Demand for US Treasuries May Fall Short Amid Surging Supply, Warns Ex-Bridgewater Exec Rebecca Patterson

A former executive of the hedge fund founded by billionaire Ray Dalio is warning that the market for US debt will soon hit a rough spot.

In a new CNBC Television interview, ex-Bridgewater Associates chief investment strategist Rebecca Patterson addresses how the US dollar has lost about 10% of its value year-to-date, its worst performance in over 50 years.

“I think there are three main things driving the dollar [devaluation]. One is slightly lower frontend rates, interest rates over this period because currencies trade on rate differentials.

But I think more importantly and what’s different this time is that you’re seeing both re-allocation out of the US both by Americans diversifying and foreigners pulling back slightly. And then third and really importantly is hedging. So let’s say I’m a large overseas pension fund, and I have a tech equity exposure, and I want to keep it because I believe in the structural story, but I’m nervous about the dollar, I’m nervous about the Fed’s independence, I can hedge out that currency risk.

So even if money stays in US equities, which helps explain where we are today, you can still see that dollar weakness.”

Patterson, who is now the chair of the Council of Economic Education, warns that the dollar devaluation will continue as investors hedge and move their capital elsewhere. She also notes that the ongoing capital re-allocation will negatively impact demand for US debt.

“This isn’t going to be a one-off. This is going to be a slow bleed out of the dollar, and I believe slowly out of US Treasuries.”

Looking closer at US Treasuries, Patterson warns that she sees the bond market facing a demand shortage in the coming months.

“I think this is rather a slow bleed. Most of the foreign investors who have US Treasuries have them in very short tenure bonds, so three years and less. They just have to let them expire and not replace them, so let them roll off.

Again, it’s not going to be a one-and-done event, I think, without a trigger. It’s just going to be: we don’t have the demand to meet the supply that’s going to be coming, I think early next year.”

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

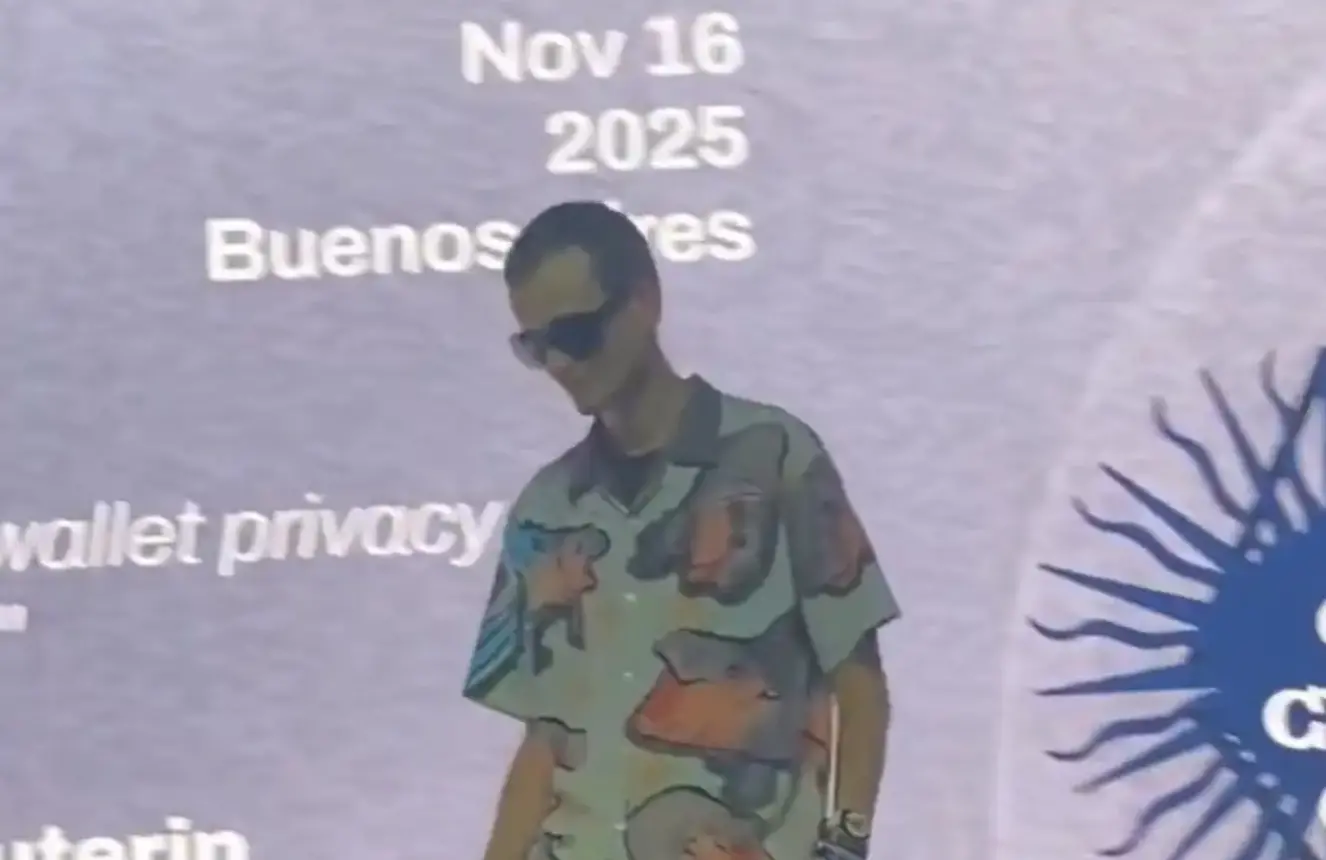

Highlights from the Ethereum Argentina Developers Conference: Technology, Community, and Future Roadmap

While reflecting on the past decade of infrastructure development, Ethereum clearly outlined its key directions for the next ten years at the developer conference: scalability, security, privacy, and institutional adoption.

PhotonPay wins the Adam Smith Award for its innovative foreign exchange solutions, reshaping the global forex management landscape

How does PhotonPay collaborate with JPMorgan Kinexys to leverage blockchain technology for 24/7, automated global fund allocation?

Compliant privacy: What is the latest Ethereum privacy upgrade, Kohaku?

Vitalik once said, "If there is no privacy transformation, Ethereum will fail."

Danny Ryan: Wall Street needs decentralization more than you think, and Ethereum is the only answer

A former Ethereum Foundation researcher provided an in-depth analysis during the Devconnect ARG 2025 talk, explaining how eliminating counterparty risk and building L2 solutions could enable the management of 120 trillion in global assets.