Bitcoin ETF Momentum Cools, But Derivatives Markets Remain Optimistic | ETF News

While spot Bitcoin ETFs experienced a slowdown, BTC's derivatives markets continue to show optimism, driven by positive funding rates and strong demand for call options.

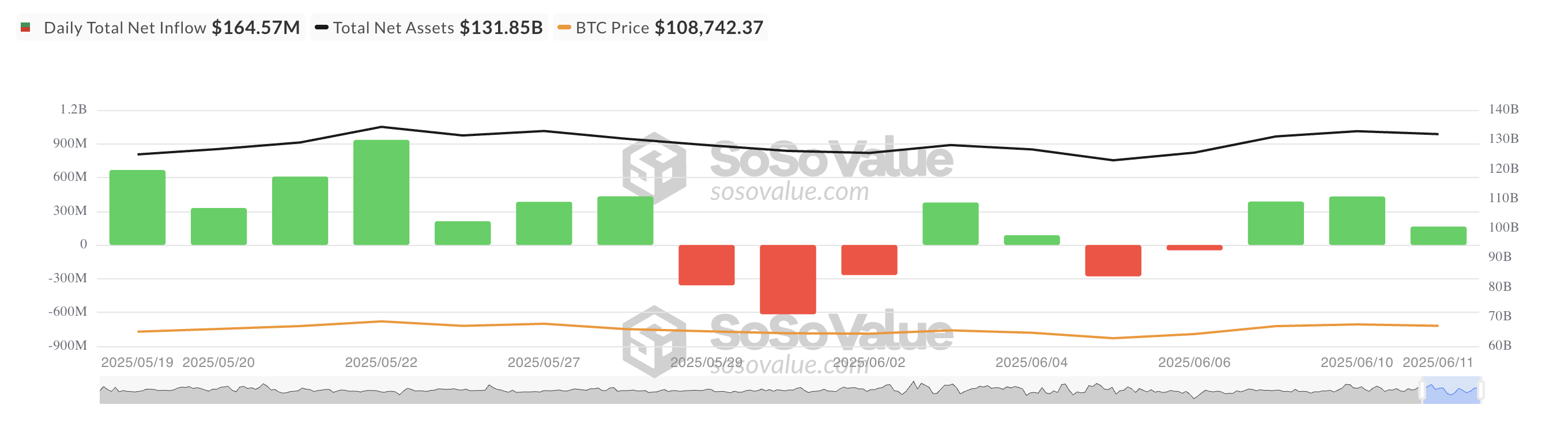

Spot Bitcoin ETFs continued their streak of net inflows for the third consecutive day, bringing in over $160 million yesterday. While this marks a healthy continuation of investor interest, it represents a pullback from the $431 million recorded the previous day.

The slowdown comes as BTC tests resistance around the $110,000 mark, stalling upward momentum in the spot market.

ETF Demand Holds Steady for BTC

On Wednesday, net inflows into US-listed spot BTC ETFs totaled $165 million. Although this figure marked continued investor interest in these investment funds, it represented a 61% decline from the $435 million posted on June 10.

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

The slowdown is largely attributed to BTC’s seeming price stagnation around the $110,000 mark over the past two days. This reflects the coin’s struggle to gain upward momentum amid profit-taking activity.

Yesterday, BlackRock’s IBIT led the pack with the highest daily inflows, totaling $131.01 million, bringing its total historical net inflow to $49.24 billion.

VanEck’s HODL ETF recorded the second-highest daily net inflow, bringing in $15.39 million on Wednesday. According to SosoValue, its total historical net inflows have now reached $968.94 million.

Traders Shrug Off Bitcoin’s Decline as Derivatives Signal Strength

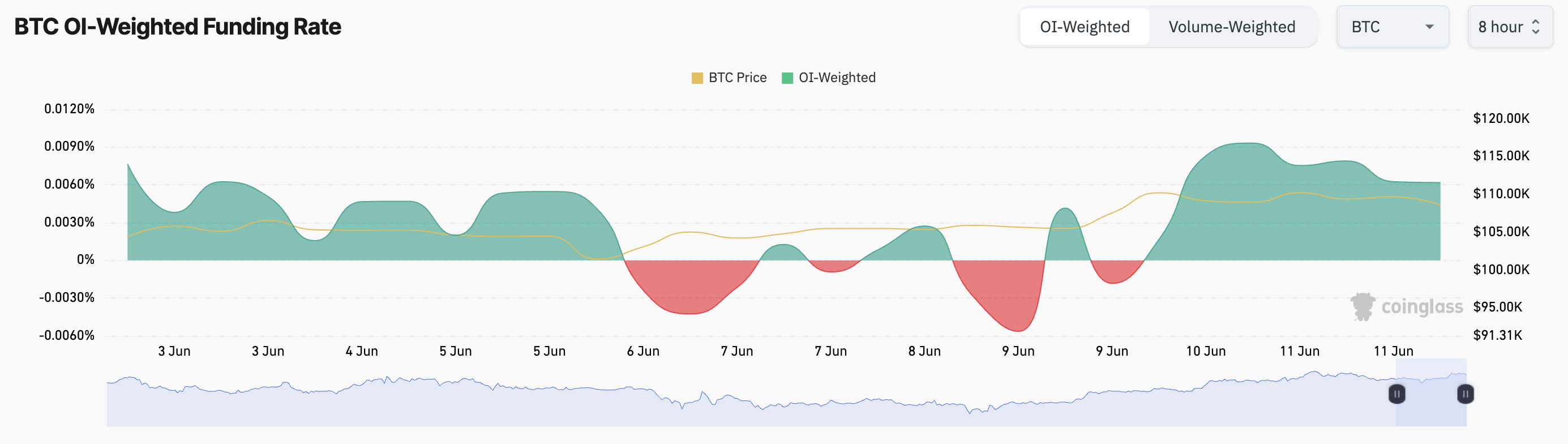

Currently trading at $107,939, BTC is down 2% over the past day. Despite this decline, sentiment across BTC’s derivatives market remains largely bullish.

For example, the coin’s futures markets continue to reflect a positive funding rate, an indicator that long positions keep outpacing shorts. As of this writing, this stands at 0.0062%.

BTC Funding Rate. Source:

Coinglass

BTC Funding Rate. Source:

Coinglass

The funding rate is a recurring payment between long and short positions in perpetual futures contracts, designed to keep the contract price aligned with the spot price. A positive funding rate like this means traders holding long positions are paying shorts, indicating that bullish sentiment dominates the BTC market.

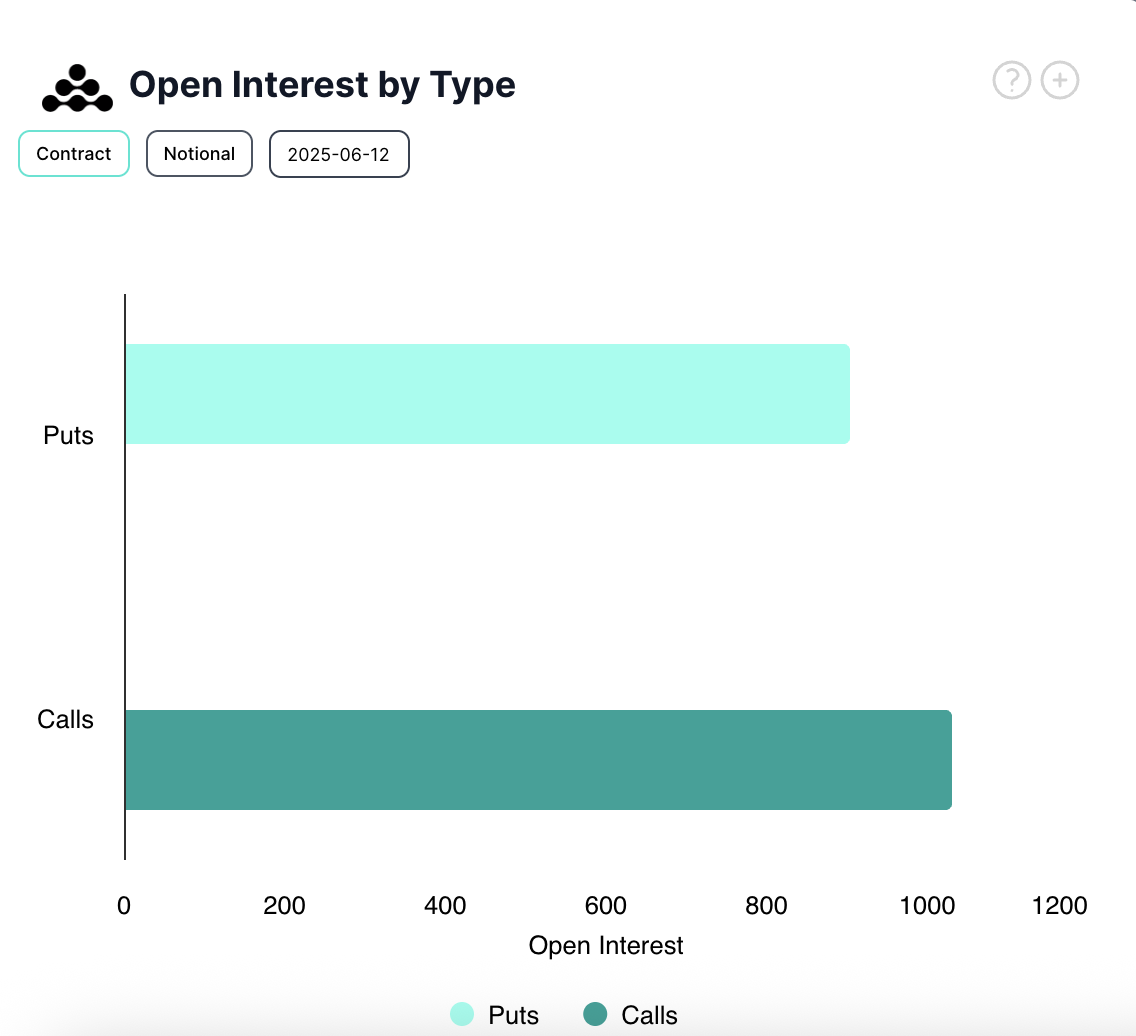

Furthermore, an assessment of the BTC options market data shows a notable demand for call contracts.

BTC Options Open Interest. Source:

Deribit

BTC Options Open Interest. Source:

Deribit

This suggests that despite the coin’s lackluster performance over the past day, many traders are positioning for a potential breakout in the near term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."