Mantle (MNT) rose to a three-month peak, rising by 20% over the last day. The network is gaining attention after peak inflows of new stablecoins.

Mantle (MNT) is drawing attention as a network with growing liquidity. The network is riding on the inflow of stablecoins, which is boosting the platform and leading to a rise in the MNT market price.

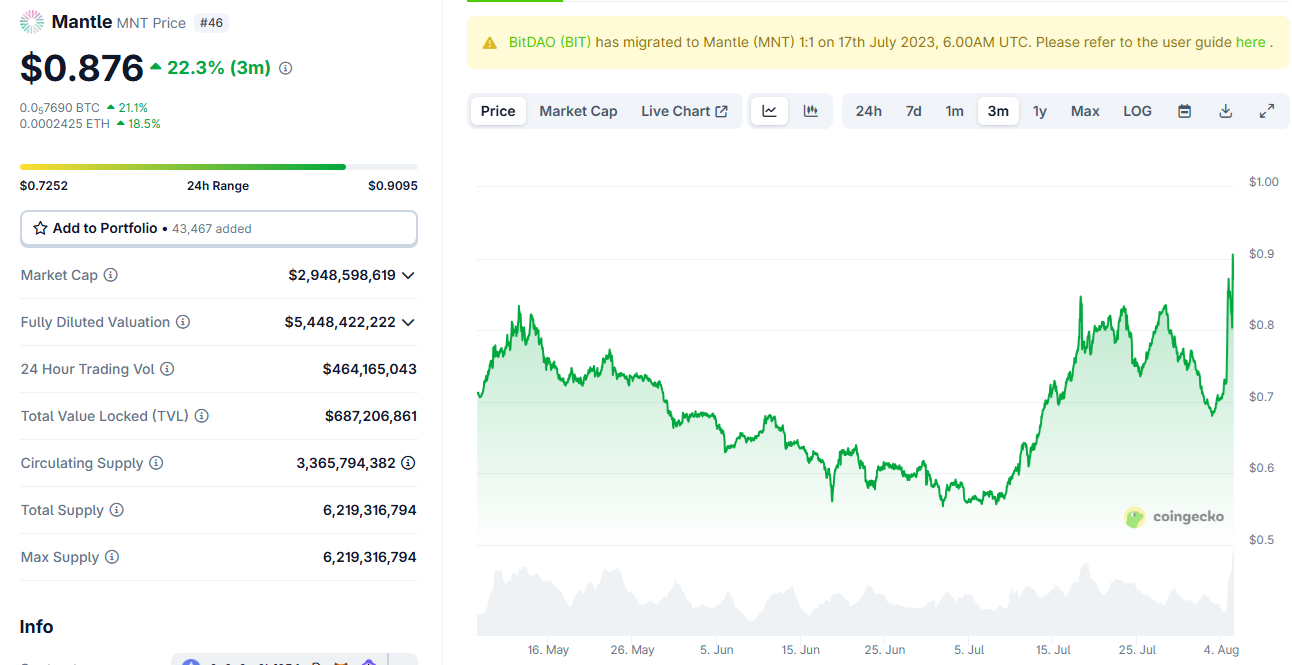

Following the news of liquidity inflows, MNT became a top gainer among altcoins. The token added over 20% in the past day, rising to $0.88. MNT also traded at its peak volume in the last three months, at over $484M in 24 hours.

MNT rallied to a three-month peak after Mantle revealed its significant ETH treasury. | Source: Coingecko

MNT rallied to a three-month peak after Mantle revealed its significant ETH treasury. | Source: Coingecko

MNT open interest also rose to a three-year peak at over $43M , also reflecting the sudden spotlight on the asset. The current rally led to an explosion of short positions, making up 33% of open interest.

The increase in short positions, expecting a correction, could also lead to an additional short squeeze and price growth. MNT is also far from its previous peaks around $1.40 achieved in 2024 and early 2025.

Mantle draws attention with ETH treasury

One of the main sources of renewed attention for Mantle comes from its status among Ethereum-holding entities. The project, formerly known as BitDAO, managed to collect a significant, barely touched ETH treasury during previous market cycles.

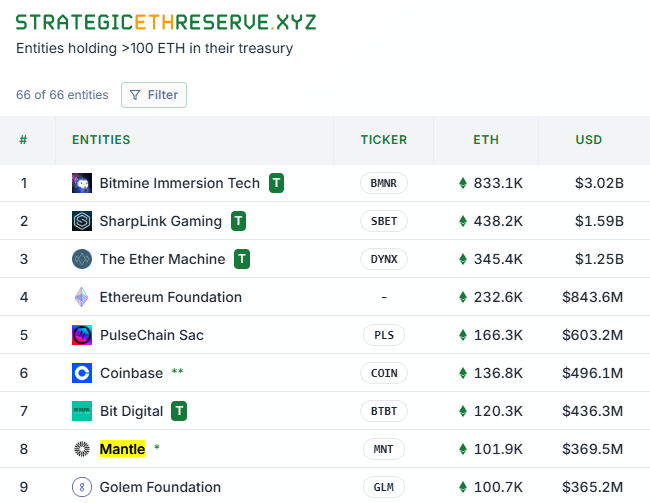

Mantle surpassed the Golem Foundation with its significant ETH treasury, giving the project options for DeFi passive income and significant liquidity. | Source: Strategic ETH Reserve

Mantle surpassed the Golem Foundation with its significant ETH treasury, giving the project options for DeFi passive income and significant liquidity. | Source: Strategic ETH Reserve

Currently, Mantle turns out to be one of the top 10 ETH holders, with a treasury of 101.9K ETH. The startup has now essentially pledged to be an ETH holder, and has the options available to treasury companies, including passive income.

Mantle even surpassed the Golem Foundation, with 100.7K ETH accrued during the 2018 ICO rush. Some of the startups did not manage to build a product, but re-emerged as ETH holders and funds, as ETH gained value as a reserve token.

Mantle, however, is one of the active Web3 companies with a significant ETH treasury and multiple potential use cases. Corporate ETH treasuries have been used for liquid staking, and Mantle itself has produced its own version of wrapped ETH.

Mantle invited renewed activity, stablecoin inflows

Web3 activity picked up in July, with a sudden spike in daily active addresses. Based on Artemis data , Mantle logged up to 130K daily active wallets, up from under 10K in the months prior.

The Mantle platform still carries around $232M in total value locked, though stablecoins are now at over $653M in value, with 22% growth for the past week.

The recent developments show that even relatively forgotten L2 chains may rally and find a prominent place in the Ethereum ecosystem. MNT has currently risen to become the top L2 token based on market capitalization.

L2 networks are gaining prominence again after a slow period, once again drawing in stablecoins, bridge transfers, and a share of app revenues. There are currently 108 L2 chains, of which the top 10 take most of the traffic. General transactions for all similar networks picked up in July, showing the Web3 space is not dead, but is waiting for favorable market conditions.

Mantle is still among the lagging chains, but the recent expansion of active wallets may allow the network to catch up and boost its DeFi sector. The network’s activity is also driven by Treehouse Protocol , which expanded its volumes by 40% in the past month.

Your crypto news deserves attention - KEY Difference Wire puts you on 250+ top sites