SUI posts double-digit gains as markets rebound, is $3 back in sight?

After several consecutive days in the red, the SUI token is showing signs of recovery as a sharp price rebound renews bullish sentiment.

SUI ( SUI ), the native token of the Sui layer-1 blockchain, has been on the rise in recent hours, posting roughly 15% in fresh gains. The rally marks the end of a month-long losing streak that saw the token break key support levels and drop to new lows.

At press time, SUI trades around $2.79, marking a strong recovery from the week’s low of $2.45. The rebound in the native token is not isolated and comes as investor sentiment improves across the broader crypto market amid easing geopolitical tensions.

SUI’s price chart |Source: crypto.news

SUI’s price chart |Source: crypto.news

While Bitcoin ( BTC ) and other major altcoins have led the market uptick , SUI stands out as a strong performer, posting double-digit gains that put it roughly 17% above its lowest point this month.

From a technical perspective, the native token is entering a crucial phase. SUI has been in a strong downtrend for the majority of this month and recently hit a low of $2.29, a price that hasn’t been seen since April.

Since then, the price has recovered slightly and is now resting at $2.79, a price right on the edge of the trend lines that can be seen on the chart. If the price continues to go up and goes above the $3 mark, there is the likelihood of a market reversal and increased upward momentum.

SUI’s market trend |Source: TradingView

SUI’s market trend |Source: TradingView

After that, the next challenge will be to cross the Target 1 price, which was the last local high that was seen during the current downtrend, and the Target 2 price will be the subsequent challenge.

On the flip side, if momentum stalls, the first level to watch is $2.70, where a local low recently formed. A drop below this area could signal a strong bearish pressure and potentially send the price to the $2.39 low.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

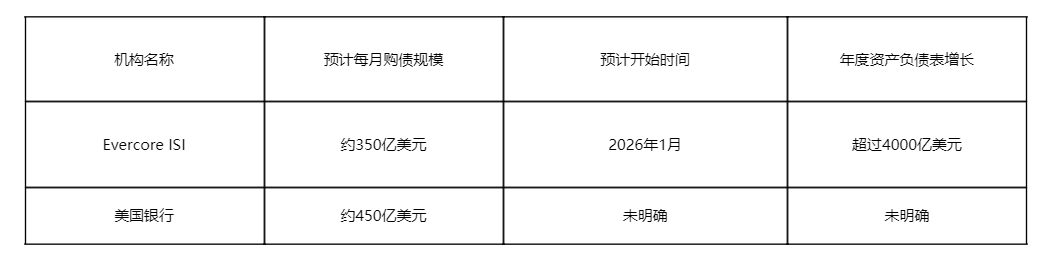

Fed Decision Preview: Balance Sheet Expansion Signals Are More Important Than Rate Cuts

The Federal Reserve cuts interest rates as expected, what happens next?

![[Bitpush Daily News Selection] The Federal Reserve cut interest rates by 25 basis points as expected; the Federal Reserve will purchase $40 billions in Treasury securities within 30 days; Gemini received CFTC approval to enter the prediction market; State Street Bank and Galaxy will launch the tokenized liquidity fund SWEEP on Solana in 2026.](https://img.bgstatic.com/multiLang/image/social/87a413b57fb2c702755e8bc5b4385a781765441081405.png)