It comes right after two major catalysts.

The big one? MEI Pharma raised $100 million—not for R&D, not for expansion, but to become a Litecoin treasury firm. That’s a massive bet on LTC from a publicly listed pharmaceutical player, and it’s sending a strong message to the broader market: Litecoin isn’t just for payments anymore, it’s a corporate asset.

Then there’s the ETF speculation. While prediction platform Polymarket places the odds of a Litecoin ETF approval this year at 83 percent, competing platforms like Myriad show users expect XRP to beat Litecoin to the finish line. Regardless, multiple filings from Canary Capital, Grayscale, and CoinShares suggest the race is on. The fact that these institutions are even in the conversation is enough to inject serious momentum.

What the LTC Price Chart Says?

LTC/USD Daily Chart- TradingView

LTC/USD Daily Chart- TradingView

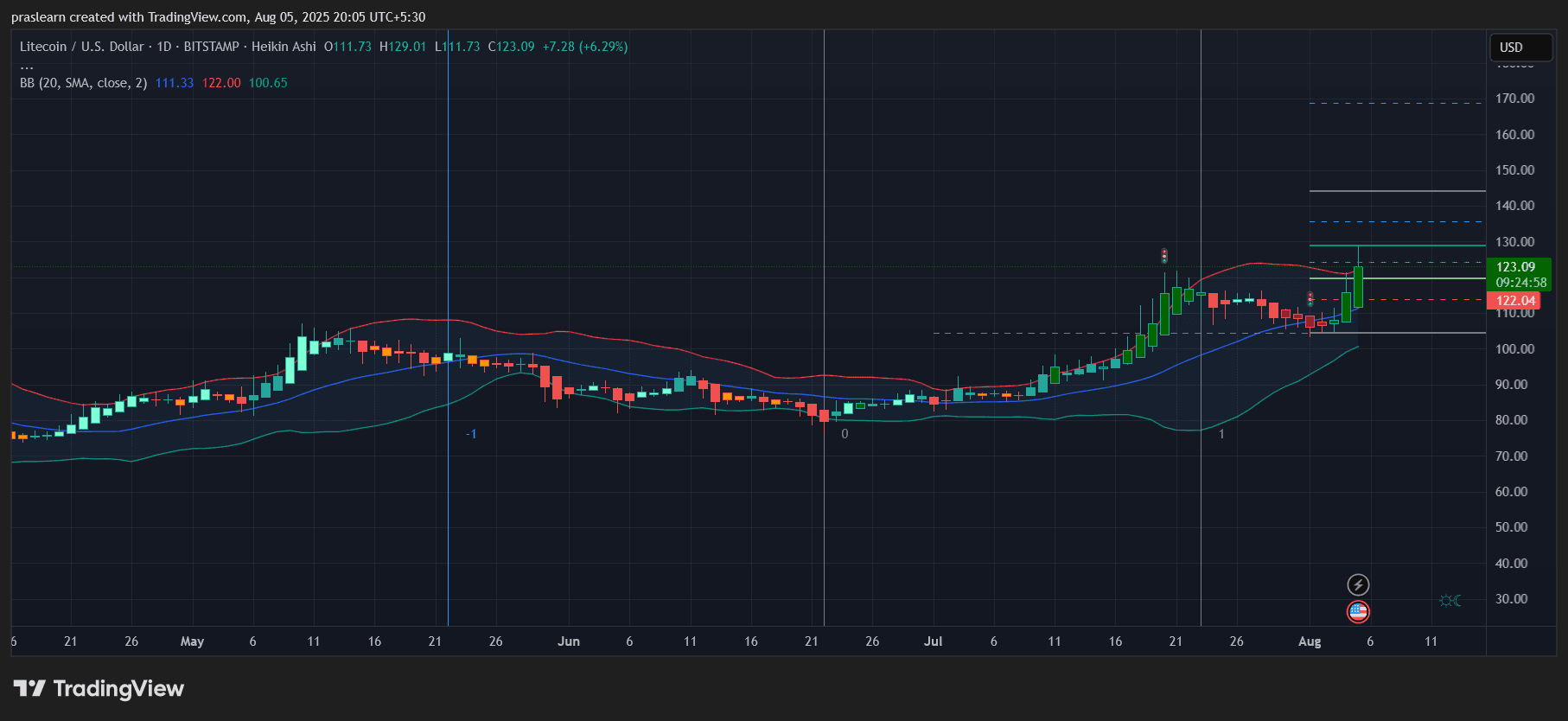

Looking at the TradingView daily chart, LTC broke above both the midline and upper band of the Bollinger Bands, which typically signals an overbought yet strong bullish condition. It’s riding above the 20-day moving average comfortably, and the Heikin Ashi candles show clear bullish continuity after a minor pullback.

That pullback after hitting $128.40 wasn’t a reversal—it looks more like a healthy consolidation. The current candle has reclaimed the upper Bollinger Band, suggesting that bulls are still in control. Momentum is strong, and the price structure is climbing with higher lows and higher highs.

If Litecoin can close above $125 in the next couple of sessions, the door opens to a retest of $135 to $140. Above that, $150 becomes the psychological level to watch. On the downside, $110 acts as strong support, and a drop below $105 would invalidate this bullish thesis.

Are ETF Rumors Already Priced In?

Litecoin ETF approval speculation has been around since February, when the SEC first acknowledged the filings. What we’re seeing now isn’t fresh news—it’s a resurfacing of old optimism, coupled with fresh capital from MEI Pharma. That matters.

In fact, the MEI investment could be the more important long-term catalyst. ETF approvals can move prices quickly, but if more firms start adding LTC to their balance sheets, that builds a deeper base of demand. And unlike ETF rumors, treasury allocations tend to stick around.

Litecoin Price Prediction: What Comes Next for LTC Price?

Short term, expect volatility. The market is jittery, and LTC will swing on every new ETF headline. But if treasury adoption continues and Litecoin maintains its role as a top payment coin—it recently captured 14.5 percent of crypto payments on CoinGate—there’s a longer runway here.

Keep an eye on three things: SEC decisions around Litecoin ETFs, corporate announcements hinting at LTC treasury positions, and any major payment platform adopting LTC.

The price is reacting to signals of real-world usage and institutional interest. If those signals get stronger, this could be the beginning of a structural uptrend, not just a hype-driven pump.

购买和交易LTC

想要购买LTC?可以选择主流合规的交易平台进行交易,注意风险管理。

$LTC, $Litecoin, $LTCPrice, $LitecoinPrice, $LitecoinETF, $ETF

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"Validator's Pendle" Pye raises $5 million, enabling SOL staking yields to be tokenized

There are truly no creative bottlenecks in the financialization of Web3.

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.