Ripple and SEC Risk Restarting Critical Settlement Process if June 16 Deadline is Missed

The ongoing legal battle between Ripple and the SEC could face more delays as they approach a critical June 16 deadline. Rumors of a settlement are also circulating, but there's no official confirmation yet.

The long-standing legal battle between the US Securities and Exchange Commission (SEC) and Ripple Labs could face another potential delay.

This possibility looms as both parties have yet to refile their motion correctly, with the June 16 deadline quickly approaching.

Could the Ripple SEC Lawsuit Face a Delay?

On May 8, BeInCrypto reported that the SEC and Ripple jointly requested an indicative ruling from Judge Torres to approve a settlement that would reduce the penalty to $50 million and dissolve the injunction placed on Ripple.

On May 15, Judge Analisa Torres rejected the parties’ request. She stated that if jurisdiction were returned to the court, she would deny the motion because it was procedurally improper.

Essentially, the parties did not follow the correct legal process when requesting, which led to the denial. Therefore, it meant that both Ripple and the SEC needed to refile under the appropriate rule.

However, as of June 5, 2025, the parties haven’t refiled. This has raised concerns about the next steps in the case. Attorney Fred Rispoli highlighted the absence of a proper refiling in a recent post on X (formerly Twitter).

He emphasized that on June 16, both parties must submit a status update to the United States Court of Appeals for the Second Circuit.

“20 days later, no refile yet by SEC and Ripple in district court, and the June 16 deadline for the status update in the 2nd Circuit looms large,” Rispoli posted.

The June 16 deadline holds significant weight, as it will determine the next steps in the case. Rispoli noted that if nothing is refiled, the Second Circuit will only have the denial of the first motion to work with. This could restart the briefing schedule.

Alternatively, if a motion is pending before Judge Torres at the time of the status update, the Second Circuit will likely extend the process by an additional 60 days.

“The next step? The message by Torres was clear that both parties need to beg for forgiveness. Ripple will say whatever to get it done, but how much public groveling is the SEC willing to do? And how much groveling will be authorized? We have 12 days to find out,” Rispoli added.

Notably, as the deadline draws near, rumors have begun circulating that Ripple, the SEC, and Judge Torres may have already reached a settlement agreement.

“Rumors swirling. Hearing SEC, Ripple & Judge Torres have finally reached an agreement. Word is Ripple came out on top,” a user stated.

The user added that an announcement could come as early as Friday, June 13. However, he cautioned that the news remains unverified. Additionally, the associated parties have not provided any official confirmation.

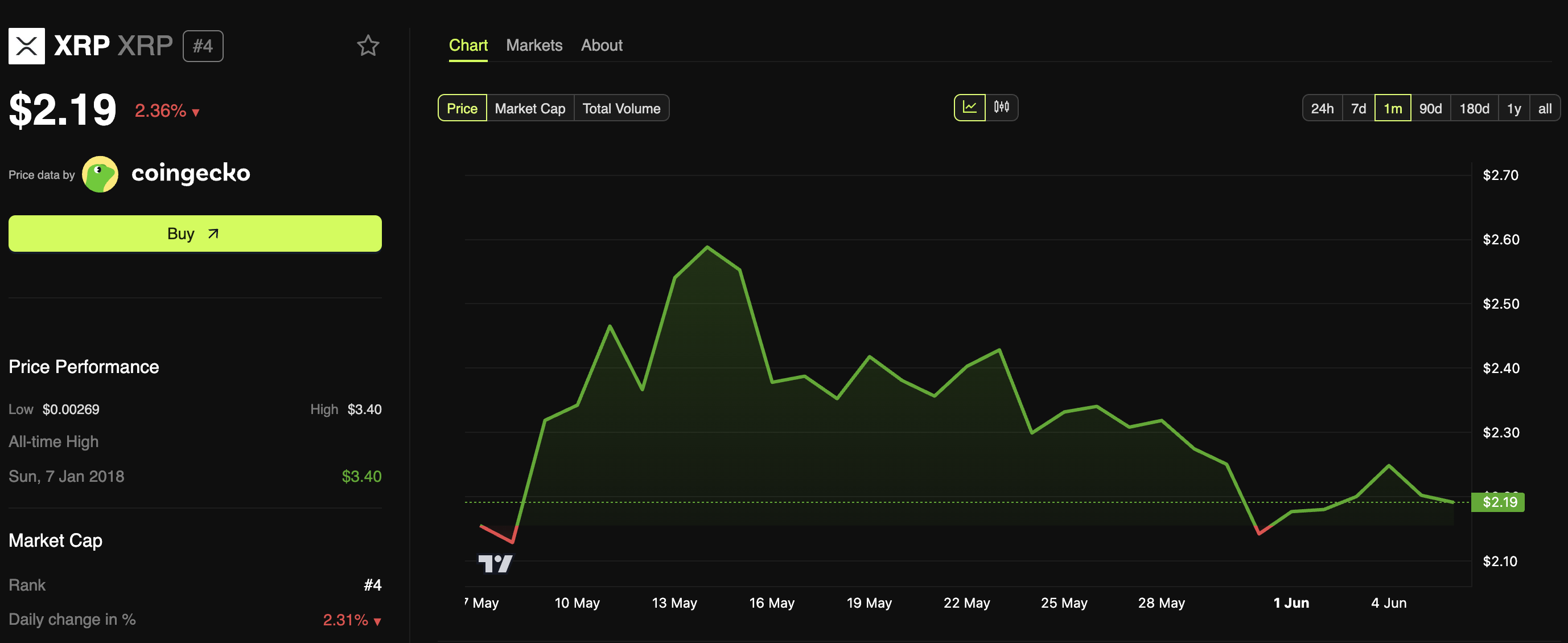

Meanwhile, amid the uncertainty, XRP’s price has also taken a hit. BeInCrypto data showed that over the past week, the altcoin’s value has seen an 8.8% decline.

XRP Price Performance. Source:

BeInCrypto

XRP Price Performance. Source:

BeInCrypto

At the time of writing, XRP’s trading price was $2.19, representing a 2.36% drop over the past 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.

Bitcoin Under Pressure Despite Fed Optimism