If ETH reaches $5,000, how much can SBET increase?

ETH is on the rise, and these Ethereum strategic reserve tokens can capture more sentiment premium.

Over the past month, Ethereum (ETH) has surged from $2100 to $3000. During this rally, publicly traded companies and mining firms have announced buying ETH as part of their "strategic reserves," with some mining companies even selling all their BTC to purchase ETH with cash.

According to statistics, strategic reserve companies have collectively purchased over 545,000 ETH in the past month, totaling over $1.6 billion.

SharpLink (SBET), as the first company to hold ETH as a strategic reserve, saw its stock price soar from $3 to over $100 after announcing the ETH purchase, then dropping back to single digits amid market criticism. Currently, the stock price has once again risen to over $20.

Recently, within just 5 days, SBET acquired nearly 50,000 ETH, surpassing the Ethereum Foundation in total ETH holdings.

Furthermore, SBET has staked a portion of its ETH holdings on-chain to earn staking rewards. As of July 8th, its staked position has earned 322 ETH.

Currently, there are 5 publicly traded companies holding ETH as a "strategic reserve":

SharpLink Gaming (SBET), BitMine Immersion Technologies (BMNR), Bit Digital (BTBT), Blockchain Technology Consensus Solutions (BTCS), GameSquare (GAME)

The ETH holdings of each company are as follows:

mNAV is the ratio of market capitalization to net asset value (NAV), calculated as:

The mNAV of ETH strategic reserve companies is primarily estimated based on their "market capitalization" / "total ETH holdings value."

Is the Market Experiencing FOMO?

The mNAV data represents the disconnect between a company's market value and its assets, reflecting the market's sentiment premium on a certain concept or stock. A higher mNAV often signifies a speculative market sentiment, while a lower mNAV indicates investors are in a relatively rational state regarding a concept or stock.

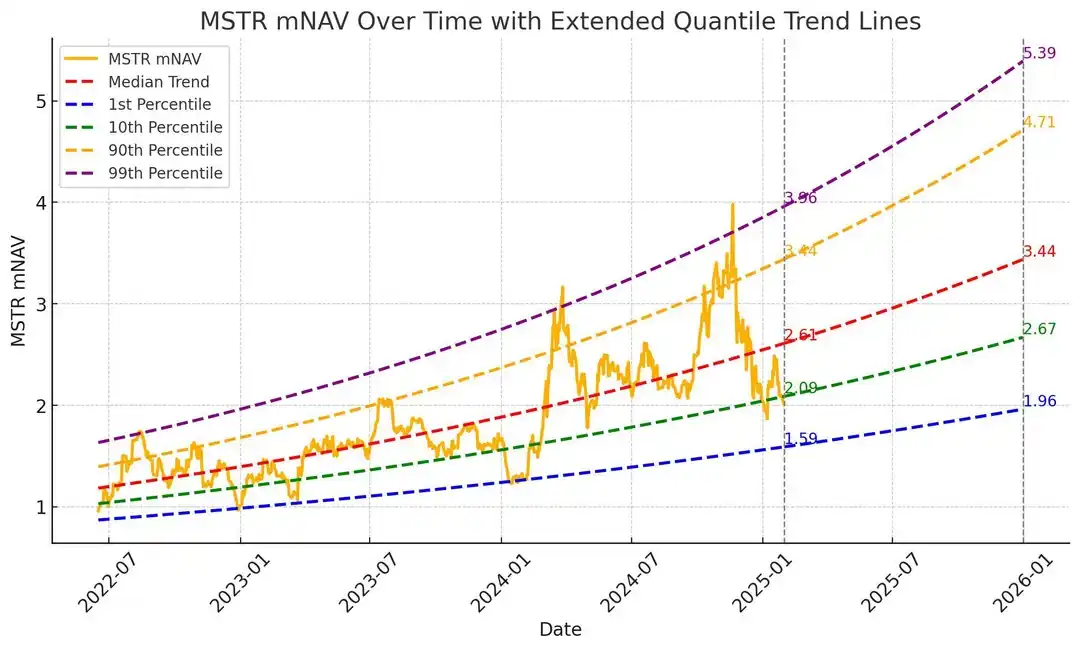

Looking at the BTC Strategic Reserve Company's premium rate, as of May 2025, MSTR's market value was approximately 1.78 times its Bitcoin Net Asset Value (mNAV). Its mNAV fluctuated between 1 and 4.5 times between August 2022 and August 2024.

MSTR's mNAV curve reflects how market sentiment in the crypto market dominates the valuation of such companies.

Its peak (e.g., 4.5 times) typically occurs during a BTC bull market cycle and when MSTR significantly increases its BTC holdings, demonstrating strong investor enthusiasm. The low point at 1 time corresponds to the crypto market bear market and consolidation period, indicating that investors are unwilling to pay a sentiment premium.

An mNAV in the 2-2.5 range signifies a relatively neutral investment sentiment and premium.

Using this measure, these 5 Ethereum strategic reserve companies fall into the following categories: SBET and BTCS are currently in this range, while BMNR and BTBT have slightly higher mNAVs.

It is important to note that BMNR and BTBT were originally mining companies, and they may still hold assets other than ETH whose value has not been calculated.

Overall, looking at the coin stocks of current Ethereum strategic reserves, they are still in a relatively rational valuation range, and the market frenzy sentiment has not reached FOMO levels.

If Ethereum Rises to 5000, How Much Can These Companies Grow?

If in the coming months, the ETH price continues to rise to $5000, assuming these companies hold the same amount of ETH and do not engage in additional fundraising, based on a relatively rational premium calculation (mNAV = 2), the stock prices and potential gains would be:

Investors need to be aware that an mNAV = 2 is a relatively neutral premium rate. If ETH were to truly rise to $5000, by then the market may be willing to pay a higher sentiment premium for these ETH strategic reserve companies.

Additionally, during this period, the ETH staked by these companies will also bring them returns, increasing their ETH holdings.

Ethereum Price Discovery? Why Suddenly an Institutional Favorite

When these Ethereum strategic reserve companies discuss why they chose ETH, the reasons mentioned mainly revolve around the following three aspects:

· Success of BTC reserve companies like MSTR

· ETH staking rewards

· ETH's potential in narratives such as stablecoins and RWAs.

Bit Digital's CEO Sam Tabar is very optimistic about replicating the MSTR model on ETH and is confident that ETH will rise to $10,000:

「(Establishing an Ethereum reserve) We are just getting started. This is just the warm-up. Just think about how Saylor kept issuing his stock to buy BTC, and then BTC kept rising, making him more capable of repeating the whole process.」

Primitive Ventures, in their bet on SBET, specifically highlighted the potential of ETH staking rewards:

「ETH has inherent staking and yield capabilities in the DeFi ecosystem, making it a truly productive asset, while Bitcoin lacks such mechanisms. SBET is poised to directly leverage ETH's on-chain mechanisms for compounding growth, delivering quantifiable returns to shareholders.」

Bitmine Immersion Technologies' CEO is more bullish on ETH's potential in the RWA and TradFi narratives. In an interview, he mentioned:

「In my view, the attractiveness of Ethereum is that it is the first-layer blockchain where real-world assets are tokenized. As more and more things in the financial world and the real world are tokenized, financial institutions like Goldman Sachs, JPMorgan, Amazon, Walmart, just as they did with stablecoins, will also want to stake Ethereum itself. We are doing what these companies will do in the future.」

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.