Date: Sat, July 26, 2025 | 10:35 AM GMT

The cryptocurrency market is gaining momentum once again following its recent pullback, with Ethereum (ETH) climbing over 2% today. This wave of upside momentum is spilling into the major memecoins— with SPX6900 (SPX) emerging as one of the standout movers.

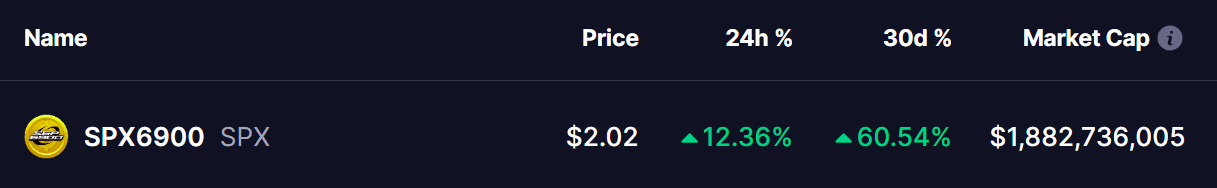

SPX has jumped 12% today, extending its monthly rally to an impressive 60%. But beyond the numbers, its chart is showcasing a classic bullish formation that could pave the way for an even larger move.

Source: Coinmarketcap

Source: Coinmarketcap

Retested Cup and Handle Breakout

On the daily chart, SPX is forming a textbook Cup and Handle pattern — a bullish continuation setup that often signals the start of strong upward moves.

The “cup” began to form months ago, starting with a steep decline from the $1.70 region before bottoming out around $0.25. From there, SPX steadily climbed, completing the rounded base and transitioning into the “handle” phase. The handle quickly found support, setting up the breakout above the neckline near $1.64–$1.75, which carried SPX to a local peak of $2.06 before a brief pullback.

SPX6900 (SPX) Daily Chart/Coinsprobe (Source: Tradingview)

SPX6900 (SPX) Daily Chart/Coinsprobe (Source: Tradingview)

The latest dip allowed SPX to retest the breakout zone, with the price briefly dropping to $1.65 before bouncing strongly back to the current level of $2.02. This retest now serves as confirmation of the breakout, keeping the bullish structure intact.

What’s Next for SPX?

With both the breakout and retest validated, SPX appears well-positioned for another leg higher. If the token can break and hold above its recent peak of $2.06, the technical target based on the height of the cup projects a move toward $3.20. Such a breakout would represent a potential 58% gain from current levels.

While some short-term fluctuations are likely as the market digests recent gains, the overall outlook remains bullish as long as SPX stays above its breakout zone.