Ahead of the weekend, the cryptocurrency market experienced a seismic shock early Friday as Bitcoin plummeted below $104,000 and Ethereum slid by over 10%, triggering a staggering $1.1 billion in leveraged liquidations within the past 24 hours.

The sharp decline was sparked by Israeli airstrikes on Iran, amplifying global geopolitical tensions and driving a classic “risk-off” sentiment among investors.

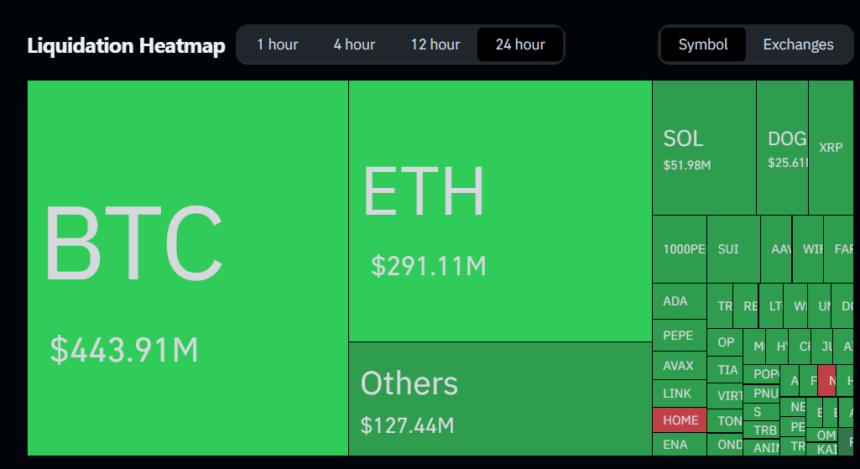

As per Coinglass data, Bitcoin-backed leveraged perpetuals have seen the wiping out of nearly $444 million, in which $422 million was accounted for by long positions and approximately $22 million by short positions.

Source: Coinglass

Source: Coinglass

Ethereum perpetuals have also recorded notable liquidation, totaling $291 million, which includes $245 million in long positions and $45 million in shorts. Other leading altcoins have also seen significant flushes following these two leaders.

Historically, such geopolitical instability has pushed investors toward traditional safe havens like gold and U.S. Treasuries, a trend reinforced by a 2022 National Bureau of Economic Research study linking conflict zones to 15-20% volatility spikes in cryptocurrency prices. Bitcoin, often dubbed “digital gold,” failed to retain its safe-haven narrative this time, dropping to key support near $103,000, while Ethereum saw its month-long rally take a sharp reversal.

Market analysts observed a spike in trading volumes and noted that the Moving Average Convergence Divergence (MACD) is signaling oversold conditions, though no immediate reversal is evident.

Caroline Mauron, co-founder of Orbit Markets, remarked, “Crypto is reacting negatively to the Israel-Iran strikes, in line with major risk assets. We expect technical support around $101,000, but geopolitical news will dominate short-term price action.”

Meanwhile, ETF net outflows for Bitcoin and a shift toward defensive altcoins suggest traders are adopting a wait-and-see approach, pending clearer macro signals.