- Polygonscan blackout sparked false outage fears amid outdated RPC endpoint issues

- POL price held firm despite network confusion, rebounding twice near $0.214 support

- Weak MACD and RSI near 46 hint at neutral to bearish sentiment for POL token

The Polygon (POL) network experienced a confusing stretch on July 30 as users reported seeing blank data from the Polygonscan block explorer, causing alarm across the community. Many mistakenly believed the blockchain itself was down due to the lack of visible block production.

However, developers and insiders clarified that the chain remained fully operational and that the issue stemmed from outdated RPC endpoints and Polygonscan’s own ongoing updates. The miscommunication triggered market uncertainty and price volatility for POL, the rebranded token formerly known as MATIC.

Polygon’s RPC disruptions fueled user panic

Several users flagged that Polygonscan showed no blocks being produced, which sparked widespread concern. In reality, the issue came down to RPC (Remote Procedure Call) endpoints not being fully patched following recent updates.

Related: Polygon Dominates Crypto Micropayments with Over 50% Market Share

Some RPC providers, like StakePool, quickly responded by sharing alternative endpoints that remained active. Nonetheless, the lack of centralized communication from Polygon Labs left users in the dark. Many struggled to verify transactions or access their wallets, increasing the sense of vulnerability.

Consequently, the trust gap widened. Some users speculated whether malicious actors could exploit the confusion, particularly through fake RPC endpoints.

While no major scams were reported, the situation highlighted the need for better communication during network disruptions. Trust Wallet, for instance, appeared to restore functionality without user-side changes, adding to the inconsistency in user experience.

POL Price Analysis and Market Sentiment

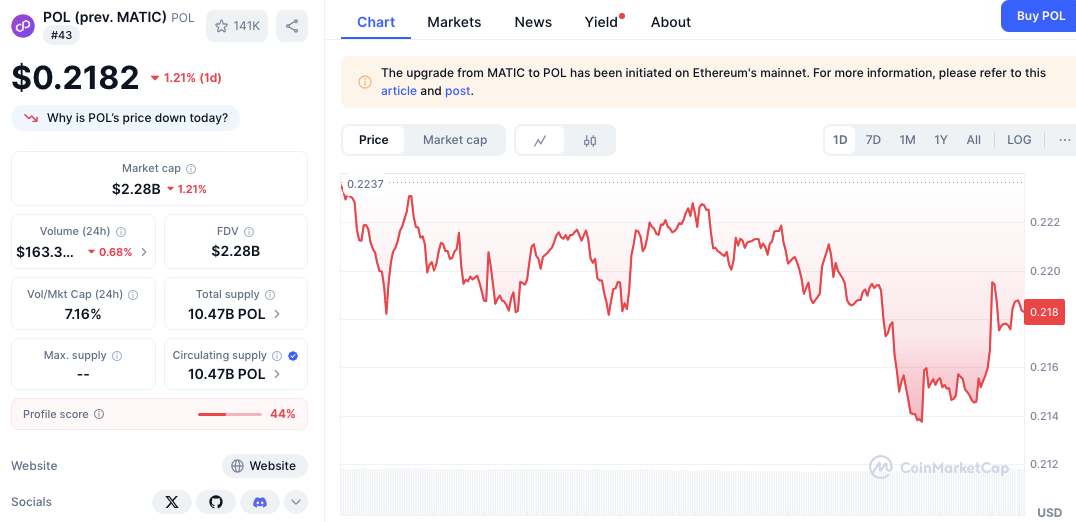

Despite the technical concerns, the POL token held up relatively well in the market. At the time of writing, it was priced around $0.2187 , down 1.31% over the past 24 hours.

Source: CoinMarketCap

Source: CoinMarketCap

The day’s range fluctuated between a low of $0.213 and a high of $0.2237. Importantly, the token showed resilience by bouncing twice from the $0.214 support level.

Related: POL Price Eyes Major Breakout Ahead of Today’s Heimdall v2 Hard Fork

POL/USD daily price chart, Source: TradingView

POL/USD daily price chart, Source: TradingView

Technical indicators reflected cautious momentum. The MACD histogram was mildly negative, suggesting slight bearish pressure . The RSI stood at 46.40, indicating a neutral to slightly oversold condition.