Can Solana (SOL) Hold Above $130 Before Q2 Ends?

Solana is under pressure as selloffs deepen and technical indicators turn bearish. Will SOL hold $130, or is a further drop imminent?

Popular altcoin Solana has shed nearly 10% of its value over the past week, and the bearish pressure does not appear to be letting up. The token dropped to $129 today, as geopolitical tensions between the US and Iran escalate.

As the second quarter of 2025 draws to a close, mounting selloffs have placed Solana’s price at risk of breaking below the crucial $130 support level. This analysis explains how.

SOL Slips as Key Indicators Remain Bearish

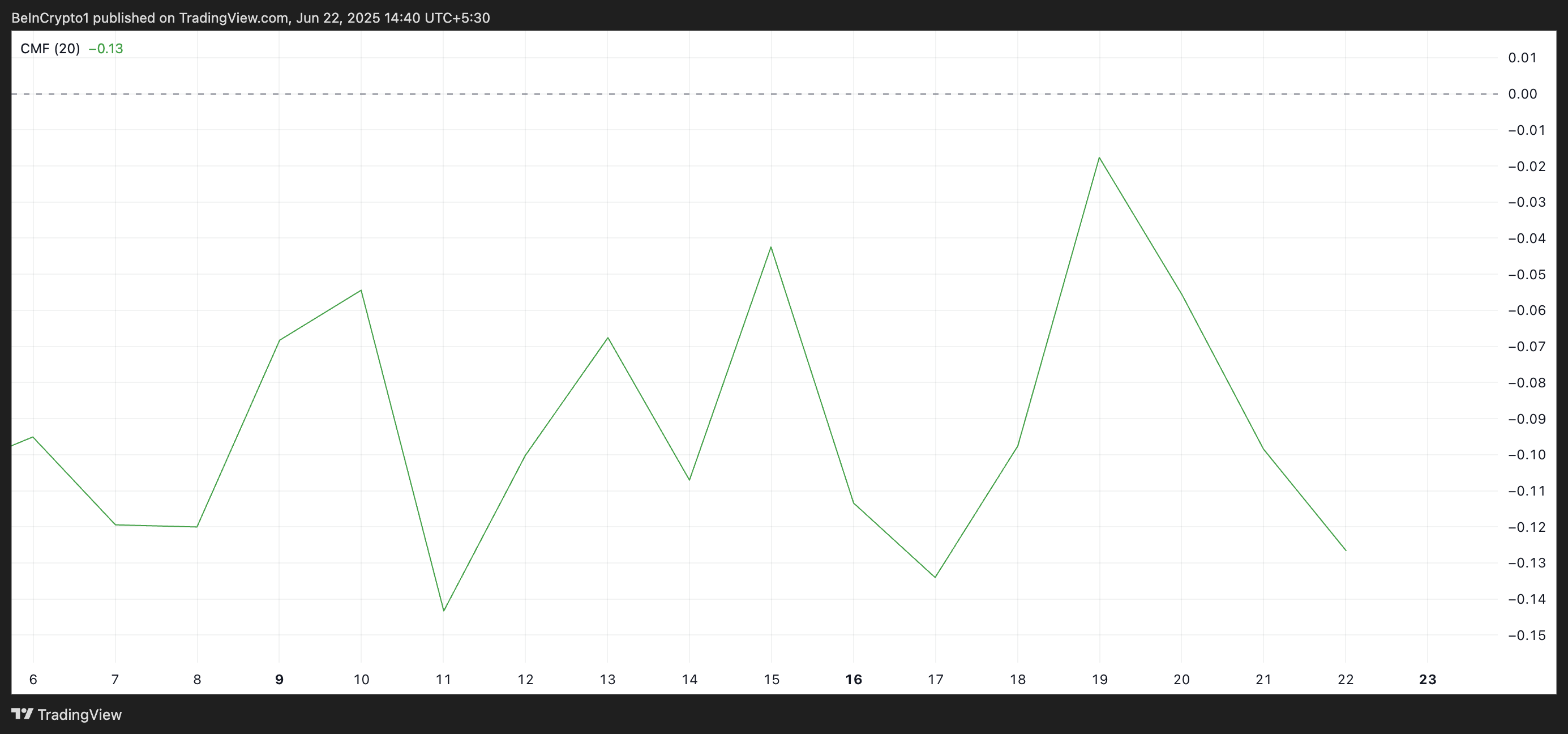

Over the past seven days, SOL’s price has steadily declined. This has been accompanied by a dip in the coin’s Chaikin Money Flow (CMF), which has fallen deeper into negative territory. As of this writing, SOL’s CMF is at -0.13.

SOL CMF. Source:

TradingView

SOL CMF. Source:

TradingView

The CMF measures the flow of money into and out of an asset over a specific period, typically 20 or 21 days. It combines price and volume data to assess buying and selling pressure. When an asset’s CMF is positive, buying volume is dominant and capital is flowing into the asset, indicating potential bullish sentiment.

Conversely, when the CMF turns negative, selling volume outweighs buying volume, meaning money flows out. This signals weakening demand for SOL, especially if the negative reading deepens while price declines.

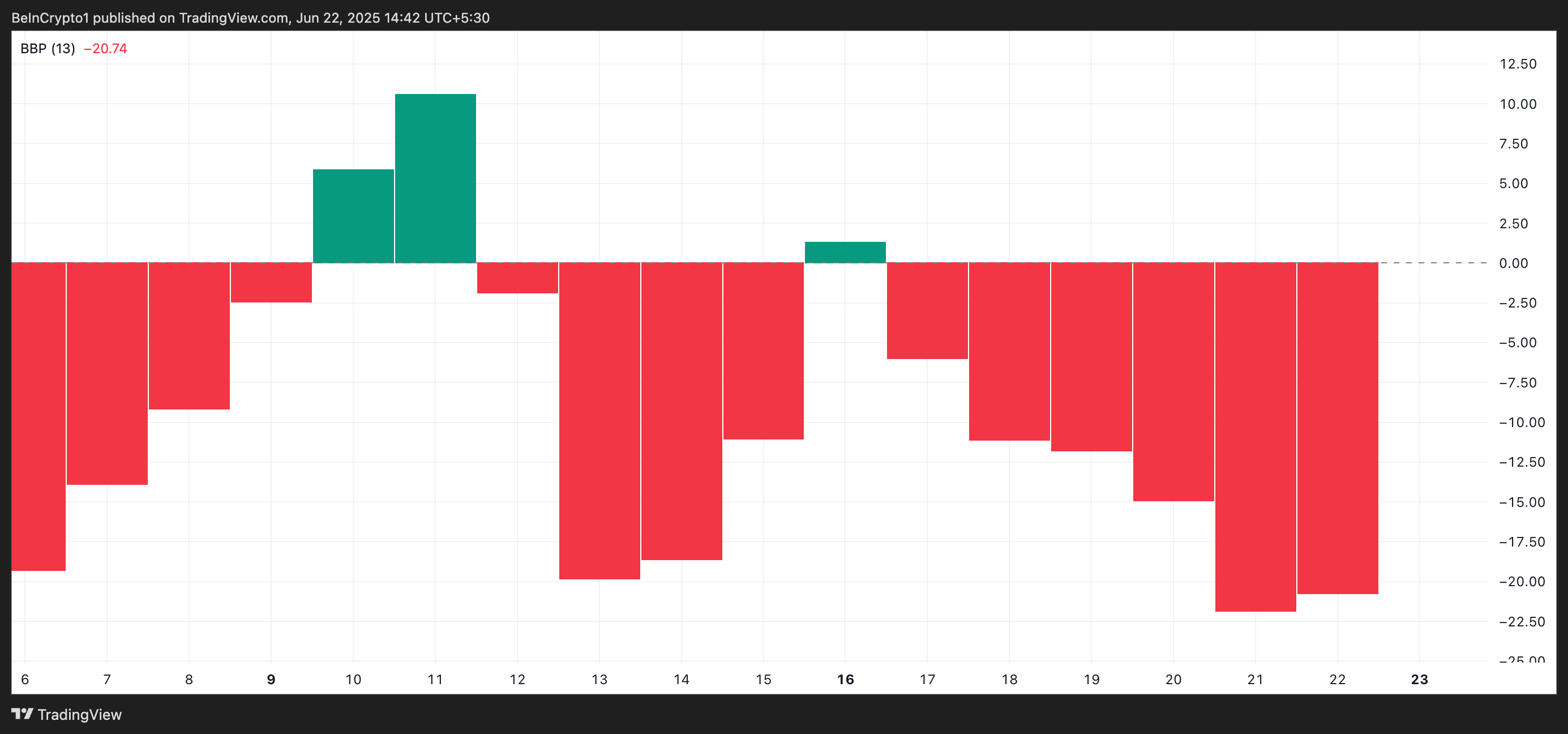

Moreover, the coin’s Elder-Ray Index, which gauges the balance between buyers and sellers, is at -20.74, signifying that sellers are firmly in control.

SOL Elder-Ray Index. Source:

TradingView

SOL Elder-Ray Index. Source:

TradingView

This indicator measures the strength of bulls and bears in the market by analyzing the difference between an asset’s price and a moving average. When it is negative, bears dominate, as prices consistently fall below the average, suggesting selling pressure outweighs buying interest.

Will SOL Recover Above $130 or Is a Drop to $123 Looming?

This bear dominance reflects the growing conviction that SOL’s price could decline further, particularly if $134 fails to hold as a support floor.

Meanwhile, a breakdown below this level could open the door for deeper losses, potentially dragging SOL toward $123.49.

SOL Price Analysis. Source:

TradingView

SOL Price Analysis. Source:

TradingView

However, if bulls manage to regain control, they could push Solana’s price upward to $142.59.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"Sell-off" countdown: 61,000 BTC about to be dumped—why is it much scarier than "Mt. Gox"?

The UK government plans to sell 61,000 seized bitcoins to fill its fiscal gap, which will result in long-term selling pressure on the market.

A $500,000 lesson: He made the right prediction but ended up in debt

The article discusses a trading incident on the prediction market Polymarket following the end of the U.S. government shutdown. Star trader YagsiTtocS lost $500,000 by ignoring market rules, while ordinary trader sargallot earned more than $100,000 by carefully reading the rules. The event highlights the importance of understanding market regulations. Summary generated by Mars AI. This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Vitalik's "Can't Be Evil" Roadmap: The New Role of Privacy in the Ethereum Narrative

While the market is still chasing the ups and downs of "privacy coins," Vitalik has already placed privacy on the technical and governance roadmap for Ethereum over the next decade.

6% APY? Aave App Enters Consumer Finance

In an era where interest rates are below 0.5%, the Aave App aims to put 6% into the pockets of ordinary people.