Powell: If Inflation Is Weaker Than Expected, Rate Cuts May Come Sooner

According to a report by Jinse Finance, Federal Reserve Chairman Jerome Powell submitted the semiannual monetary policy report to the House Financial Services Committee: The United States is not currently in a state of economic recession, and the Atlanta Fed’s GDP model does not indicate any signs of a recession in the U.S. economy. Inflation may not be as strong as expected; if this is the case, it could mean that interest rate cuts may come earlier than anticipated. If the labor market weakens, rate cuts could also be implemented ahead of schedule.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

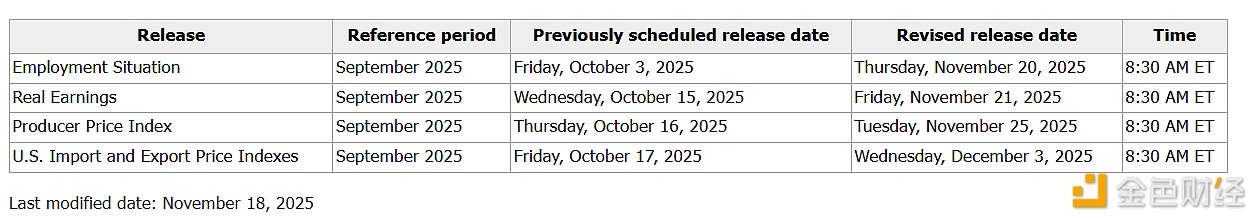

Release dates set for new batch of US data, including CFTC weekly report and PPI

The Dow Jones Index closed down 498.5 points, with the S&P 500 and Nasdaq also declining.

All three major U.S. stock indexes closed lower.