-

Solana (SOL) is showing signs of a potential market reversal as a major whale unstaked and moved significant holdings, signaling shifting sentiment among long-term investors.

-

Despite recent selling pressure and a dip to $141, SOL has demonstrated resilience with buyers stepping in, suggesting possible support around current levels.

-

According to Onchain Lens, a four-year staker recently unstaked over 125,000 SOL worth $17.64 million, highlighting growing impatience among large holders.

Solana’s recent whale activity and positive netflows hint at a potential price rebound, with buyers absorbing selling pressure and technical indicators supporting a recovery.

Major Solana Whale Unstakes Over 125k SOL, Indicating Market Frustration

After maintaining a staking position for four years, a prominent Solana whale has begun liquidating a substantial portion of their holdings. The whale unstaked 25,008 SOL tokens valued at approximately $3.7 million and transferred 25,000 SOL to Binance, according to Onchain Lens data. Over the last two months, this entity has cumulatively unstaked 125,045 SOL, equating to $17.64 million. Despite this, the whale still retains 1.17 million SOL locked in staking contracts, valued at $174.17 million.

This movement reflects a growing impatience among long-term holders amid Solana’s recent price stagnation within a descending channel. The altcoin’s decline from a local high of $187 to a low near $141 has likely contributed to this shift in sentiment. Large-scale selling by whales often signals waning conviction, which can influence broader market psychology and price dynamics.

Solana Netflows Turn Positive After Two Weeks of Outflows

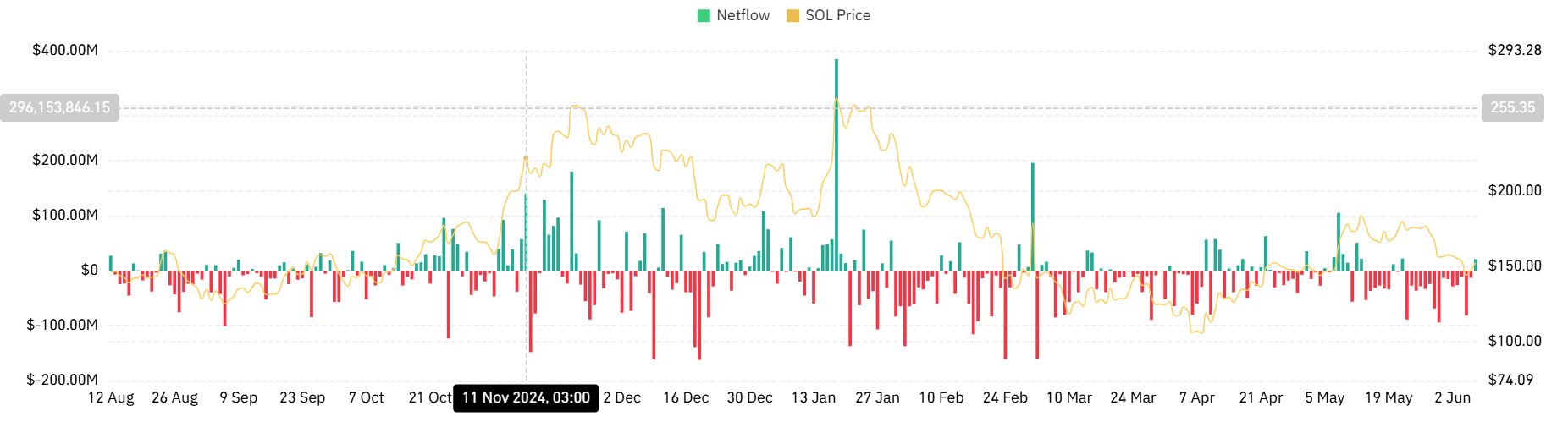

Source: CoinGlass

Exchange data from CoinGlass highlights a notable shift in Solana’s netflows. After 16 consecutive days of negative netflows—where outflows exceeded inflows—SOL’s netflows flipped positive. This indicates that more SOL tokens were deposited into exchanges than withdrawn, typically a bearish indicator as it suggests increased selling pressure may be imminent.

However, despite this influx of tokens to exchanges, SOL’s price has remained relatively stable, suggesting that selling pressure has not yet overwhelmed the market. This divergence between netflow data and price action points to a complex interplay of supply and demand dynamics at work.

Buyers Absorb Selling Pressure, Supporting a Potential Price Bounce

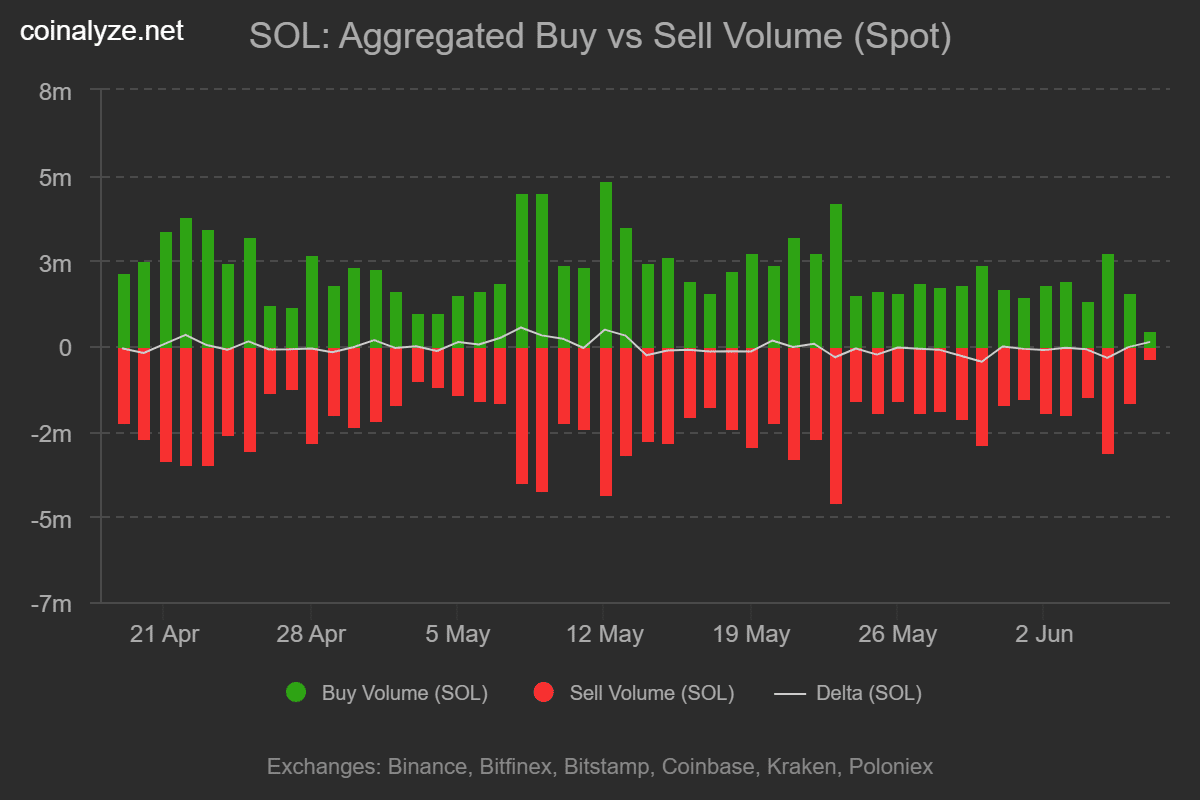

Source: Coinalyze

Contrary to expectations of a continued sell-off, Solana has demonstrated resilience as buyers have stepped in to absorb selling pressure. Since hitting a low of $141 three days ago, SOL has posted gains for two consecutive days, trading around $152 at the time of writing—a 3.16% increase over 24 hours.

Spot market data from Coinalyze reveals that buyers acquired approximately 479,000 SOL, with a positive delta of 113,000 tokens, indicating demand currently outpaces supply. This buying activity suggests confidence among retail and smaller investors, potentially stabilizing the price and setting the stage for a recovery.

Technical Indicators Signal Early Signs of Recovery

Source: TradingView

From a technical perspective, Solana’s Stochastic RSI has recently made a bullish crossover, signaling strengthening momentum. This technical pattern often precedes upward price movements, suggesting that SOL could continue its recovery.

If this momentum sustains, SOL is poised to reclaim the $165 resistance level. Confirmation of this uptrend would be validated by a sustained RSI crossover. Conversely, renewed selling pressure from whales or large holders could push the price back toward the critical $140 support level.

Conclusion

Solana’s recent whale unstaking activity and positive netflow reversal present a nuanced picture of market sentiment. While large holders appear increasingly impatient, the influx of buyers absorbing selling pressure indicates underlying demand. Technical indicators support the possibility of a near-term recovery, with $165 as a key target. Market participants should monitor whale activity and netflows closely, as these factors will likely influence SOL’s trajectory in the coming weeks.