Is XRP a Good Investment in 2025?

-

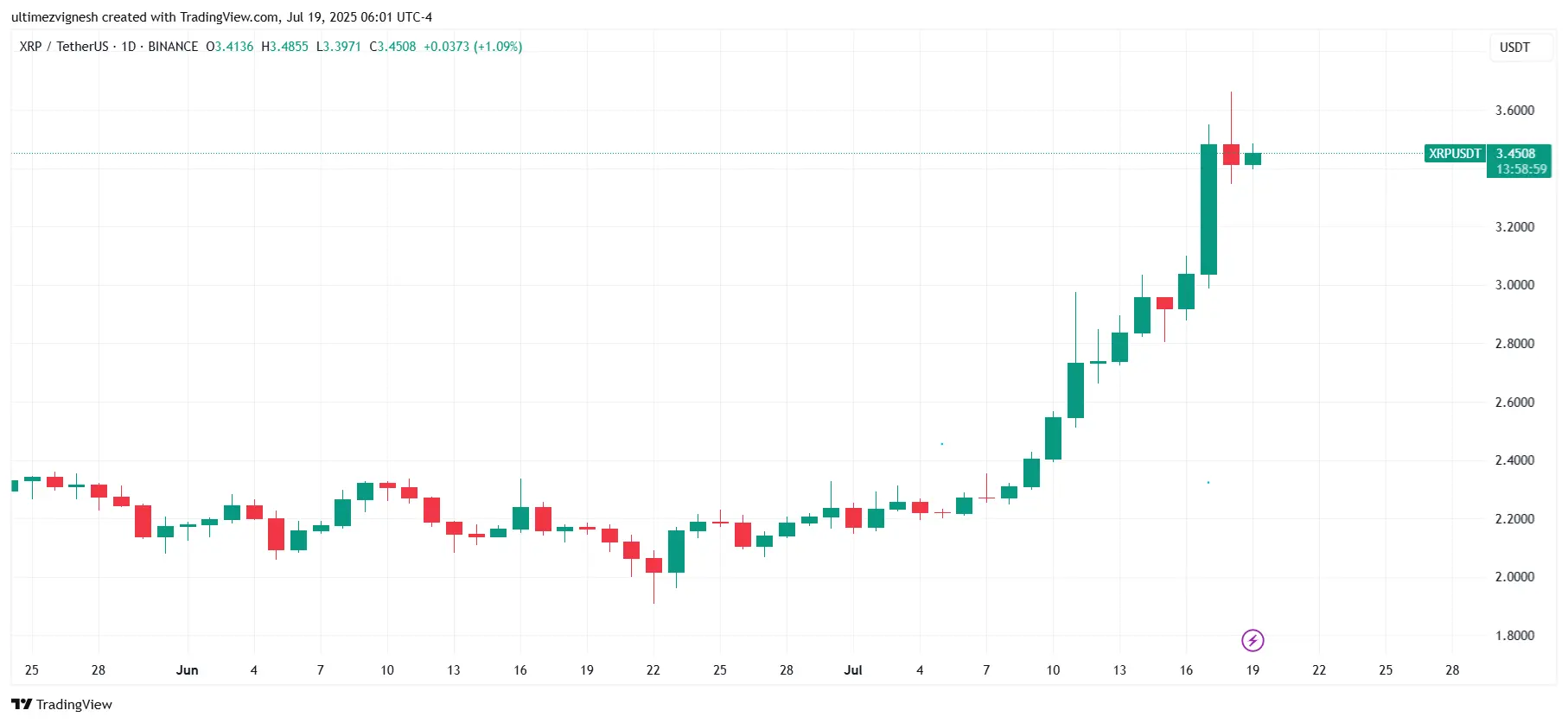

XRP Surges 64.8% in 3 Months: XRP rallies to $3.65 after Ripple settles SEC case, ending years of legal uncertainty.

-

Pro-Crypto Policies Fuel XRP Growth: Trump’s election and pro-crypto leadership boost XRP momentum, with investors celebrating big gains.

In the last seven days, XRP has experienced a surge of 23.6%. At one point yesterday, it hit a peak of $3.65.

Pro-XRP lawyer John Deaton and crypto veterans like Michael Arrington have praised the newly gained strength of the token crediting the bullish rally to reduced SEC pressure and growing adoption.

Read on for more details.

XRP’s Massive Bullish Rally

At the beginning of this month, the price of XRP was at $2.17. In the first eight days of the month, the price majorly stayed within the range of $2.35 and $2.14. On July 9, with a single day growth of 3.94%, the XRP market closed above the range. Since then, it has jumped by approximately 48.54% to $3.43.

Importantly, as mentioned above, at one point yesterday, the market even touched a peak of $3.65.

In the last three months, XRP has reported a rise of 64.8%, and, in the last one month, a surge of 59.1%.

This indicates strong bullish momentum.

The Beginning of the XRP Era

Attorney John Deaton stated that the rally was long overdue, highlighting that XRP was surpassed for nearly four years due to the SEC lawsuit against Ripple.

The SEC sued Ripple in December 2020, alleging XRP was an unregistered security. In July 2023, a judge ruled that programmatic sales of XRP were not securities, a partial win for Ripple, but institutional sales were. In March 2025, Ripple settled the lawsuit, agreeing to a $50 million fine. Both parties have dropped their appeals, with the case effectively winding down as of July 2025, awaiting final procedural approvals.

Originally, it was the political shift in the US that helped Ripple to reach a settlement with the SEC.

Shortly after the victory of Donald Trump against Kamala Harris in the US presidential election, the then SEC chair, Gary Gensler, who was known for his tough stance against Ripple, stepped down from his position.

Since the inauguration of Trump, he has implemented several pro-crypto policies, including the appointment of pro-crypto official Paul S Atkins as the successor of Gensler.

In the month of the US election (November, 2024) alone, XRP recorded an impressive monthly return of 281.7%.

- Also Read :

- Ripple’s XRP Breaks 2018 Record After Trump’s Historic Crypto Law

- ,

Legal Clarity Boosted XRP

Until recently, there was no clarity on how Ripple would reach a settlement with the SEC.

The SEC vs. Ripple lawsuit saw final confusion regarding the $125 million penalty and the permanent injunction against Ripple. A judge initially upheld these, rejecting a joint SEC-Ripple request to reduce the fine to $50 million and dissolve the injunction.

However, in March 2025, Ripple announced a settlement, agreeing to pay a $50 million fine. Both parties then dropped their appeals, effectively resolving the prolonged legal battle by July 2025.

In Q1, the XRP market recorded a quarterly return of +0.45%. In Q2, it increased to 7.12%. So far this quarter, it has surged by 54.6%.

How XRP Investors React?

John Deaton stated that the rally was a relief for long-term holders.

A crypto analyst, identified as CrediBULL, claimed that an investment of $10,000 he made in 2019 in XRP has swelled to $196,000 due to the latest bull run.

On the flip side, many, including Dave Portney, the founder of Barstool Sports, expressed their regret for selling XRP too early.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hotcoin Research | Fusaka Upgrade Approaching: Analysis and Outlook on Ethereum Long and Short Positions

This article will review Ethereum's recent performance, provide an in-depth analysis of the current bullish and bearish factors facing Ethereum, and look ahead to its prospects and trends for the end of this year, next year, and the medium to long term. The aim is to help ordinary investors clarify uncertainties, grasp trends, and provide some reference to support more rational decision-making during key turning points.

Crypto Market Surges as Bitcoin Rebounds and Privacy Coins Shine

In Brief Bitcoin rebounded over the weekend, testing the $86,000 mark. Privacy-focused altcoins Monero and Zcash showed notable gains. Total market value surged, crossing the $3 trillion threshold again.

Crypto Markets Rebound as Traders Signal Seller Fatigue

In Brief Crypto markets rebounded amid significant liquidations and oversold RSI signals. Weekend trading conditions with thin liquidity influenced rapid price shifts. The rebound's sustainability remains uncertain, prompting scrutinous investor attention.

Cardano : Network security questioned after a major incident