-

Solana’s recent performance highlights both its potential for future growth and its struggles with institutional support amid a competitive landscape.

-

Despite low institutional inflows, retail and whale accumulation showcases a strong conviction among investors, hinting at a bullish outlook.

-

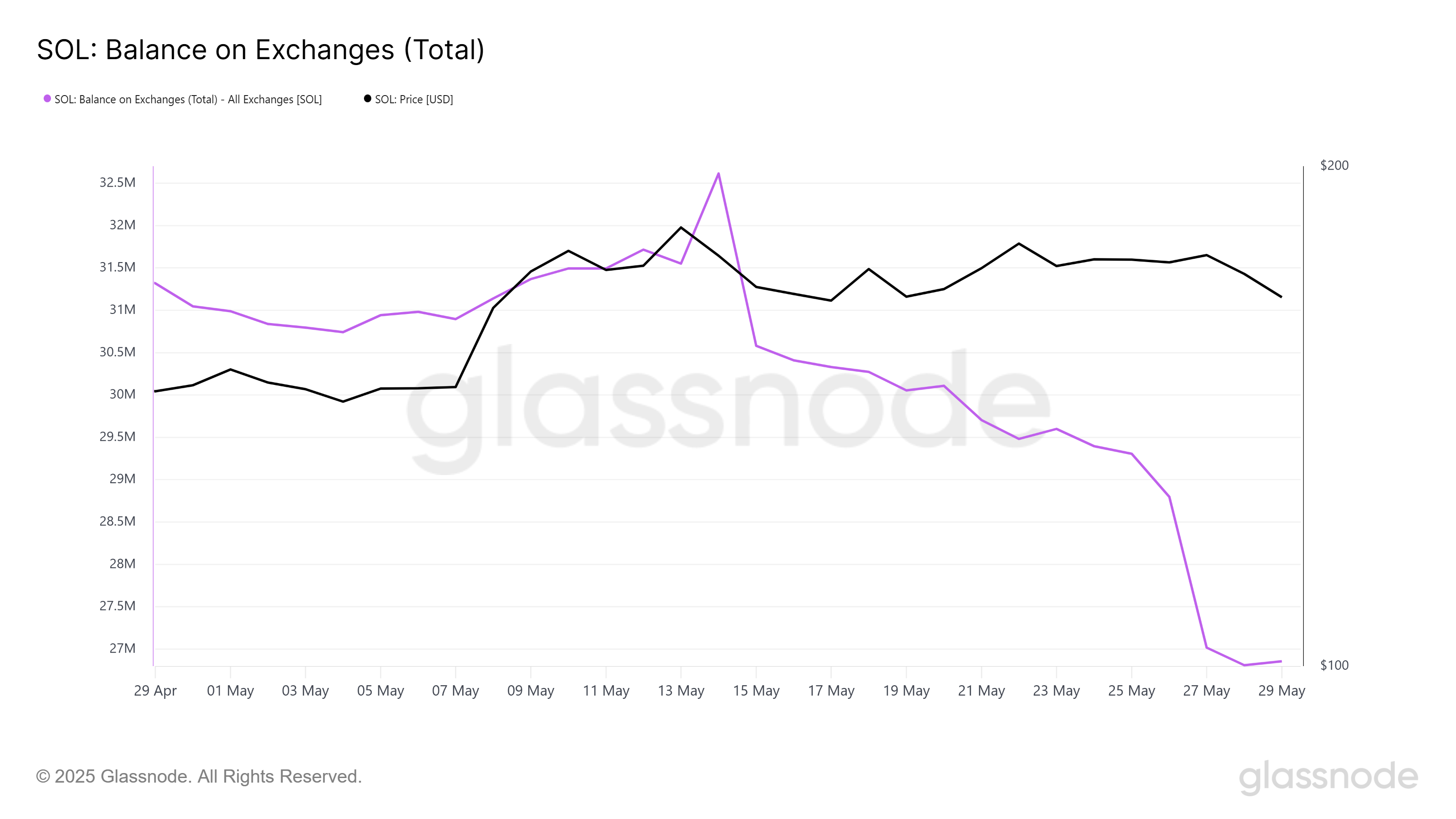

“Retail investors remain steadfast, with a significant $677 million removal of SOL from exchanges, indicating long-term faith,” notes COINOTAG.

This article explores Solana’s performance, institutional interest, and market predictions for June while assessing bullish signals from retail and whale investors.

Solana Faces Challenges Amidst Growing Competition

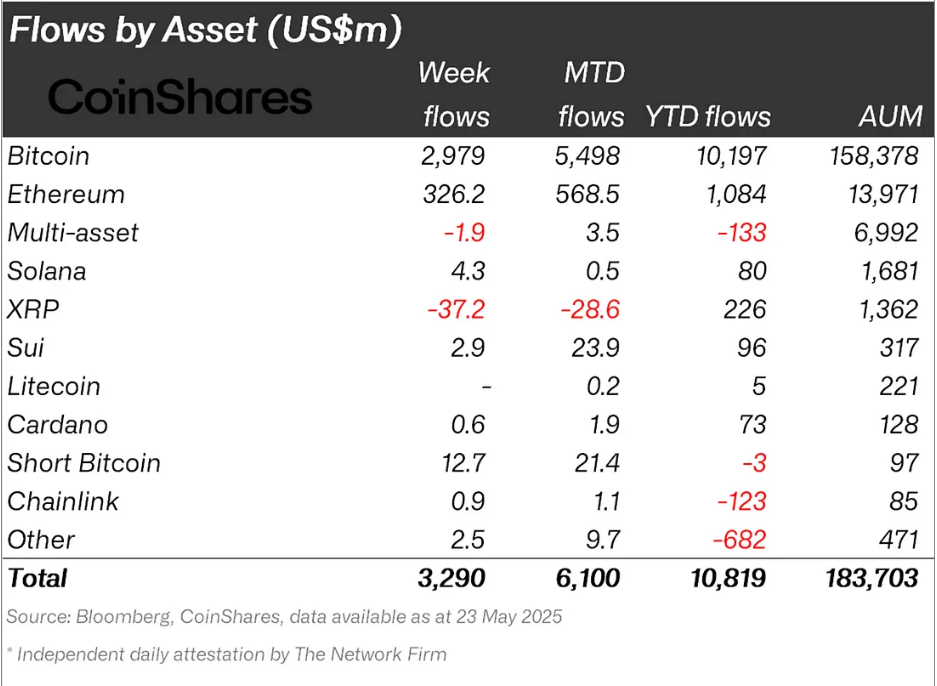

In May, Solana’s institutional support reached a notable low, attracting only $0.5 million in investments while competitors such as SUI gained $23.9 million. The setback reflects a growing trend where institutional investors are diverting their attention to newer platforms that provide promising development avenues. This decline further emphasizes Solana’s need for rejuvenated institutional interest to regain momentum in an evolving market.

The stark contrast in inflows indicates a potential red flag for Solana as it continues to grapple with the competitive offerings from other blockchains. The trend of low institutional support risks alienating larger investors, which may cause Solana to miss out on significant capital inflow essential for its growth and long-term sustainability.

Recent data highlights a downward trend in institutional investment, raising concerns about Solana’s viability as a long-term investment option compared to its rapidly growing competitors.

Retail Investors’ Confidence in Solana

Despite a challenging institutional landscape, retail investors demonstrate resilience and confidence in Solana, as evident from the significant removal of 4.13 million SOL tokens, valued over $677 million, from exchanges in May. This behavior illustrates a growing conviction among both retail investors and whales, who are betting on the eventual appreciation of Solana’s value.

This accumulation trend indicates that even with institutional interest dwindling, there remains robust belief in Solana’s long-term potential. Analysts suggest that retail sentiment could support a price stabilization, preventing drastic declines even amid unfavorable market conditions.

Forecasting SOL’s Price Movements for June

Currently priced at $164, Solana has experienced an 11.5% increase compared to the beginning of May, though it remains 12% lower than its peak during the month. Given this context, analysts predict that SOL will likely trade within a range of $161 to $178 in June. A breakthrough above the $178 resistance could catalyze further escalation towards the $188 mark, especially in light of the potential Golden Cross pattern in the moving averages that suggests bullish market sentiment.

Conversely, traders should remain vigilant; historical data shows June has often recorded bearish trends for Solana, with negative returns in several previous years. The average June return for Solana over the last five years sits around -8.97%, presenting a cautionary note for investors as they navigate potential market dynamics this month.

Investors must be cautious, as a drop below the critical $161 support level may lead to increased selling pressures, possibly triggering declines to the $150 or even $144 price point. Such a turn of events would challenge the prevailing bullish narrative and highlight the underlying vulnerability in Solana’s price stability.

In conclusion, Solana’s trajectory in May brings mixed signals for June, showing a blend of wary institutional behaviors but strong retail confidence. Stakeholders need to monitor both market developments and investor sentiment closely to navigate the complexities surrounding Solana’s position in the blockchain ecosystem.

Conclusion

As Solana grapples with institutional disengagement while benefitting from retail investment, the upcoming month will be critical in defining its market standing. Investors looking to capitalize on potential upswings must stay vigilant to broader market cues and the historical tendencies of June, effectively balancing ambition with caution.